- A feasibility study of Steppe Gold’s (STGO) ATO Gold Project in Mongolia, supports a 12-and-a-half-year aggregate mine life

- Gold recovery is forecasted to be 79 per cent with further recoveries of up to an estimated 10 per cent through a CIP/CIL plant in the future

- With a conservative metal price modelled, including $1,610 per gold ounce, the ATO Gold Project is shown to deliver a solid set of results which features strong cash flows and a rapid payback of capital

- All financial analysis for the life of the mine includes the total design, construction and commissioning, production, and closure

- Steppe Gold Ltd. (STGO) is up 5.185 per cent and is trading at $1.42 per share at 1:38 p.m. ET

A feasibility study of Steppe Gold’s (STGO) ATO Gold Project supports an aggregate 12-and-a-half-year aggregate mine life.

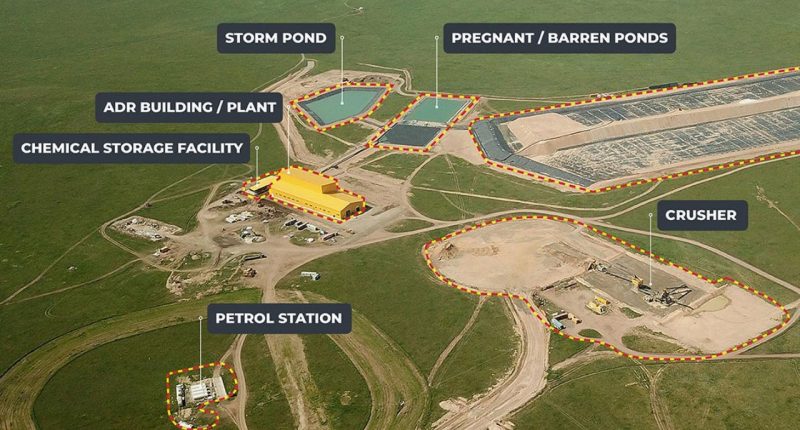

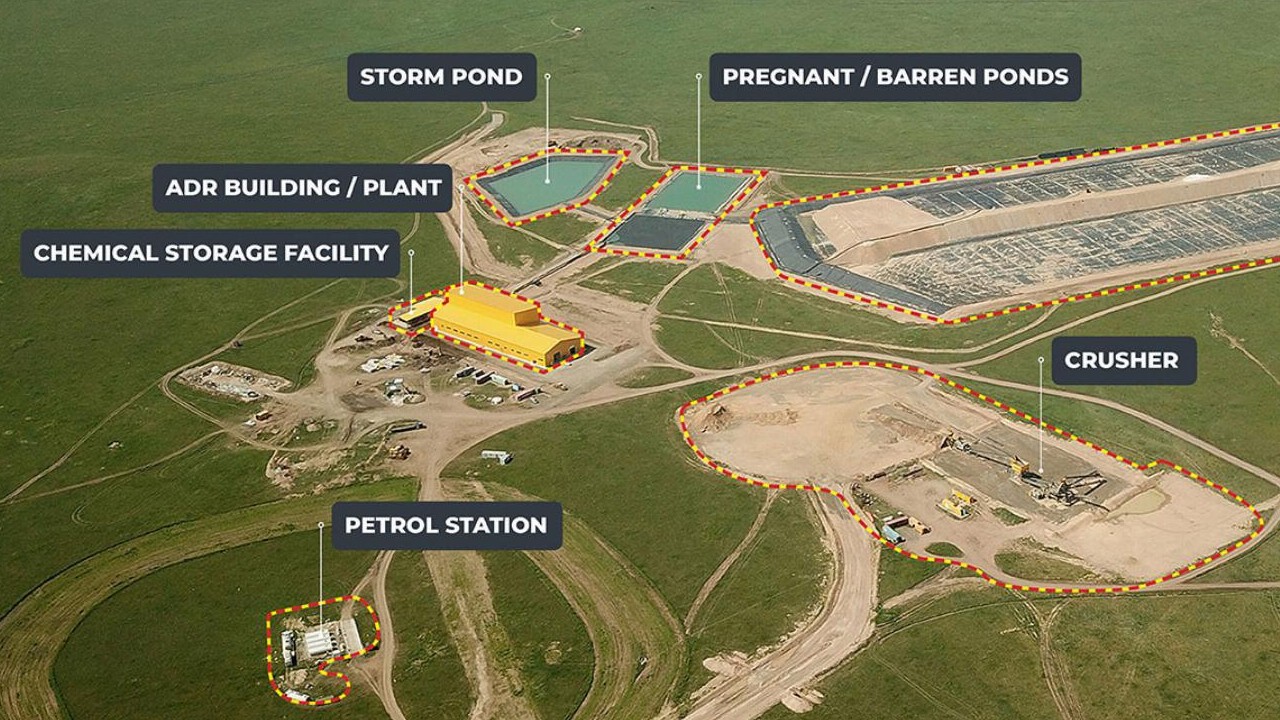

The results reinforce the company’s phase 2 expansion plans with construction already underway and permitting and infrastructure in place.

Gold recovery is forecasted to be 79 per cent with further recoveries of up to an estimated 10 per cent through a CIP/CIL plant in the future.

With a conservative metal price modelled, including $1,610 per gold ounce, the ATO Gold Project is shown to deliver a solid set of results that feature strong cash flows and a rapid payback of capital.

The project’s mineral reserve estimate uses a base gold price of $1,610 per ounce, silver price of $21 per ounce, zinc price of $2,515 per tonne and lead price of $1,970 per tonne, USD.

The project achieved total gross revenue of US$1.72 billion and earnings before interest, taxes, depreciation, and amortization of US$584 million over the 12-and-a-half-years, with first concentrate production anticipated in Steppe’s Q4, 2023.

Pre-tax net present value of US$320 million with an internal rate of return of 109 per cent and a post-tax net present value of US$232 million with an internal rate of return of 67 per cent are driven by rapid payback of three years from the initial capital outlay.

Steppe has already started construction work which benefits the phase two expansion, with a new 2.5 million tonnes per annum fixed crusher being installed and expanded infrastructure underway.

Steppe Gold Ltd. (STGO) is up 5.185 per cent and is trading at $1.42 per share at 1:38 p.m. ET.