- Galantas Gold (GAL) has drilled 31.8 g/t gold over 4.4 m at its Omagh Project in Northern Ireland

- The result stems from three holes from the Kearney Vein as part of the ongoing 4,000 m drilling program at the project

- The company will now focus on identifying potential mineralization to the north and south of Kearney

- Galantas Gold is focused on operating and expanding Northern Ireland’s first gold mine

- Galantas Gold (GAL) is unchanged trading at $0.50 per share

Galantas Gold (GAL) has drilled 31.8 g/t gold over 4.4 m at its Omagh Project in Northern Ireland.

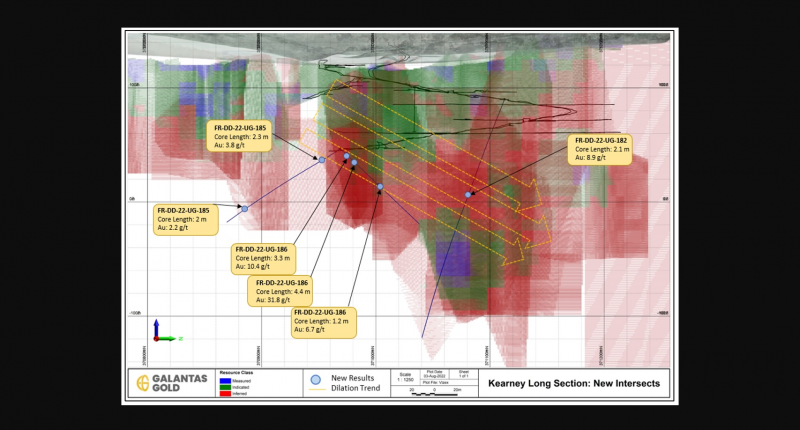

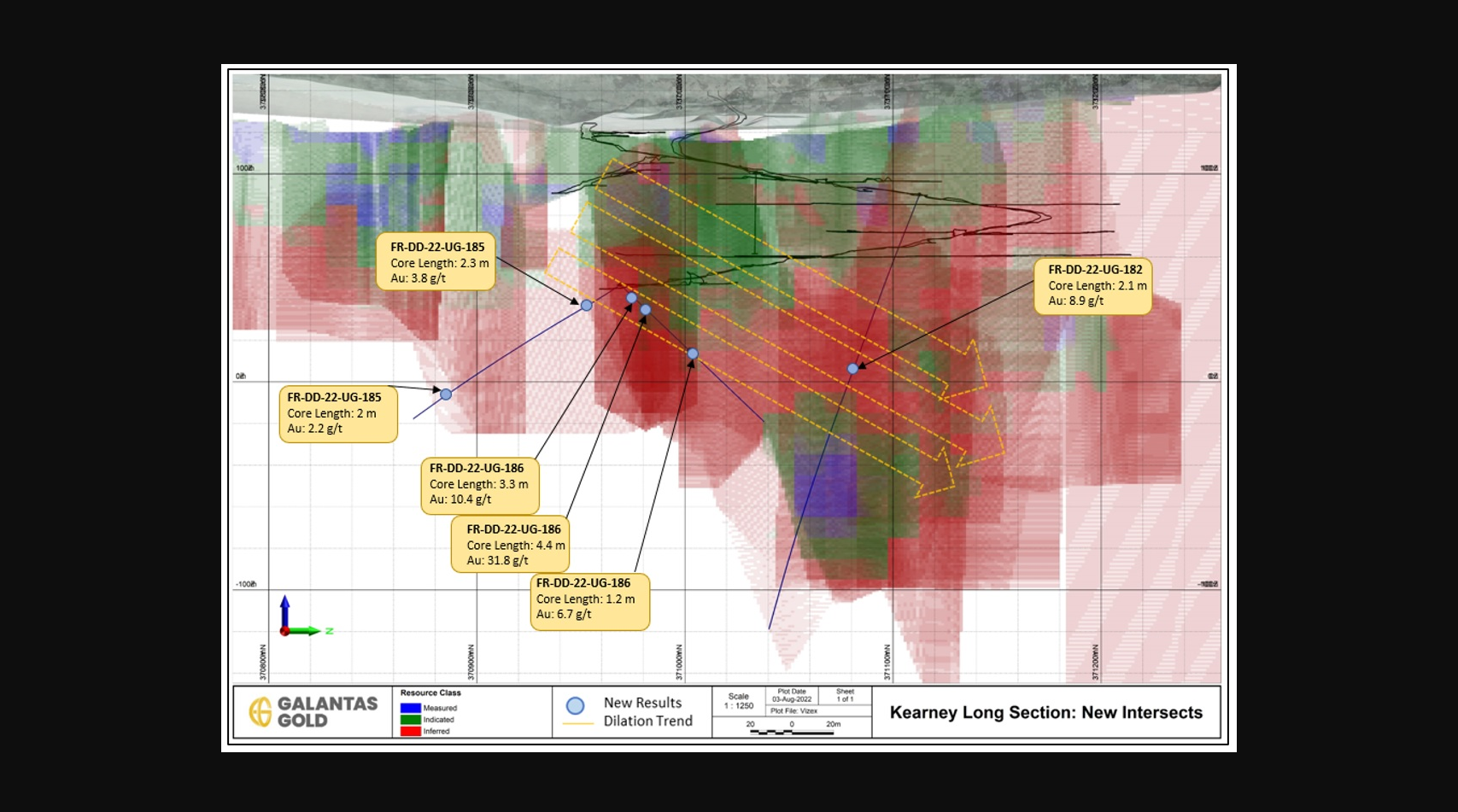

The result stems from three holes from the underground development at the Kearney Vein, which is part of the ongoing 4,000 m drilling program at the project.

Hole FR-DD-22-UG-186 targeted a dilation zone within the Kearney Vein.

Hole FR-DD-22-UG-182 targeted the main Kearney Vein approximately 25 m south of the previously reported FR-DD-22-UG-181 (31.7 g/t gold and 58.5 g/t silver over 7 m).

Galantas has commissioned the secondary egress and is now blasting its first stope at Omagh.

It is reviewing its mine plan and production guidance for the next 16 months including when to advance development to the higher-grade Joshua Vein.

