- Plato Gold Corp. (PGC) has identified gold drill hole targets on its Marriott Property following interpretation of a 2022 magnetic airborne geophysics survey

- The total magnetic intensity map shows three magnetic high anomalies

- The drill hole targets correspond to magnetic highs anomalies and the intersection of regional east-west faults and northeast southwest and northwest southeast cross faults

- Plato Gold Corp. (PGC) is up 16.67 per cent, trading at $0.035 at 12:30 pm ET

Plato Gold Corp. (PGC) has identified gold drill hole targets on its Marriott Property following interpretation of a 2022 magnetic airborne geophysics survey.

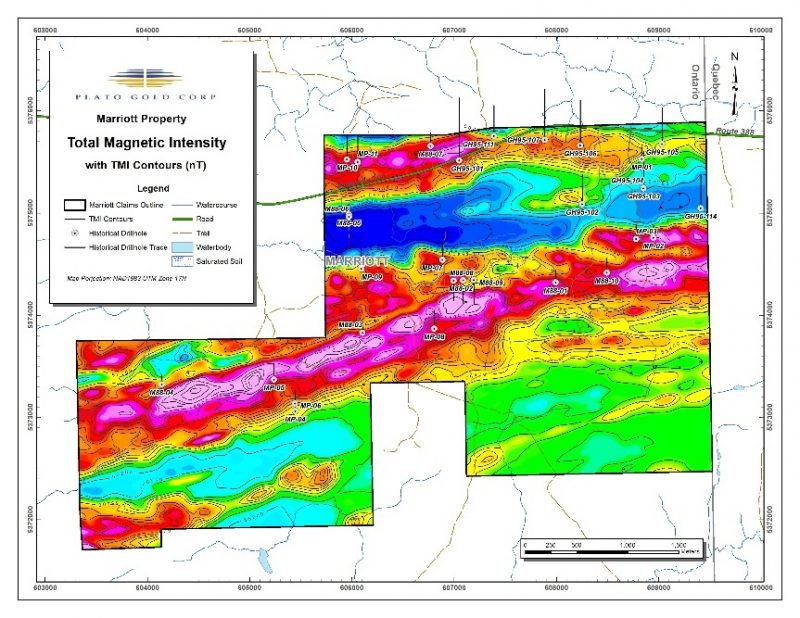

The total magnetic intensity map shows three magnetic high anomalies.

One magnetic anomaly runs continuous east-west, which corresponds to the iron-rich tholeiitic basalts according to the local geology map. There is a second east-west magnetic anomaly along Highway 101 which also corresponds to iron-rich tholeiitic basalt. There is also a third east-west magnetic anomaly in the southwest corner of the property.

The drill hole targets correspond to magnetic highs anomalies and the intersection of regional east-west faults and northeast southwest and northwest southeast cross faults. The drill targets are within the Destor-Porcupine Deformation Zone of the Abitibi Greenstone Belt which is known to regionally host gold mines.

Pioneer Exploration Consultants Ltd. conducted an airborne magnetic survey using an unmanned aerial vehicle on the entire Marriott Property between Feb. 13 and Mar. 4, 2022.

Plato Gold is a Canadian exploration company with projects in Timmins, Ontario, Marathon, Ontario and Santa Cruz, Argentina.

Plato Gold Corp. (PGC) is up 16.67 per cent, trading at $0.035 at 12:30 pm ET.