- BlackBerry (TSX:BB) pivots to AI, leverages its Cylance platform for predictive cybersecurity and integrates AI into IoT and automotive solutions like Spark and Ivy

- Shares are up over 8 per cent on the TSX and 10 per cent on Nasdaq year-to-date, and more than 80 per cent higher than last year

- John Wall appointed president of QNX division, succeeding Mattias Eriksson; Wall brings decades of embedded software expertise

- BlackBerry stock (TSX:BB) closed trading at C$5.89

For more than four decades, BlackBerry (TSX:BB) has been a cornerstone of Canada’s technology sector. Once synonymous with smartphones, BlackBerry has reinvented itself as a software and cybersecurity powerhouse, and now, it’s doubling down on artificial intelligence as a key growth driver.

Why it matters

BlackBerry’s AI strategy is anchored in its Cylance platform, which delivers predictive cybersecurity solutions designed to stop threats before they occur. Beyond security, the company integrates AI into Internet of Things (IoT) and automotive systems through platforms like Spark and Ivy, securing connected devices and enabling in-vehicle data processing. Generative AI tools such as Cylance Assistant further empower enterprises and governments to make faster, smarter security decisions.

Market reaction

Investors have taken notice. Year-to-date, BlackBerry shares are up nearly 8 per cent on the TSX and more than 10 per cent on the Nasdaq. Compared to this time last year, the stock has surged nearly 80 per cent on both exchanges, a sign of renewed confidence in the company’s pivot toward AI-driven solutions.

Addressing investor skepticism

Some may ask: “What makes BlackBerry’s AI ambitions different from its smartphone era?” The answer lies in focus and market dynamics. Unlike consumer-driven trends, BlackBerry’s AI strategy targets cybersecurity and IoT infrastructure—sectors experiencing rapid growth and where BlackBerry already commands trust and credibility. These are long-term plays, not fleeting fads, giving the company a sustainable edge.

However, investors should remain mindful of broader market risks. If the predicted “AI bubble” bursts, BlackBerry’s ability to pivot—demonstrated in its transition from hardware to software—could prove invaluable.

Valuation perspective

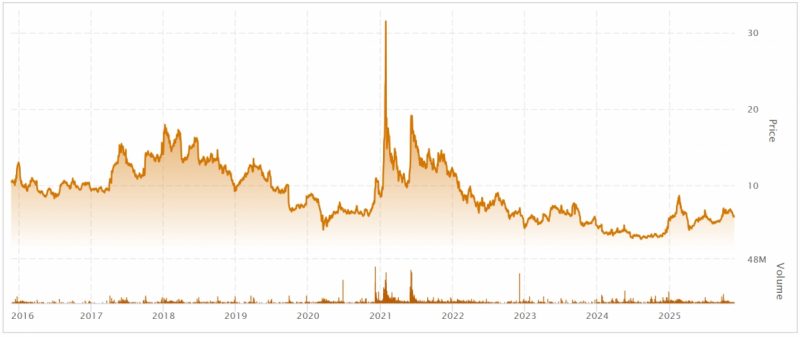

At just under C$6 (or about US$4) per share, BlackBerry trades near historical lows. Over the past decade, its stock has oscillated like an ocean wave, occasionally spiking to C$15, C$17, even C$23 on the TSX. For those eyeing entry points, this could represent a trough in that cycle.

Leadership update

In a significant leadership move, BlackBerry has appointed John Wall as president of its market-leading QNX division, effective immediately. Wall, a recognized authority in embedded software, has been with QNX since 1993 and most recently served as Chief Operating Officer. His deep experience in product engineering and automotive systems positions QNX for continued growth in connected and autonomous vehicle markets.

Wall succeeds Mattias Eriksson, who will remain as an advisor until year-end to ensure a smooth transition. BlackBerry’s board expressed gratitude for Eriksson’s contributions and wished him success in future endeavours.

About BlackBerry

BlackBerry Ltd. offers intelligent security software and services to enterprises and governments worldwide. The company leverages AI and machine learning to deliver cybersecurity, safety and data privacy solutions.

BlackBerry stock (TSX:BB) closed trading up 0.86 per cent at C$5.89.

Join the discussion: Find out what everybody’s saying about Blackberry, and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.