- Kraken Robotics (TSXV:PNG) signed a partnership with SeeByte Ltd. on a maritime mission planning, data collection and data analysis solution

- The robotics company specializes in advanced synthetic aperture sonar for maritime platforms including uncrewed underwater vehicles of all sizes and the Katfish high-speed survey/detection system

- Their combined solution intends to offer a readily available integrated system for maritime operations

- Kraken Robotics stock last traded at C$1.50 per share

Kraken Robotics (TSXV:PNG) signed a partnership with SeeByte Ltd. on a maritime mission planning, data collection and data analysis solution.

Based out of St. John’s, Newfoundland and Labrador, the robotics company specializes in advanced synthetic aperture sonar for maritime platforms including uncrewed underwater vehicles of all sizes and the Katfish high-speed survey/detection system.

Kraken provides turnkey mine hunting solutions, which collects data and turns it into seabed intelligence, which customers can use to inform their decision-making in the field. SeeByte develops and supplies maritime software solutions. Their combined solution intends to offer an integrated system for maritime operations.

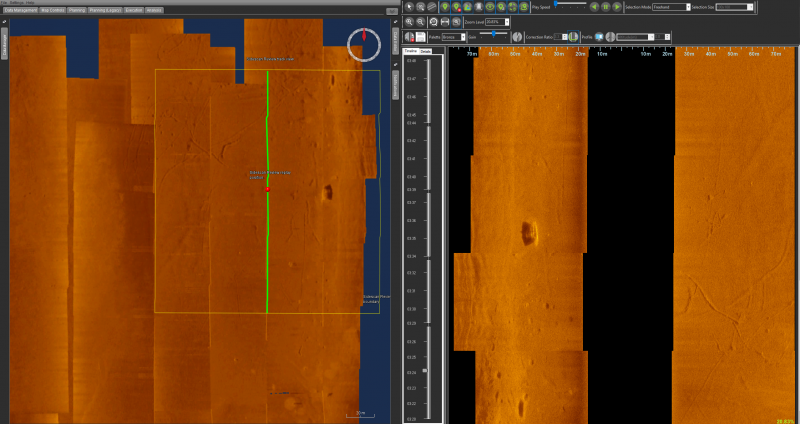

In a statement, company president and CEO Greg Reid said, “Our sonar systems are used worldwide for critical decision-making, providing swaths up to 400 m and constant resolutions of down to 2 cm x 2 cm. Having completed several integrations and customer demos with SeeByte, Kraken is excited to integrate with SeeByte’s advanced capabilities. This provides navies worldwide with the ability to seamlessly leverage SeeByte’s mission management tools to optimally plan, analyze and review Kraken’s high-resolution synthetic aperture sonar data.”

Katfish is a high-speed seabed survey system that provides ultra-high-resolution imagery and bathymetry (the measurement of depth of water in oceans, seas or lakes) for defence and commercial customers. The system is composed of Kraken’s synthetic aperture sonar, tentacle winch, and autonomous launch and recovery system. Applications include subsea pipelines, fibre-optic cables, key transit route safety and combat mission management systems.

Both companies intend to demonstrate this collaboration at the NATO exercise REPMUS 2024 later this month and will continue to collaborate to advance products and solutions.

SeeByte Ltd., a subsidiary of Battelle, provides global maritime clients with software solutions to enhance their uncrewed systems such as the SeeTrack mission management system, Neptune autonomy system, and automated target recognition.

Kraken Robotics is a marine technology company providing complex subsea sensors, batteries and robotic systems.

Kraken Robotics (TSXV:PNG) stock last traded at C$1.50 per share and is up 248.84 per cent over the past year.

Join the discussion: Find out what everybody’s saying about this Canadian micro-cap tech stock on the Kraken Robotics Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Kraken Robotics Inc.)