- Alamos Gold (AGI) has signed an agreement to acquire Manitou Gold (MTU) by way of a court-approved plan of arrangement

- The acquisition consolidates Alamos’ existing ownership of Manitou shares and increases its regional land package around Island Gold with the addition of the Goudreau Property

- Excluding Alamos’ existing ownership of Manitou, Alamos expects to issue approximately 1.0 million shares for total consideration of C$14 million

- Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America

- Alamos Gold Inc. was down 0.361 per cent, trading at C$13.80 at 9:40 AM ET

Alamos Gold (AGI) has signed an agreement to acquire Manitou Gold (MTU) by way of a court-approved plan of arrangement.

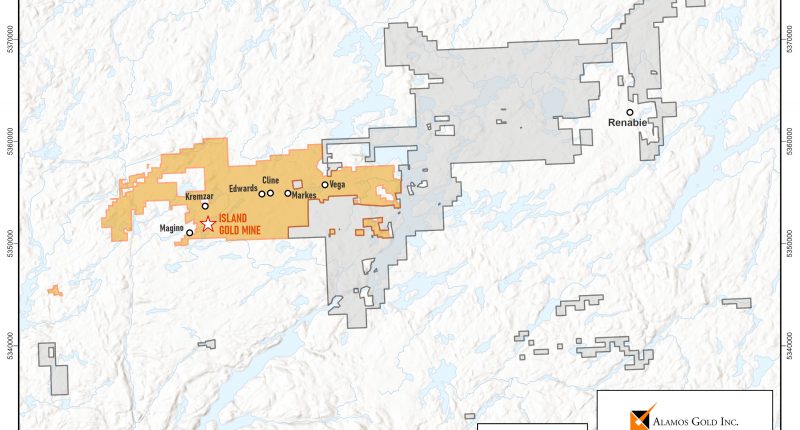

This acquisition of all of the issued and outstanding shares of Manitou Gold Inc. will consolidate Alamos’ existing ownership of Manitou shares and increase its regional land package around Island Gold with the addition of the Goudreau Property.

This includes 40,000 hectares adjacent to and along strike from the Island Gold Mine, adding significant exploration potential across the relatively under-explored Michipicoten Greenstone Belt.

The acquisition is expected to increase Alamos’ land package around the Island Gold Deposit to 55,277 ha, a 267-per-cent increase.

The acquisition extends Alamos’ mineral tenure along strike to the east within the Goudreau Lake Deformation Zone, a primary control on gold mineralization within the Goudreau-Lochalsh segment of the Michipicoten Greenstone Belt.

The expanded land package will now include the majority of the mineral tenure between the only two major mines within the belt – the Island Gold Mine and the past-producing Renabie Gold Mine (aggregate production of 1.1 million ounces of gold from 1947-1991).

The Goudreau Property also adds six additional belt-scale deformation zones hosting several gold occurrences, including Cradle Lake-Emily Bay, Loch Lomond, Missinaibi, Baltimore, Easy Lake and Renabie Deformation Zones.

The terms of the agreement state that Manitou shareholders will receive 0.003525 of a common share of Alamos for each Manitou share. Excluding Alamos’ existing ownership of Manitou, Alamos expects to issue approximately 1.0 million shares for a total of C$14 million.

“Since our acquisition of Island Gold in 2017, much of our focus has been on near mine drilling where we have had tremendous success discovering more than four million ounces of high-grade Mineral Reserves and Resources,” noted John A. McCluskey, President and Chief Executive Officer.

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America.

Alamos Gold Inc. (AGI) was down 0.361 per cent, trading at C$13.80 at 9:40 AM ET.