- Pure Gold Mining Inc. (PGM) has entered into a bought deal offering with Clarus Securities Inc., as lead underwriter

- The underwriters have agreed to purchase 6,580,000 flow-through common shares for gross proceeds of C$10,001,600

- The company has also granted an over-allotment option to the underwriters to purchase an additional 987,500 flow-through shares

- The offering is expected to close on May 5, 2021

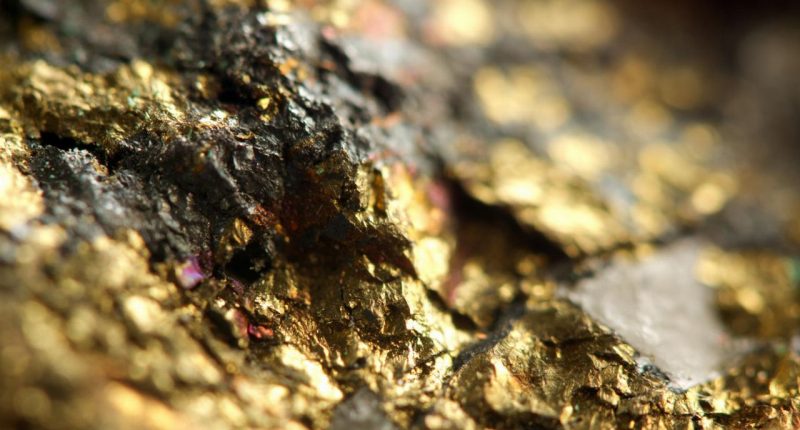

- PureGold Mining (PGM) is a growth company focused on becoming Canada’s next iconic gold producer

- PureGold Mining is unchanged, trading at $1.41 per share at 3 pm ET

Pure Gold Mining Inc. (PGM) has entered into a bought deal offering with Clarus Securities Inc., as lead underwriter.

The underwriters have agreed to purchase, on a bought deal basis 6,580,000 flow-through common shares for gross proceeds of C$10,001,600.

The flow-through shares will be priced at $1.52.

Pure Gold Mining has also granted an over-allotment option to the underwriters to purchase an additional 987,500 flow-through shares on the same terms as the offering for a period ending 30 days following the closing of the offering.

In the event the over-allotment option is exercised in full, the aggregate gross proceeds of the Offering will be $11,501,840.

The securities will be offered in the provinces of British Columbia, Alberta, and Ontario by short form prospectus.

The offering is expected to close on May 5, 2021, subject to regulatory approvals including the approval of the TSX Venture Exchange.

Proceeds will be used to finance “Canadian development expenditures”, as defined in the Income Tax Act (Canada), on its property in Ontario.

PureGold Mining (PGM) is a growth company focused on becoming Canada’s next iconic gold producer.

PureGold Mining is unchanged, trading at $1.41 per share at 3 pm ET.