Copper bulls are running wild as some experts forecast the metal’s price to reach US$12,000/tonne in the next two years.

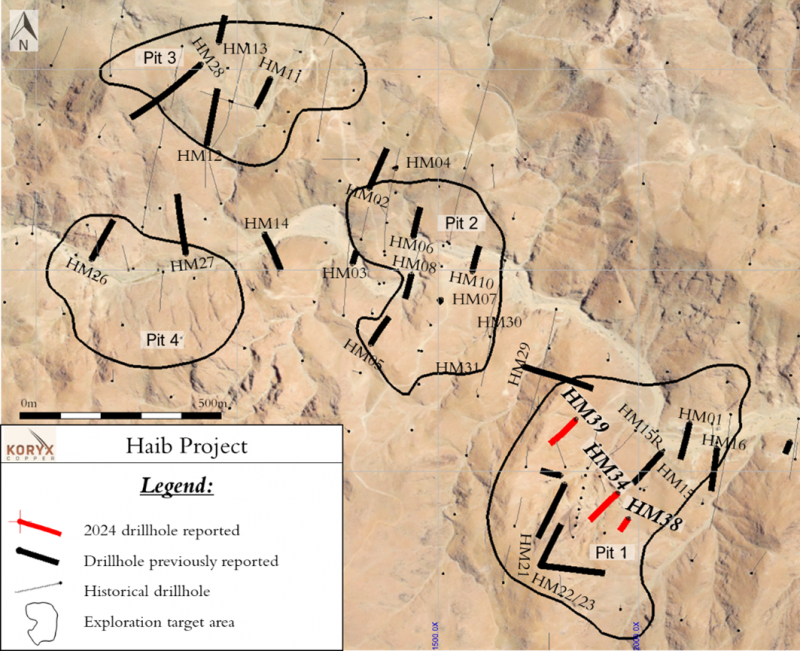

This outlook is good news for the likes of Koryx Copper Inc. (TSXV:KRY), whose team has once again demonstrated the promising potential of its Haib copper project in southern Namibia with the release of its recent third round and fourth round of assay results from the ongoing drilling program.

The Canadian mineral exploration company’s latest four drill holes have not only confirmed the presence of high-grade mineralization but have also underscored the deposit’s ability to deliver significant widths of copper resources within the known historical resource.

Since the resumption of drilling activities in October 2023, Koryx Copper has completed 22 holes, amounting to an impressive 4,043 metres. All 22 holes have been sampled and submitted to ALS Laboratories Ltd. in Johannesburg, South Africa, for analysis.

Koryx Copper drilling program highlights

The highlights from the recent drilling program include intersecting 168.60 metres at 0.40 per cent copper equivalent (CuEq), with multiple 2-metre intervals showcasing even higher grades.

In mid-April 2024, the team released the fourth round of assay results from the drill program. At the forefront of those results was hole HM17, which returned 0.93 per cent CuEq over 12 metres from near surface, including 4 metres at 1.52 per cent CuEq.

Significant intersections:

| Hole# | Zone | From (m) | To (m) | Width (m)1 | CuEq (%)2 | Cu (%) | Mo (%) | ||||||||

