Investors seeking exposure to materials critical to global electrification and decarbonization should know about Leading Edge Materials (TSXV:LEM), an overlooked mining stock developing three highly prospective projects in the European Union (E.U.).

Each of its three projects is on a path to:

- Becoming a sustainable source for the E.U.’s green technology supply chain

- Playing a significant role in the fast-growing US$54 billion lithium-ion battery (LIB) market

- Propelling shares beyond their undervalued position, as we’ll discuss later on

Let’s begin to explore why the critical materials stock deserves a place in your portfolio by delving into its first project.

The Woxna graphite mine is targeting vertically integrated graphite to lithium-ion battery anode material production

Leading Edge’s Woxna mine in Sweden – the only built and permitted graphite mine in the E.U. – is ideally positioned to capitalize on an outsized gap between E.U. production of and demand for graphite and anode material (slide 11), as well as disrupt China’s over 70 per cent share of the global graphite market.

Graphite is a key component in fuel cells’ bipolar plates, which distribute gas and air, conduct electrical current, and prevent gas and coolant leaks. It is also prized for its low cost and high energy density as anode material, which helps to store energy in LIBs. These use-cases, in addition to everything from pencils to polishes to nuclear reactor cores, afford graphite a 25x demand growth forecast from 2020 to 2040.

According to Woxna’s NI 43-101 technical report released in July 2021, the fully built processing plant is estimated to produce an average of 7,435 tonnes of coated spherical purified graphite (CSPG) per year over its 15-year lifespan, with 85-90 per cent less carbon emissions than comparable Chinese products.

The report goes on to provide a resource estimate of 834,500 tonnes of total graphitic carbon measured and indicated and 204,900 tonnes inferred, which is enough to achieve anode production – through a joint venture with Sicona Battery Technologies (slide 17) – for about 100,000 electric vehicles (EVs) per year. This scenario affords Woxna a post-tax net present value (8 per cent) of US$248 million, a post-tax internal rate of return of 37.4 per cent, and accumulated project revenues over US$1.4 billion.

The PEA does not account for two other deposits owned by Leading Edge – under granted exploitation concessions – that boast indicated and inferred mineral resource estimates of their own, awarding investors with potential upside through future development as the company ramps up a 500-tonne-per-year anode material demonstration plant for customer qualification trials.

The Norra Karr heavy rare earth elements project could supply 1.2 million-1.9 million EVs per year

The mining stock’s Norra Karr project, also located in Sweden, represents another promising resource for the European Union’s critical materials supply chain. In this case, investors stand to benefit from exposure to heavy rare earth elements, such as dysprosium and terbium, which are essential for the production of permanent magnets for the US$560 billion EV and US$60 billion wind turbine markets.

EV motors use between 2-4 kg of permanent magnets to create a constant magnetic field, which is oppositely charged from the field produced by the motor’s coil. This combination causes a repulsive effect which, when attached to an axle, creates an efficient and effective means of power generation. The need for permanent magnets will be so great, according to the International Energy Agency, that rare earth elements can expect a 7x growth in demand from 2020 to 2040.

Norra Karr’s 2021 preliminary economic assessment (PEA) estimates a 26-year life of mine with annual production of 5,351 tonnes of rare earth oxides, including 1,005 tonnes of magnet rare earth oxides, such as dysprosium (42 per cent of revenue), neodymium (21 per cent), terbium (16 per cent) and praseodymium. This is in addition to 732,885 tonnes of a nepheline syenite co-product per year in demand for glass-making, ceramics, pigments and fillers, and 10,200 tonnes of a zirconium dioxide co-product per year used in insulation, abrasives and enamels.

The PEA goes on to estimate that project output could support the production of permanent magnets for between 1.2 million and 1.9 million EVs per year, while yielding an attractive operating margin of US$38.48 per kg of rare earth oxides over the life of mine.

Norra Karr’s robust resource and operational capacity, propelled by the tailwind of global electrification, affords it a post-tax net present value (10 per cent) of US$762 million, a post-tax internal rate of return of 26.3 per cent, and accumulated project revenues of over US$9.9 billion. With an exploration license extended until 2026, these figures could improve considerably as the company enhances its element separation capabilities, hones bulk-sampling for commercial evaluations, and gathers data for a follow-up to the 2015 pre-feasibility study.

The Bihor Sud nickel-cobalt project substantiates initial drilling with a year of prospective results

The company’s 51-per-cent ownership of the Bihor Sud nickel-cobalt project in Romania – expandable to 90 per cent upon the filing of a positive feasibility study – holds promise for high-grade mineralization based on initial prospecting and sampling from past mine

workings.

Cobalt is critical to high-quality LIBs, with about 50 per cent of global production going toward battery storage. Its main use-case, for cathode material, enables the smooth flow of lithium ions during charging and discharging with optimal thermal stability and energy density. The metal is also found in widely used nickel-cadmium and nickel-metal hydride batteries.

Nickel, for its part, is another essential cathode component behind LIBs’ high-energy and low-cost storage capacity, ultimately leading to a longer driving range for customers.

Given how the average EV battery contains about 10 kg of cobalt and 30 kg of nickel, it is no surprise that demand for the metals is estimated to grow by 20x between 2020 and 2040, likely sending their already elevated prices further into the sky. That’s about US$16,500 per tonne of nickel and US$29,100 per tonne of cobalt as of Dec. 20, 2023.

