- CIBT Education Group (MBA) has filed its audited consolidated financial statements and MD&A for the fiscal year ended August 31st, 2021

- Net income for the group increased by 209 per cent to $5.18 million

- EBITDA increased by 135 per cent to $21.41 million

- Total asset value grew 15 per cent to $519.04 million from last year

- CIBT is one of Canada’s largest education services and academic real estate companies

- CIBT Education Group Inc. (MBA) opened trading at C$0.64 per share

CIBT Education Group (MBA) has filed its audited consolidated financial statements and MD&A for the fiscal year ended August 31st, 2021.

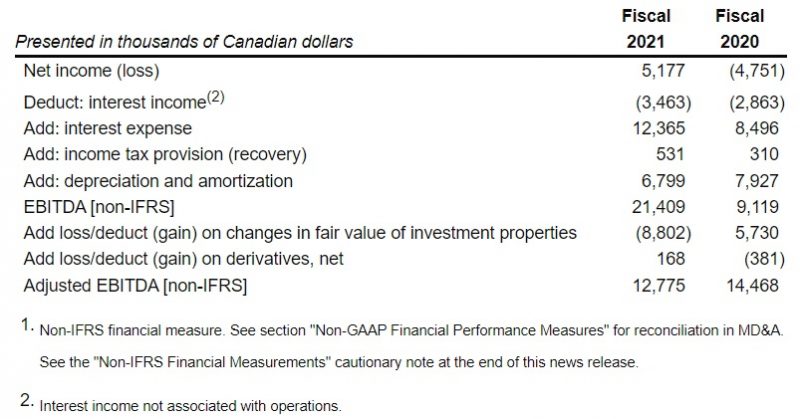

The following table presents selected financial data from the 2021 Financial Report with comparisons. All figures are in thousands of Canadian dollars, except share and per share data, unless otherwise noted.

Toby Chu, Chairman, President and Chief Executive Officer of CIBT commented on the results.

“CIBT management is pleased to report that gross revenue was substantially preserved in Fiscal 2021, despite a full year of COVID-19 restrictions, in which we generated total revenue of $60.87 million.”

“For all of fiscal 2021, we were operating under strict provincial and federal lockdown measures. However, we were able to fulfill our mandates of controlling our expenses, preserving our revenue and cash flow, advancing key real estate development projects, providing consistent and quality services to our students, and being progressive in seeking under-valued real estate opportunities.”

Toby added,

“In Fiscal 2021, we allocated funds to the rezoning and development of various properties, converted some of our education platforms from a traditional in-class model to online classes, added new educational programs, and completed one property acquisition. Our corporate finance activities included our real estate limited partnerships raising over $8.4 million in equity and completing $171 million in mortgage financing, re-financings and construction loans. As a result, we are proud to have achieved these milestones despite the economic challenges caused by the ongoing pandemic.”

Notable highlights in fiscal 2021 include;

- Net income for the group increased by 209 per cent to $5.18 million

- Net income attributable to CIBT shareholders increased by 283 per cent to $4.7 million

- Income per share increased by 250 per cent to $0.07 per share

- EBITDA increased by 135 per cent to $21.41 million

- Total asset value grew 15 per cent to $519.04 million compared to the same period of last year