| HM34

|

Main | 2.00 | 18.00 | 16.00 | 1.06 | 1.06 | 0.003 | ||||||||

| Including | 6.00 | 14.00 | 8.00 | 1.71 | 1.71 | 0.005 | |||||||||

| Main | 32.00 | 200.60 | 168.60 | 0.40 | 0.40 | 0.005 | |||||||||

| Including | 32.00 | 36.00 | 4.00 | 0.71 | 0.71 | 0.003 | |||||||||

| Including | 42.00 | 46.00 | 4.00 | 0.70 | 0.70 | 0.005 | |||||||||

| Including | 50.00 | 52.00 | 2.00 | 1.02 | 1.02 | 0.008 | |||||||||

| Including | 58.00 | 68.00 | 10.00 | 0.47 | 0.47 | 0.008 | |||||||||

| Including | 88.00 | 90.00 | 2.00 | 1.48 | 1.48 | 0.002 | |||||||||

| Including | 108.00 | 110.00 | 2.00 | 1.50 | 1.50 | 0.004 | |||||||||

| Including | 112.00 | 116.00 | 4.00 | 0.45 | 0.45 | 0.006 | |||||||||

| Including | 118.00 | 120.00 | 2.00 | 1.02 | 1.02 | 0.005 | |||||||||

| Including | 120.00 | 134.00 | 14.00 | 0.46 | 0.46 | 0.008 | |||||||||

| Including | 162.00 | 168.00 | 6.00 | 0.51 | 0.51 | 0.008 | |||||||||

| Including | 184.00 | 200.60 | 16.60 | 0.40 | 0.40 | 0.007 | |||||||||

| HM38

|

Main | 16.00 | 50.00 | 34.00 | 0.73 | 0.73 | 0.004 | ||||||||

| Including | 24.00 | 26.00 | 2.00 | 1.32 | 1.32 | 0.006 | |||||||||

| Including | 30.00 | 34.00 | 4.00 | 1.23 | 1.23 | 0.002 | |||||||||

| Including | 36.00 | 38.00 | 2.00 | 2.28 | 2.28 | 0.008 | |||||||||

| Including | 40.00 | 44.00 | 4.00 | 0.61 | 0.61 | 0.004 | |||||||||

| Including | 46.00 | 50.00 | 4.00 | 0.67 | 0.67 | 0.003 | |||||||||

| Main | 88.00 | 138.00 | 50.00 | 0.33 | 0.33 | 0.008 | |||||||||

| Including | 112.00 | 120.00 | 8.00 | 0.63 | 0.63 | 0.008 | |||||||||

| HM39

|

Main | 16.00 | 66.00 | 50.00 | 0.37 | 0.37 | 0.002 | ||||||||

| Including | 54.00 | 58.00 | 4.00 | 1.16 | 1.16 | 0.004 | |||||||||

| HM17

|

Main | 8.00 | 20.00 | 12.00 | 0.93 | 0.93 | 0.009 | ||||||||

| Including | 16.00 | 20.00 | 4.00 | 1.52 | 1.52 | 0.022 | |||||||||

| HM32

|

Main | 0.00 | 98.00 | 98.00 | 0.43 | 0.43 | 0.008 | ||||||||

| Including | 8.00 | 12.00 | 4.00 | 0.73 | 0.73 | 0.016 | |||||||||

| Including | 14.00 | 18.00 | 4.00 | 1.12 | 1.12 | 0.013 | |||||||||

| Including | 26.00 | 28.00 | 2.00 | 1.47 | 1.47 | 0.007 | |||||||||

| Including | 48.00 | 58.00 | 10.00 | 0.54 | 0.54 | 0.009 | |||||||||

| Including | 70.00 | 74.00 | 4.00 | 0.75 | 0.75 | 0.012 | |||||||||

| Main | 128.00 | 138.00 | 10.00 | 0.35 | 0.35 | 0.016 | |||||||||

| Including | 136.00 | 138.00 | 2.00 | 0.73 | 0.73 | 0.018 | |||||||||

| Main | 222.00 | 230.50 | 8.50 | 0.34 | 0.34 | 0.005 | |||||||||

| Including | 222.00 | 224.00 | 2.00 | 0.72 | 0.72 | 0.003 | |||||||||

| HM33

|

Main | 6.00 | 40.00 | 34.00 | 0.37 | 0.37 | 0.007 | ||||||||

| Including | 14.00 | 22.00 | 8.00 | 0.49 | 0.49 | 0.005 | |||||||||

| Main | 112.00 | 120.00 | 8.00 | 0.41 | 0.41 | 0.001 | |||||||||

| 1. Width refers to intersection width; true widths have not been determined. | |||||||||||||||

| 2. CuEq (copper equivalent) has been used to express the combined value of copper and molybdenum and is provided for illustrative purposes only. No allowances have been made of recovery losses that may occur should mining eventually result. Calculations use metal prices of US$3.00/lb copper, US$10/lb molybdenum using the formula: CuEq% = Cu% + (Mo% [$10/$3]) | |||||||||||||||

These results underscore the robustness of the mineralization within the Haib copper project and signify its potential to emerge as a significant copper asset in the region.

The significance of these results cannot be overstated

They provide further validation of the project’s resource potential and reinforce investor confidence in Koryx Copper’s ability to unlock substantial value from the Haib deposit.

Moreover, the consistent delivery of high-grade intercepts over considerable widths enhances the project’s attractiveness for potential development and production.

In an interview with the Market Online’s “The Watchlist,” the company’s president and CEO, Pierre Léveillé, explained that the company is on its way to increase the average grade of the project and improve the economics while adding value.

About the Haib copper deposit

The Haib copper deposit, approximately 40 kilometres from the southern boundary of Namibia, is a substantial copper / molybdenum (Mo) resource covering an expansive 370 square km area. With more than 70,000 metres of historical drilling and several metallurgical test work programs conducted over the years, the project boasts a solid foundation for future development.

Delving into the geological history of the area, the Haib copper deposit stands as one of the oldest deposits globally, dating back approximately 1.8 billion years (Archean).

Over the millennia, it has undergone various geological transformations, including shearing and faulting events that have contributed to the concentration of copper and molybdenum. Notably, numerous mineralized structures have been identified in the Pit1 area (see map above), further underscoring the geological richness of the region.

Investment corner

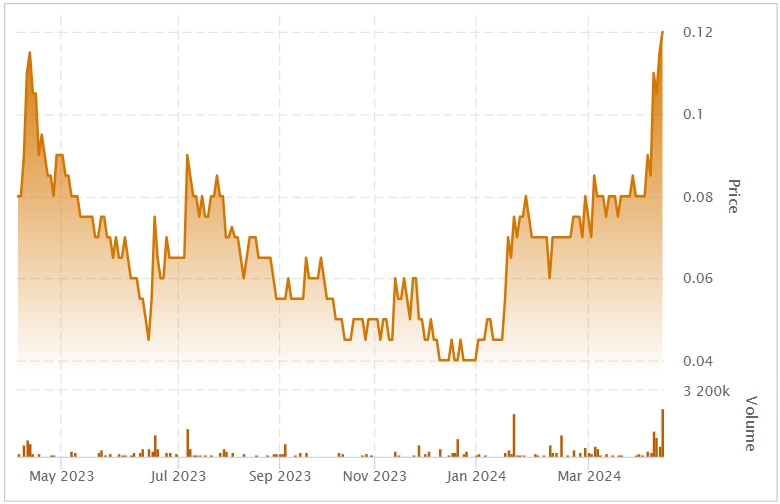

Boasting a stock value up just over 30 per cent since this time last month, Koryx Copper Inc. presents a compelling investment opportunity, buoyed by the continued success of its drilling program at the Haib copper project.

With robust assay results reinforcing the project’s resource potential and a favourable trajectory for copper prices in the foreseeable future, investors are encouraged to conduct further due diligence into the company.

As global demand for copper continues to rise, Koryx Copper stands poised to capitalize on this trend, making it an attractive proposition for investors seeking exposure to the red metal sector.

Join the discussion: Find out what everybody’s saying about this stock on the Koryx Copper Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Koryx Copper Inc., please see full disclaimer here.