A major underground resource project in Western Newfoundland is gaining attention for its potential to reshape the North American road salt supply chain.

Backed by a newly released feasibility study, the development promises strong financial returns, long-term operational resilience, and direct access to key markets. With optimized engineering, regulatory momentum, and a clear path to production, this initiative stands out as a compelling opportunity for investors seeking exposure to essential infrastructure and commodities.

Atlas Salt Inc. (TSXV: SALT) has unveiled the results of its Updated Feasibility Study (UFS) for its wholly-owned Great Atlantic Salt Project, located near St. George’s in Western Newfoundland. This development could position Atlas Salt to become a leading supplier of high-purity road salt in North America, with robust economics and a clear path to production.

This article is disseminated in partnership with Atlas Salt Inc.. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Project overview

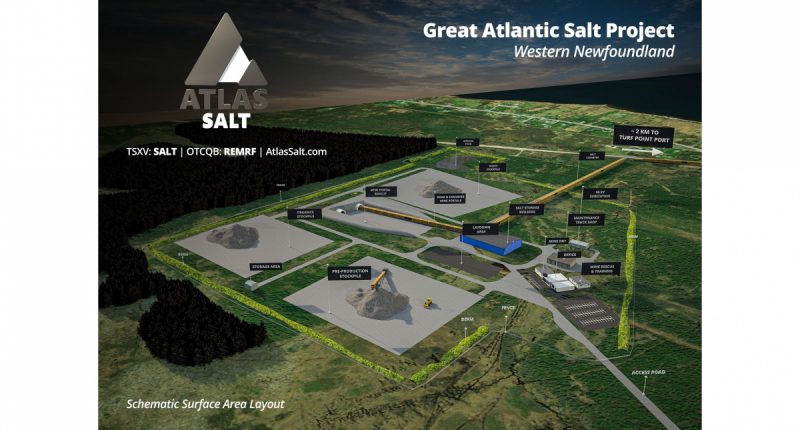

The Great Atlantic Salt Project is a large-scale, underground room-and-pillar mine designed to produce 4.0 million tonnes per annum (Mtpa) of high-purity road salt at full production. Located just 3 km from the Trans-Canada Highway and adjacent to deepwater port facilities, the site offers direct access to key markets in Eastern Canada, the U.S. Northeast, and Western Europe.

The deposit consists of a flat-lying, laterally extensive halite formation with minimal insoluble content, supporting a 24-year mine life based on 95 million tonnes of Proven and Probable Reserves at an average grade of 95.9 per cent NaCl.

Investment highlights

The UFS confirms the project’s strong financial metrics:

- Post-tax NPV (8 per cent): C$920 million

- Post-tax IRR: 21.3 per cent

- Payback period: 4.2 years

- Pre-tax NPV (8 per cent): C$1.68 billion

- Pre-tax NPV (5 per cent): C$2.75 billion

- Post-tax NPV (5 per cent): C$1.57 billion

- Initial capital cost: C$589 million

- LOM sustaining capital: C$609 million

- Average annual operating cashflow (EBITDA): C$325 million

- Average annual post-tax free cashflow: C$188 million

- Total undiscounted post-tax cashflow: C$3.93 billion

- Operating cost (LOM average): C$28.17 per tonne FOB mine site port.

Technical advancements

The UFS incorporates several optimizations over the 2023 Feasibility Study:

- Optimized production plan: Updated geotechnical, ventilation, and infrastructure studies support efficient construction and long-term operations.

- Equipment integration: Use of Sandvik continuous mining equipment enhances productivity and reduces unit operating costs.

- Port and logistics improvements: Upgraded stockpile and shiploading systems enable high-capacity, efficient loading.

- Economic resilience: Financial model reflects inflationary trends and updated pricing assumptions.

- Regulatory alignment: All post-environmental assessment conditions are incorporated, ensuring compliance.

Mining and processing design

- Mining method: Room-and-pillar underground mining.

- Access: Surface portal and conveyor decline system.

- Daily production rate: ~11,500 tonnes/day.

- Processing: Salt is crushed and screened underground, conveyed to surface, and shipped via covered conveyor. No chemical processing is required.

Infrastructure and logistics

- Port capacity: Designed for scalable throughput up to 4.0 Mtpa.

- Shiploading: Conveyor-fed shiploader with optimized cycle times.

- Storage: Surface stockpile capacity of ~72,000 tonnes.

- Power: 10 MW connected load sourced from the provincial grid.

- Accommodation: No camp required due to proximity to established communities.

Market opportunity

North America consumes over 25 million tonnes of road salt annually, with Eastern Canada and the U.S. Northeast representing the highest demand. Great Atlantic is ideally positioned to address regional supply challenges, offering a reliable, high-purity domestic source.

Leadership insights

“The improvement in projected free cash flow is especially significant as it validates the strengthened economics of Great Atlantic and enhances lender confidence in financing this world-class development,” Atlas Salt’s CEO, Nolan Peterson, explained in a news release. “With the previously announced regulatory approval of our Early Works Development Plan, Atlas Salt is strategically positioned to advance Great Atlantic and create substantial value for all stakeholders.” He elaborated further on this in an exclusive interview with The Market Online’s “The Watchlist” with Ricki Lee, which you can watch in the video below. Mr. Peterson was recently appointed in June of 2024 after a period of management change for the company.

Permitting and next steps

Atlas Salt has made significant progress on the regulatory front:

- Environmental assessment: Conditionally released in 2024.

- Early works development plan: Approved in 2025.

- Capital development plan: To be submitted post-engineering.

- Commercial production approval: Final stage permit aligned with commissioning.

Next steps include:

- Filing the NI 43-101 Technical Report.

- Advancing financing discussions.

- Progressing detailed engineering and procurement.

- Continuing stakeholder and community engagement.

Investor’s corner

The Updated Feasibility Study presents Atlas Salt’s Great Atlantic Project as a world-class, economically resilient, and ideally located development. With strong financial metrics, optimized operations, and regulatory momentum, Atlas Salt is well-positioned to deliver long-term value to investors and stakeholders alike. Since the year began, Atlas Salt stock (TSXV:SALT) has risen more than 22 per cent and it is 11 per cent higher compared to October 2024.

To keep up with the latest updates from the company, visit Atlas Salt online.

Join the discussion: Find out what the Bullboards are saying about Atlas Salt and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.