- In 2024, Orano will invest over C$115M in in-situ uranium recovery at its Imouraren Project in Niger’s Tim Mersoï Basin

- Imouraren is Africa’s largest uranium deposit

- The Arlit Fault, which hosts Imouraren and controls mineralization in Tim Mersoï, runs directly into Myriad’s (M) 100-per-cent optioned Agebout license

- Management intends to explore for the license’s potentially Athabasca-like high-grade uranium later this year

- CEO Thomas Lamb spoke with Brieanna McCutcheon about the news

- Myriad Uranium is a Canadian mineral exploration company focused on uranium and gold

- Myriad (M) last traded at $0.31 per share

In 2024, Orano will invest over C$115M in in-situ uranium recovery at its Imouraren Project in Niger’s Tim Mersoï Basin.

Imouraren is Africa’s largest uranium deposit, and the world’s second largest, at 384 million lbs eU3O8.

The application of in-situ recovery, the uranium industry’s leading low-cost production method globally, could be revolutionary for Niger, which relies on conventional open-cast or underground mining methods.

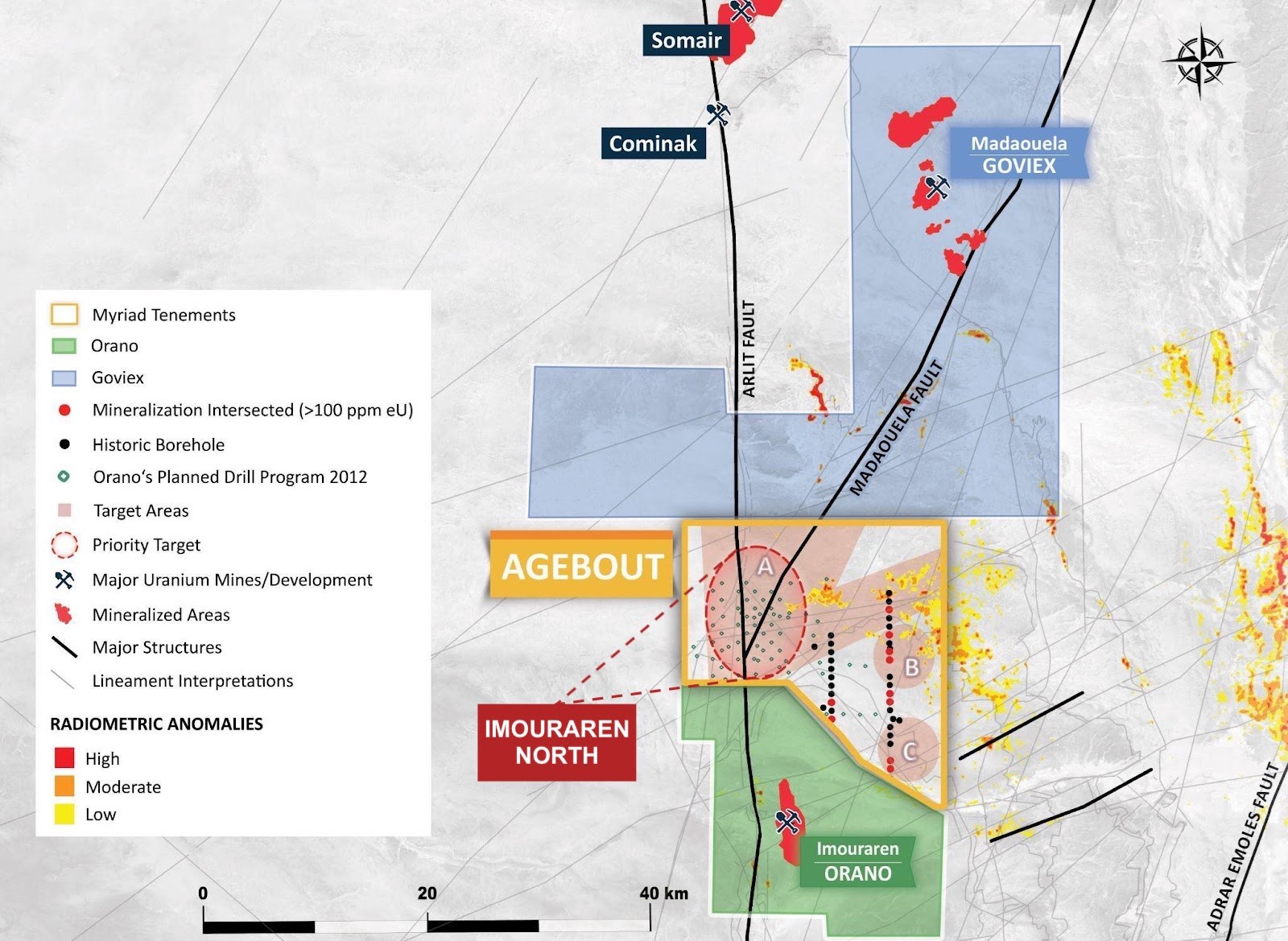

The Arlit Fault, which hosts Imouraren and is interpreted to control mineralization in Tim Mersoï, runs directly into Myriad’s (M) 100-per-cent optioned Agebout license. Arlit also intersects with the Madaouela Fault system – 15 km north of Imouraren – which hosts Goviex’s 100-million-lb eU3O8 Madaouela deposit.

Myriad refers to the intersection of Arlit and Madaouela as Imouraren North, where it believes Athabasca-like high-grade uranium may be present at deeper strata along certain fault boundaries.

It plans to be the first to explore the area later this year backed by Areva’s regional exploration data for Agebout, including airborne geophysics, radiometry, mapping, and 39 boreholes.

Areva planned to test Imouraren North for roll-front sandstone deposits, but was forced to halt its efforts due to the 2011 Fukushima Daiichi accident.

CEO Thomas Lamb spoke with Brieanna McCutcheon about the news.

Myriad Uranium is a Canadian mineral exploration company with a 100-per-cent option on over 1,800 km2 of uranium exploration licenses in the Tim Mersoï Basin, Niger. It also holds a 50-per-cent interest in the Millen Mountain Gold Property in Nova Scotia.

Myriad (M) last traded at $0.31 per share.

This is sponsored content, please see full disclaimer here.