“The ongoing drilling program has now successfully demonstrated the dilation zone model at both the Kearney and Joshua veins with multiple high-grade intercepts,” stated Mario Stifano, CEO of Galantas. “Ongoing development of the underground decline will facilitate deeper drilling and more precise targeting of dilation zones to the south at Kearney planned later this year. Drilling is also planned from the 1084 level, with the aim of identifying and delineating new dilation zones to the north at Kearney.”

Summary of drill results:

| Hole ID | Azimuth/Dip (degrees) | Intersect (m) (downhole) | Est. true width (m) | Intersect vertical depth (m) | Gold (g/t) | Silver (g/t) | Lead (%) | Core loss (%) |

| FR-DD-22-UG-186 | 039/37 | 3.3 | 2.5 | 140 | 10.4 | 29.4 | 1.6 | 0 |

| And | 039/37 | 4.4 | 3.0 | 143 | 31.8 | 39.2 | 4.0 | 0 |

| Including | 1.4 | 1.0 | 69.6 | 86.6 | 9.6 | 0 | ||

| And | 038/37 | 1.2 | 0.7 | 156 | 6.7 | 6.8 | 0 | 0 |

| FR-DD-22-UG-185 | 158.4/28 | 2.3 | 0.5 | 141 | 3.8 | 4.8 | 0.2 | 22.0 |

| And | 160.4/33 | 2.0 | 0.5 | 184 | 2.2 | 2.8 | 0.1 | 7.4 |

| FR-DD-22-UG-182 | 122.2/55.3 | 2.1 | 1.0 | 158 | 8.9 | 36.4 | 0.9 | 36.8 |

Galantas Gold is focused on operating and expanding Northern Ireland’s first gold mine.

Galantas Gold (GAL) is unchanged trading at $0.50 per share as of 10:06 am EST.