- Rhyolite Resources Ltd. (RYE) has entered into a private placement agreement with BMO Capital Markets

- BMO has agreed to buy 16 million common shares of Rhyolite Resources at a price of $0.88 per common share for gross proceeds of approximately $14 million

- Rhyolite Resources is also undertaking a non-brokered private placement of approximately $4 million at a price per common share equal to the offering price

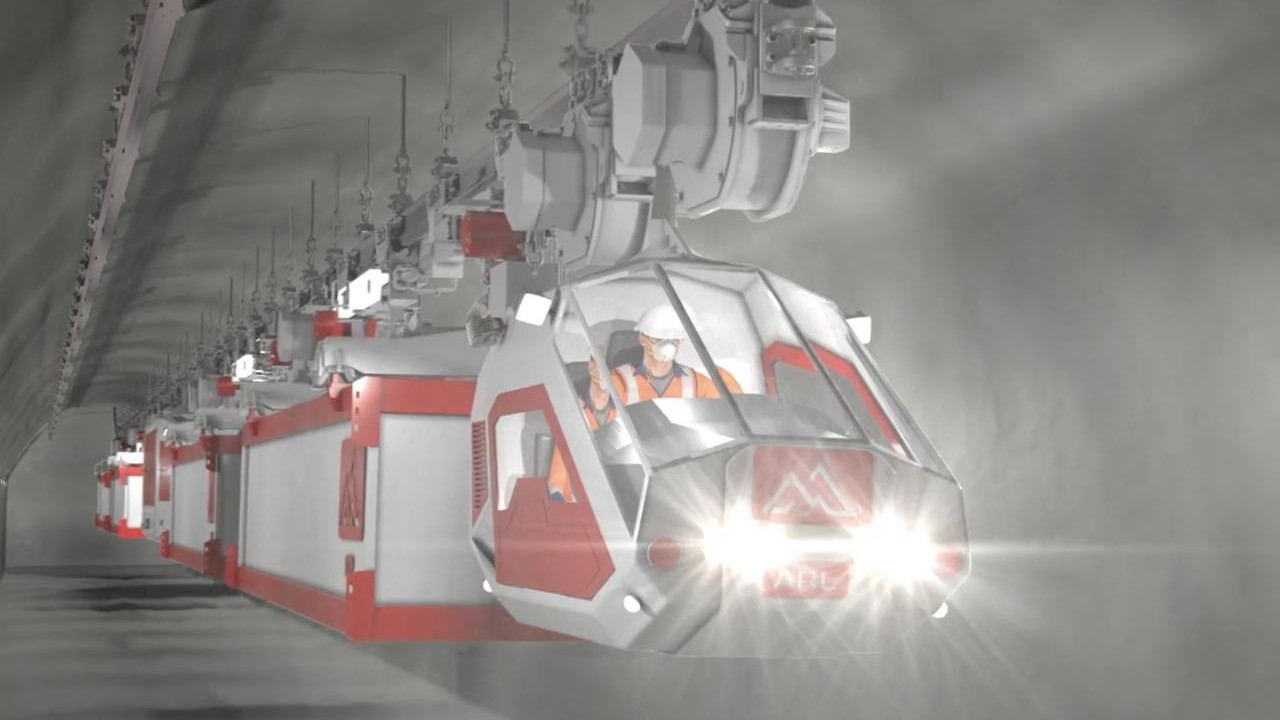

- The company intends to use the net proceeds to further the engineering work on Muckahi, procurement of Muckahi equipment, exploration in Suriname, and corporate purposes

Rhyolite Resources Ltd. (RYE) has entered into a private placement agreement with BMO Capital Markets for gross proceeds of approximately $14 million.

BMO has agreed to buy 16 million common shares of Rhyolite Resources at a price of $0.88 per common share.

Rhyolite Resources has granted BMO an option to purchase up to an additional 4.5 million common shares, exercisable up to 48 hours prior to the closing of the offering,

Rhyolite Resources is also undertaking a non-brokered private placement of approximately $4 million at a price per common share equal to the offering price.

The company intends to use the net proceeds to further the engineering work on Muckahi, procurement of Muckahi equipment, exploration in Suriname, and corporate purposes.

The offering is expected to close by December 21, 2021.

Rhyolite Resources seeks to acquire development assets that are too costly to mine conventionally but are of high value when mined with the Muckahi Mining System.

Its technical advantages and focus on ESG using systems leadership theory, are key to building value for its shareholders and stakeholders.

Rhyolite Resources Ltd. (RYE) is up 13.33 per cent and is trading at $1.02 per share as of 4:06 p.m. EST.