- Mandalay (MND) has achieved profitable production and sales in Q2 2022

- The average processing gold equivalent head grade for the quarter was 17.1 g/t

- The company is confident that it will achieve its operational and financial guidance for the year

- President and CEO Dominic Duffy spoke with Sabrina Cuthbert about the results

- Mandalay Resources is a Canadian-based natural resource company with producing assets in Australia (Costerfield gold-antimony mine) and Sweden (Björkdal gold mine)

- Mandalay (MND) is down by 7.42 per cent trading at $2.37 per share

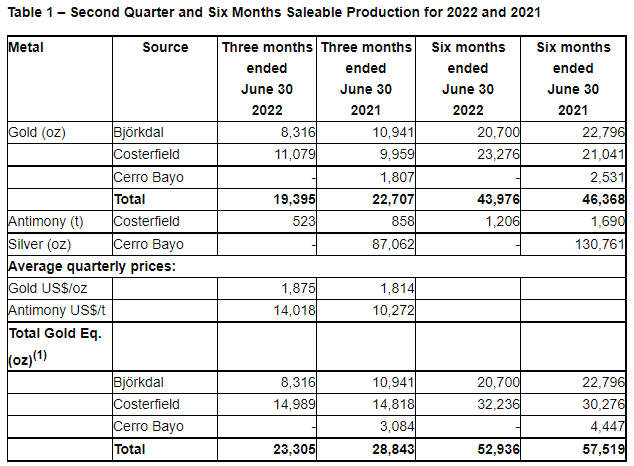

Mandalay (MND) has achieved profitable production and sales in Q2 2022.

Production was below expectations due to mining areas that expanded the footprint beyond planned development.

The company achieved profitability in the quarter despite encountering lower grades than expected and elevated sick leaves due to COVID protocols.

The average processing gold equivalent head grade for Q2 was 17.1 g/t.

Mandalay expects improvements as it focuses on maximizing processing rates and moves to more centralized higher-grade areas during the second half of the year. It remains confident that it will achieve its 2022 operational and financial guidance.

President and CEO Dominic Duffy spoke with Sabrina Cuthbert about the results.

Mandalay Resources is a Canadian-based natural resource company with producing assets in Australia (Costerfield gold-antimony mine) and Sweden (Björkdal gold mine).

Mandalay (MND) is down by 7.42 per cent trading at $2.37 per share as of 10:40 am EST.

Latest News

-

GlobeNewswire 2 days ago

-

GlobeNewswire February 20, 2025

-

GlobeNewswire February 20, 2025

-

GlobeNewswire February 18, 2025

-

Newsfile February 12, 2025

-

Jonathon Brown February 6, 2025

Latest Bullboard Posts

-

obvious why I own shares in this company. Now they are guiding for a slight...3 days ago

-

https://carboncredits.com/the-future-of-antimony-rising-prices-supply-chain-risks-and-demand-growth/2 weeks ago

-

https://www.zerohedge.com/commodities/critical-metal-bombs-bullets-erupts-mega-squeeze-amid-global-shortageMarch 7, 2025

-

TORONTO, Feb. 20, 2025 (GLOBE NEWSWIRE) -- Mandalay Resources Corporation...February 20, 2025

-

TORONTO, Feb. 20, 2025 (GLOBE NEWSWIRE) -- Mandalay Resources Corporation...February 20, 2025

-

TORONTO, Feb. 18, 2025 (GLOBE NEWSWIRE) -- Mandalay Resources Corporation...February 18, 2025