- Toronto-based mining company Moneta Porcupine Mines (ME) has begun a drill program at its Golden Highway Project in Ontario

- The company intends to drill 20,000 metres, focusing initially at the Halfway target and then at the South Basin target

- Drilling work will seek to expand the project’s existing gold resources outside the South West deposit

- The South West deposit was the subject of a recent preliminary economic assessment, which outlined a potential to produce up to 87,500 ounces of gold per year

- Moneta Porcupine Mines (ME) is currently down 3.23 per cent and is trading at C$0.15 per share

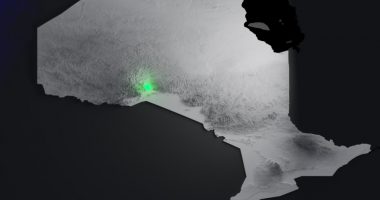

Toronto-based mining company Moneta Porcupine Mines (ME) has begun a drill program at its Golden Highway Project in Ontario.

The program will consist of 20,000 metres of drilling – with further drilling dependent on results – which has been designed to expand the company’s existing gold resources and test a number of additional targets.

Moneta Porcupine will focus initially on the Halfway target and then at the South Basin target, as well as other regions outside of the South West deposit, which was the subject of a recent preliminary economic assessment.

According to an announcement dated September 9, 2020, the South West deposit has the potential to produce up to 87,500 ounces of gold each year at a cost of approximately C$780 (US$590) per ounce. This would generate after-tax free cash flow of around $49 million annually, resulting in the repayment of initial capital worth $144 million over a period of 3.4 years.

Drilling at the Halfway target will test the extent of previously identified mineralisation, where historic results include grades of up to 8.87 grams per tonne of gold over 3.25 metres.

Likewise, earlier drilling work at the South Basin target returned 2.2 metres at 15.67 grams per tonne of gold, including 0.6 metres at 39.6 grams per tonne.

Gary O’Connor, CEO of Moneta Porcupine Mines, said he is very pleased with the ongoing success of exploration work at the Golden Highway Project.

“The new planned drill program will continue to test resource expansion potential with drill testing of new targets, initially at Halfway where Moneta intersected significant gold mineralisation in 2019, and proceeding to the South Basin target as well as testing the extensions at Westaway which remains open.

“All drilling will be conducted outside of the South West deposit which was the focus of the recent successful preliminary economic assessment study which highlighted good robust economics,” he added.

Moneta Porcupine Mines (ME) is currently down 3.23 per cent to C$0.15 per share at 3:05pm EDT.