- Altai Resources Inc. (ATI) reported that the Quebec Government has announced that Bill 21 will come into effect on August 23, 2022

- Introduced on February 2, 2022, the Bill serves mainly to end petroleum exploration and production and the public financing of those activities

- The company filed a claim seeking compensation from the Minister of Energy and Natural Resources of Quebec and the Quebec Government for what it calls the illegal expropriation of its Quebec oil and gas licences

- Altai Resources Inc. (ATI) is trading steady at $0.065 per share as of noon ET

Altai Resources Inc. (ATI) reported that the Quebec Government has announced that Bill 21 will come into effect on August 23, 2022.

Introduced on February 2, 2022, and assented to on the following April, The company noted that the Bill serves mainly to end petroleum exploration and production and the public financing of those activities.

In March 2022, the company filed a claim seeking compensation from the Minister of Energy and Natural Resources of Quebec and the Quebec Government for what it calls the illegal expropriation of its Quebec oil and gas licences.

The company added that over the last 30 years, it had incurred vast expenditures in the exploration and development of its oil and gas licences.

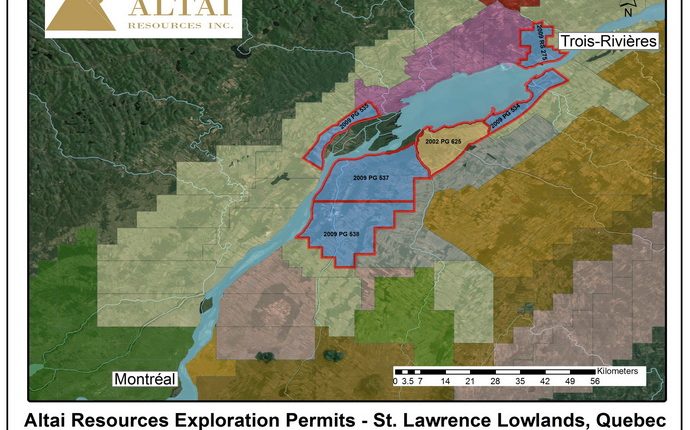

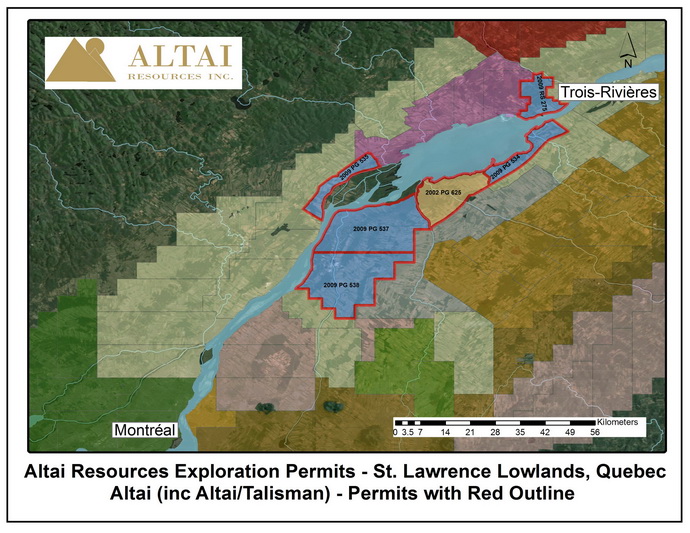

Altai Resources Inc. (ATI) is a Canadian based resource company, with a diversified portfolio of natural gas, oil, and gold properties in Canada. It is engaged in the exploration and development of mineral properties. Its portfolio includes Sorel-Trois Riviere’s natural gas property, Cessford oil field, and Malartic gold project. It holds interest in the heart of the St. Lawrence Lowlands Utica Shale gas play in Quebec.

Altai Resources Inc. (ATI) is trading steady at $0.065 per share as of 12:00 pm ET.