- WPD Pharmaceuticals (CSE:WBIO) and Moleculin Biotech’s Annamycin drug has received FDA approval for Fast Track Designation.

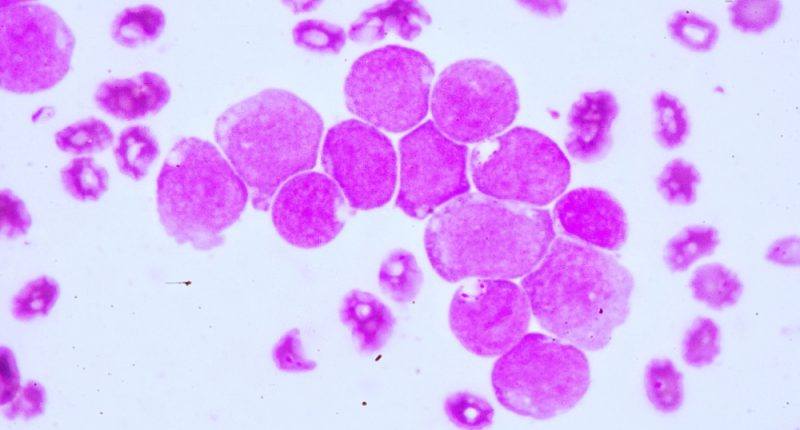

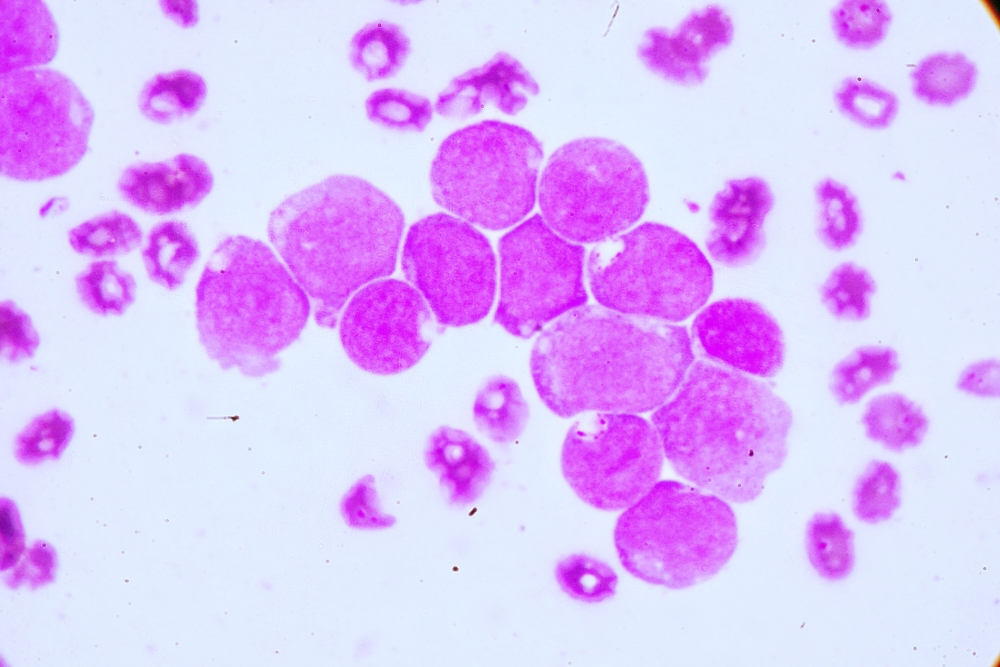

- Annamycin is a drug which may become a possible treatment for specific types of leukemia.

- The Fast Track Designation will make the drug eligible for Accelerated Approval, if it meets the relevant criteria.

- WPD’s share price is up by 18.71 per cent, with shares trading at $1.65 apiece.

WPD Pharmaceuticals’ (WBIO) Annamycin drug has been approved for Fast Track Designation by the U.S. Food and Drug Administration (FDA).

Tests are currently underway, to study Annamycin as a potential treatment for relapsed or refractory acute myeloid leukemia (AML).

WPD gained the Fast Track Designation through their development partner Moleculin Biotech.

The Fast Track Designation will make Annamycin eligible for a number of privileges, including more frequent communication from the FDA.

The FDA will meet with WPD and Moleculin to discuss the drug development plan, proposed clinical trials design, use of biomarkers, and collection of appropriate data for drug approval.

Annamycin’s developers may also be able to complete a Rolling Review. A Rolling Review allows a drug company to submit its New Drug Application for FDA review in sections, rather than when the entire application is finished.

The Fast Track Designation may also make Annamycin eligible for Accelerated Approval and Priority Review, if it meets the relevant criteria.

WPD CEO Mariusz Olejniczak welcomed the approval from the FDA, which he described as “an important validation of the significant unmet need that we are collectively trying to address with our partners at Moleculin.”

WPD’s share price is up by 18.71 per cent, with shares trading at $1.65 apiece.