The stock markets have been on a rollercoaster ride recently, both in Canada and the United States. On Wednesday, the S&P 500 soared more than 9 per cent, marking its third-largest gain in a single day since World War II. The Dow also saw its biggest percentage advance since March 2020, while the NASDAQ scored its biggest one-day gain since January 2001 and its second-best day on record.

However, Canada’s main stock index, the TSX, plummeted at the beginning of the week due to growing recession concerns. This was triggered by U.S. President Donald Trump’s stubborn stance on his extensive tariff plans, which sent ripples through global markets. The TSX had not been that low since September 2024.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

US stocks took another big hit as the White House stood firm after President Trump’s announcement of unexpectedly high tariff rates on major US trading partners. It appeared as if Canada’s main stock index was on track to rebound from seven-month lows on Tuesday after three consecutive sessions of heavy selling, but that was not the case. The ongoing tariff dispute has jostled markets at home and abroad, and there appears to be no end in sight.

Trump announced a temporary drop in tariff rates for most countries to 10 per cent for 90 days. Canada and Mexico won’t be subjected to an additional 10 per cent duty, however. The European Union announced Thursday a similar 90-day pause on U.S. goods.

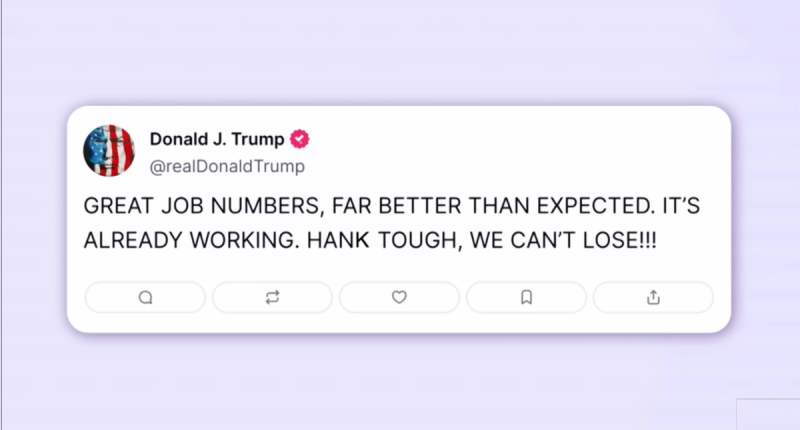

Stocks have swung wildly, with the TSX, Dow, and Nasdaq all up or down by more than a thousand points in a single trading day. To ease these fears, President Trump took to his social media platform to tell investors to “hang tough,” but he made a typo and wrote “Hank Tough”. Maybe in times like these, we should be tough like Hank.

Almonty Industries (TSX:AII, Forum), a global tungsten producer, has clarified for the market that its operations are not affected by US President Trump’s executive order on reciprocal tariffs. The order, released on April 2, 2025, imposes tariffs on all US trade partners, with harsher measures reserved for those carrying the largest trade deficit with the economic superpower.

According to management’s review of the order’s Annex I and Annex II, Almonty’s tungsten products and related materials, classified under HTS codes 2611.00.30, 2611.00.60, and 2825.90.30, are not subject to Trump’s reciprocal tariffs, ensuring stable trade and a more resilient US supply chain supported by the company’s recent partnership with American Defense and its ongoing relocation to the US.

Tungsten is a metal critical to the defense, manufacturing, clean energy technology, and high-performance electronics industries, granting it a multi-billion-dollar market expected to grow over the long term. China and allied states’ control of over 85 per cent of global tungsten production puts the supply chain at risk. This opens the door for players like Almonty – which plans to deliver 7 per cent of global supply and over 40 per cent of supply outside of China by 2027 – to capitalize on demand for conflict-free tungsten.

Theralase Technologies (TSXV:TLT, Forum), a clinical-stage pharmaceutical company dedicated to the research and development of light, radiation, sound, and/or drug-activated small molecules and their formulations, intended for the safe and effective destruction of various cancers, bacteria, and viruses, is pleased to announce that RuvidarT has been proven more effective in the treatment of Herpes Simplex Virus, Type 1 (HSV-1) versus FDA-approved, standard of care treatments Acyclovir (5 per cent) and Abreva (10 per cent Docosanol) in a preclinical animal model.

In the latest Theralase research, Balb/C mice were infected with human HSV-1 virus on Day 0. On Day 1 post-infection, these mice were treated with either Acyclovir (5 per cent), Abreva (10 per cent Docosanol), or Ruvidar.

Bombardier (TSX:BBD, Forum) is in the final assembly stage of its first Global 8000 jet at its production centre in Toronto. Major components are on site, and high-tech manufacturing is progressing as planned, with the aircraft slated to enter into service in 2025.

The profitable company recently finalized flight testing with a separate Global 8000 aircraft at its test centre in Wichita, completing multiple flights to Europe and “drawing rave reviews from test pilots,” according to Tuesday’s news release. The Global 8000 leads the industry with a range of 8,000 nautical miles and a top speed of Mach 0.94 – making it the fastest civil aircraft since the Concorde – enabling passengers to travel Dubai-Houston, Singapore-Los Angeles, London-Perth, among many other top destination pairings, while enjoying four living spaces and the longest seated length size in its class.

You never now what the next day is going to bring. In these turbulent times, investors are encouraged to “Hank Tough” and deepen their due diligence to ensure their portfolios are as up-to-date as possible to endure the current market volatility. By staying informed and making strategic decisions, investors can navigate the rollercoaster ride of the stock markets and potentially capitalize on opportunities presented by news-making stocks like Almonty Industries, Theralase Technologies, and Bombardier.

For previous editions of Buzz on the Bullboards, click here.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up HereJoin the discussion: Find out what everybody’s saying about these stock on Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image via Truth Social.)