- Ivanhoe Mines (IVN) has set a personal best in the development of its part-owned Kamoa-Kakula copper project in the Democratic Republic of Congo

- Over the course of September project operators successfully added a record 2,000 metres to the site’s underground development

- This brings the underground site’s total development to just over 22 kilometres, shooting the project 44 per cent ahead of schedule

- As a result of the sustained progress at the site, the company expects first copper production to begin in less than a year

- Ivanhoe Mines (IVN) is down 3.49 per cent and is trading at C$4.70 per share

Ivanhoe Mines (IVN) has set a personal best in the development of its part-owned Kamoa-Kakula copper project in the Democratic Republic of Congo.

Over the course of September, project operators successfully added more than 2,000 metres to the site’s underground development.

This record-breaking monthly figure brings the underground site’s total development to just over 22 kilometres, shooting the project 44 per cent ahead of schedule.

Development over September focussed on the project’s Kakula and Kansoko mines, while work in October will begin mining Kakula’s high-grade ore from the southern access drive.

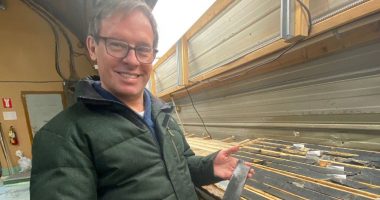

Commenting on the project’s rapid advancement, CEO of the site’s operator, Mark Farren, said the new underground record puts development progress months ahead of plan.

“With each passing month, our mining and engineering teams are increasingly confident that the forecasted mining productivity rates used in our engineering studies are conservative – a testament to the focus and dedication of the project’s mining crews as well as the remarkable consistency of the Kakula and Kansoko orebodies,” he added.

Mark went on to say that the project’s next major step will be the joining of the northern and southern access drives, which is expected to happen in November. Currently the two access drives have less than 520 metres remaining before they connect in the high-grade centre of the deposit.

As a result of the sustained progress at the site, the company expects first copper production to begin in less than a year. Once complete, the project will be the world’s highest-grade major copper mine and is expected to process more than 3.8 million tonnes each year in its first five years.

Ivanhoe Mines currently owns 39.6 per cent in interest in the project, with the remaining interest split between Zijin Mining Group, Crystal River Global and the DRC Government.

Ivanhoe Mines (IVN) is down 3.49 per cent and is trading at C$4.70 per share at 2:41pm EDT.