- NV Gold Corporation (NVX) has arranged subscriptions for a non-brokered private placement of units for gross proceeds of C$3,000,000

- The placement arranged is up to 12,000,000 units at $0.25 per unit

- The proceeds will be used for the advancement of existing properties and the potential acquisition of new properties

- NV Gold is confident that a robust gold market and 100% ownership of an extensive gold property portfolio will provide exciting opportunities in 2021

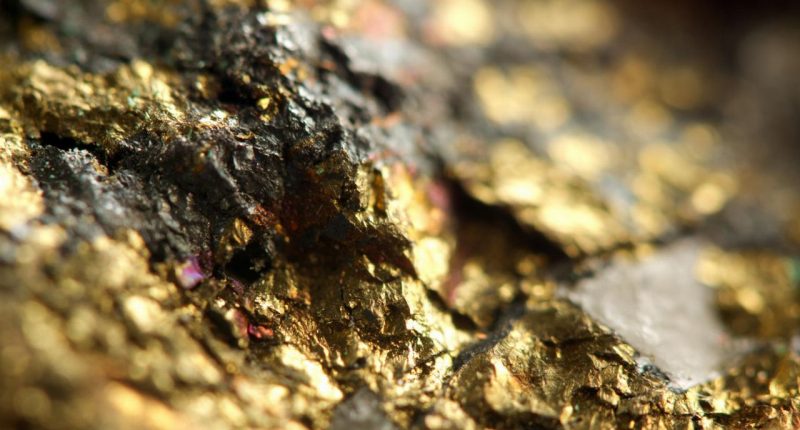

- NV Gold Corporation (NVX) is a Vancouver-based exploration company focused on delivering value through mineral discoveries in Nevada

- NV Gold is down 8.96 per cent, trading at $0.305 per share at 10:15 am ET

NV Gold Corporation (NVX) has arranged subscriptions for a non-brokered private placement of units for gross proceeds of C$3,000,000.

“I would like to welcome the large strategic lead orders from both new European and North American investors alongside the continued strong support from our existing investors, including Crescat Capital. With a commodities supercycle underway, including positive sentiment in the gold sector, NV Gold is positioned extremely well to participate with a very busy exploration year planned in Nevada in 2021. We appreciate the patience of our long term shareholders who are supportive in our systematic and focused exploration strategy to make Nevada’s next big gold discovery,” commented Peter A. Ball, President and CEO of NV Gold.

The placement arranged is up to 12,000,000 units at $0.25 per unit. Each unit will consist of one share and one warrant exercisable at $0.40 per share for 36 months.

The proceeds will be used for the advancement of existing properties, the potential acquisition of new properties, and for general working capital. To minimize dilution, the Placement will not exceed $3 million.

NV Gold’s President and CEO added,

“The combination of our recent US$10 million option exploration agreement with Hochschild Mining (US) Inc. on our SW Pipe Gold Project, our follow-up exploration programs at our Sandy and Slumber Gold Projects after all assays are received and modelled, and key potential accretive acquisitions of new drill ready gold projects currently under review provide opportunities for a new discovery in Nevada.

In addition, we continue to review other projects within our extensive Nevada gold portfolio with strategic groups for additional option agreements. With a strong treasury, a robust gold market, 100% ownership of an extensive gold property portfolio in Nevada, a new strategic partner, a globally recognized technical team, a focused high impact exploration plan for 2021, and supportive shareholders, I couldn’t be more excited for the year ahead.”

NV Gold Corporation (NVX) is a Vancouver-based exploration company focused on delivering value through mineral discoveries in Nevada.

NV Gold is down 8.96 per cent, trading at $0.305 per share at 10:15 am ET.