- Consolidated Uranium (CUR) has closed its private placement for gross proceeds of $20,000,750

- The offering was upsized from its original gross proceeds of $15.0 million

- The company issued 7,547,453 units of the company at a price of C$2.65 per unit

- Red Cloud Securities Inc. acted as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters

- The company paid cash commissions of $1,200,045 and issued 452,847 warrants to the underwriters

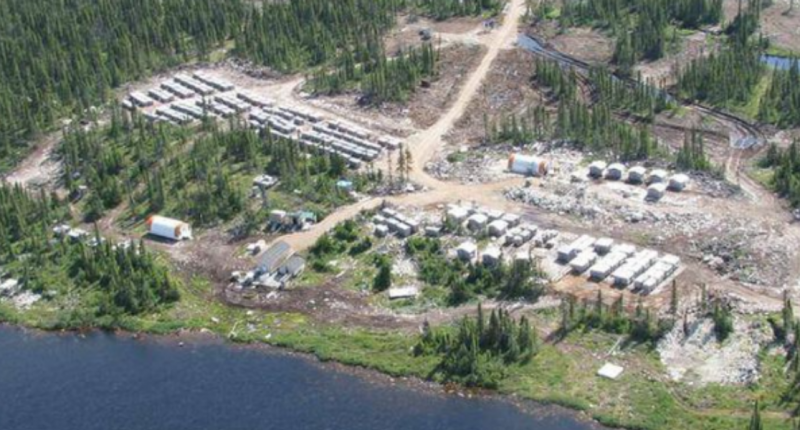

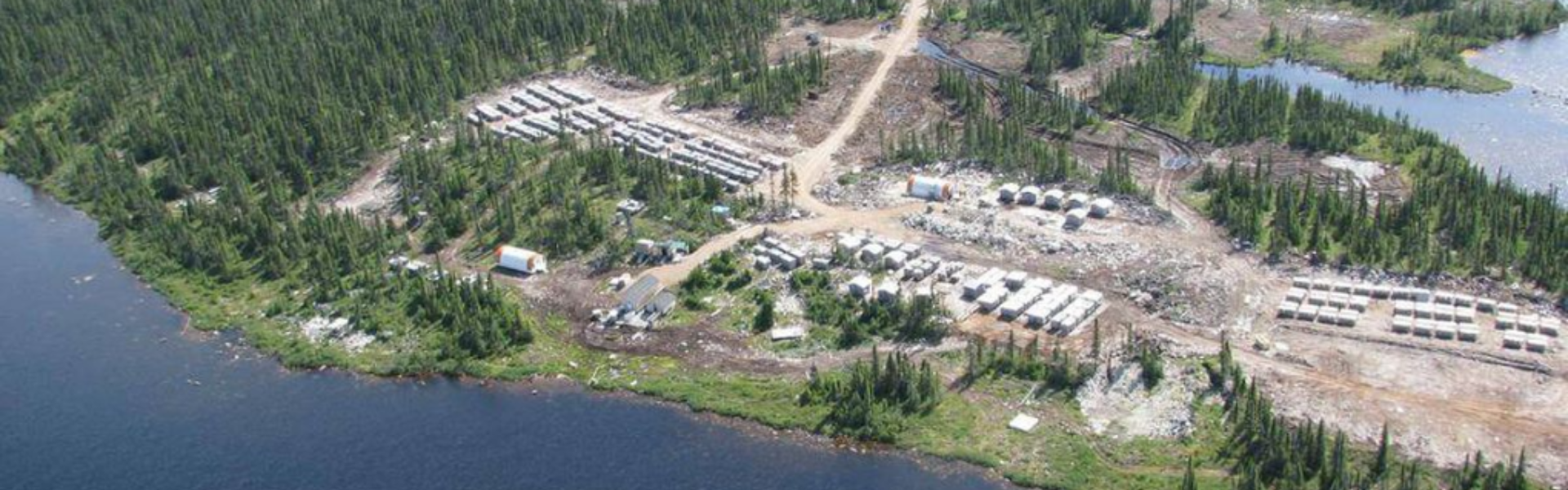

- Consolidated Uranium is an exploration company that has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina and the U.S.

- Consolidated Uranium Inc. (CUR) opened trading at C$2.83 per share

Consolidated Uranium (CUR) has closed its previously announced private placement for gross proceeds of $20,000,750.

The company issued 7,547,453 units of the company at a price of C$2.65 per unit. The offering was upsized from its original gross proceeds of $15.0 million.

Red Cloud Securities Inc. acted as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters that included Haywood Securities Inc. and PI Financial Corp. Each unit is comprised of one common share and one half of one common share purchase warrant. Each warrant can be exercised to acquire one common share at a price of C$4.00 at any time on or before November 22, 2023.

Philip Williams, President and CEO commented on the financing.

“We are very pleased to have completed another over-subscribed and strongly institutionally subscribed private placement. I want to take the opportunity to thank existing and new shareholders for their support and confidence in the company and our business plan, which remains to continue to build out the portfolio, the team and aggressively advance our current projects with a particular focus on the newly acquired past producing mines in the U.S. We strongly believe that with our strengthened balance sheet and track record of adding accretive acquisitions, we are well positioned to continue to execute and add value for all shareholders.”

Net proceeds are expected to be used for general working capital purposes. The company paid cash commissions of $1,200,045 and issued 452,847 warrants to the underwriters.

All securities issued are subject to a statutory hold period ending on March 23, 2022.

Consolidated Uranium is an exploration company that has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina and the United States.

Consolidated Uranium Inc. (CUR) opened trading at C$2.83 per share.