- Cosa Resources (CSE:COSA) has acquired the 100 per cent owned Orbit uranium exploration property in Saskatchewan’s Athabasca Basin region

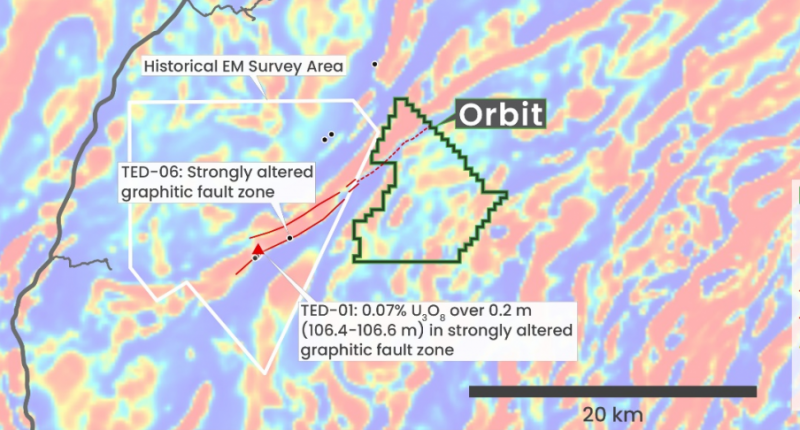

- Orbit covers 4 kilometres of the interpreted strike extension of a reactivated graphitic structural trend

- Drilling 10 km southwest along trend intersected 0.07 per cent uranium over 0.2 metres within strongly altered graphitic faulting

- Cosa Resources Corp. (COSA) opened trading at $0.35 per share

Cosa Resources (CSE:COSA) has acquired the 100 per cent owned Orbit uranium exploration property in Saskatchewan’s Athabasca Basin region.

Orbit covers 4 kilometres of the interpreted strike extension of a reactivated graphitic structural trend.

Drilling 10 km southwest along trend intersected 0.07 per cent uranium over 0.2 metres within strongly altered graphitic faulting.

Boasting two mineral claims, the 66.69 square kilometre project was acquired by low-cost staking and is 100 per cent owned by Cosa Resources.

Cosa’s uranium exploration portfolio now comprises 1473.4 sq. km. of highly prospective exploration ground in the Athabasca Basin Region of Saskatchewan.

Limited diamond drilling completed on strike intersected favourable results, confirming the conductive trend represents reactivated graphitic structures hosting strong alteration and weak mineralization.

The Vancouver-based company’s president and CEO, Keith Bodnarchuk, said in a statement the acquisition of Orbit further demonstrates Cosa’s commitment to identifying and pursuing opportunities that have been historically overlooked and under-explored.

“We will continue to seek new opportunities that afford Cosa’s shareholders exposure to meaningful exploration in exciting areas,” Bodnarchuk said.

Cosa’s VP of Exploration, Andy Carmichael, said in a statement that this prospective land has never seen a ground-based electromagnetic survey or a drill hole despite being located along trend of a graphitic structure hosting strong alteration and weak uranium mineralization.

“Located only 22 kilometres south of a past producing mine and a currently operating mill, we look forward to advancing this project towards drill testing,” Carmichael said.

Cosa expects initial exploration work will include airborne or ground EM surveying to map the interpreted extension of the prospective graphitic structural zone, airborne, or ground gravity surveying to locate gravity low anomalies potentially indicative of basement-hosted alteration zones, and diamond drilling as warranted.

Cosa Resources Corp. is a natural resource company engaged in the acquisition and exploration of mining properties. The company is focused on the Heron Property, north of La Ronge, Saskatchewan.

Cosa Resources Corp. (COSA) opened trading at $0.35 per share.

Join the discussion: Find out what everybody’s saying about this stock on the Cosa Resources Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.