Bihor Sud hosts over 100 kilometres of underground galleries with abundant and extensive mineralization, with galleries 7 and 4, the company’s initial focus, demonstrating the presence of cobalt-nickel-gold, and zinc-lead-copper-silver mineralization, respectively, in historical waste dump samples.

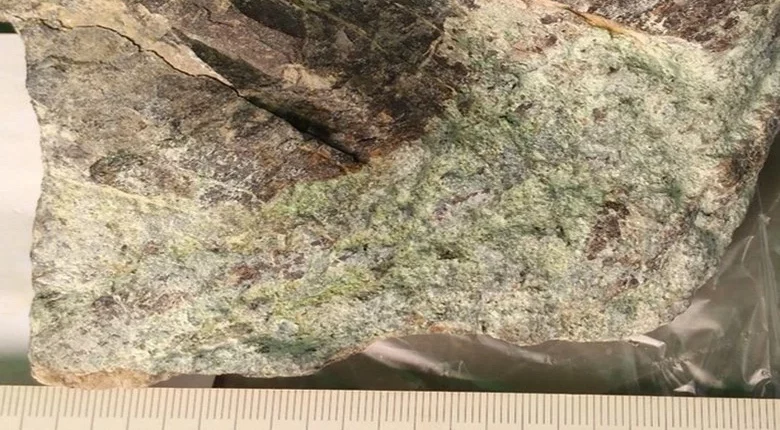

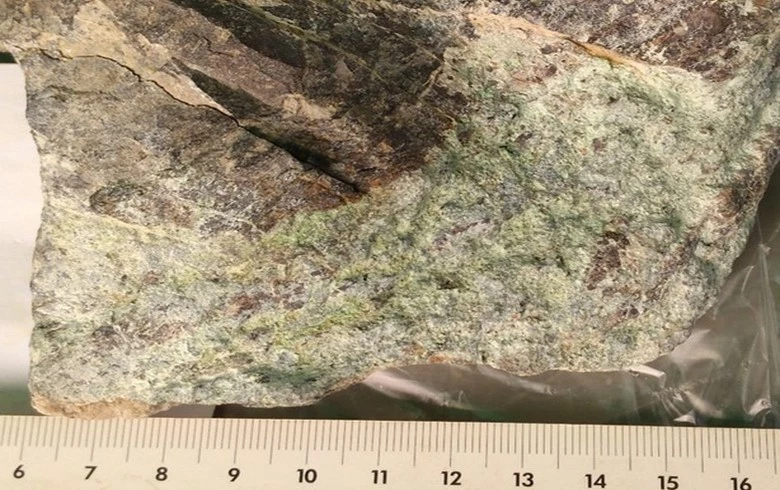

Leading Edge began its 2023 exploration program in January encountering over 100 m of visual nickel and cobalt mineralization in Gallery 7, as well as zinc-copper-lead-silver mineralization in Gallery 4, confirming waste dump sample results.

In March, the company expanded the mineralized footprint by 50 m above Gallery 7 and initiated a trenching program to extend the potential resource.

Initial assays from gallery walls and 246 m of trenching, released in June, delineated Bihor Sud’s scale and high-grade potential. Trenching assays reached as high as 6.12 per cent zinc, 10.5 per cent lead, 0.3 per cent copper and 530 ppm silver, indicating a potential lead-zinc-silver structure over 1 km in length. Underground samples reached as high as 30 per cent nickel and 4.71 per cent cobalt in Gallery 7, and 5.51 per cent zinc, 3.31 per cent lead, 1.08 per cent copper and 240 ppm silver in Gallery 4.

In October, the company continued its momentum toward an initial diamond drilling campaign with high-grade chip sampling assays, which were collected from mineralized zones identified through mapping and X-ray fluorescence. The assays confirm mineralized segments in Gallery 4 (350 m) as high as 11.7 per cent copper, 18.7 per cent zinc, 11.7 per cent lead and 649 g/t silver, and in Gallery 7 (over 150 m) as high as 15.65 g/t gold, 3.5 per cent cobalt and 29.7 per cent nickel.

Leading Edge delivered a second, equally impressive batch of systematic chip samples in December, extending Gallery 7’s cobalt-nickel-gold occurrences by 250 m to a total length of approximately 400 m. Highlights include 6.7 per cent cobalt, 13 per cent nickel and 7.5 g/t gold.

The company believes it has identified immediate drill targets backed by Gallery 7’s consistent mineralization, as well as clear structural and strike/dip insights from previous mapping results. For this reason, it will skip channel sampling and move straight into an underground drill program with the goal of an initial resource statement. Management secured an exclusive five-year exploration license in May 2022 and sees considerable upside in historical galleries to be examined.

A prime example of market inefficiency

Strengthened by diversified exposure to critical materials, robust global tailwinds, and exploration results in support of investors’ long-term conviction, Leading Edge ties its value proposition together with a tailormade management team that holds a combined 48 per cent interest in the stock.

Interim CEO and top shareholder (38.75 per cent), Eric Krafft, brings vast experience in M&A, corporate finance, and as a board member of numerous private financial holding and ship-owning companies. His leadership is complemented by:

- Chairman Lars-Eric Johansson, who served as President and CEO of Ivanhoe Mines (TSX:IVN) from 2006-19, in addition to separate stints as CFO of Kinross Gold (TSX:K), Noranda and Falconbridge from 1989 to 2006

- Director Daniel Major, the CEO of GoviEX Uranium (TSXV:GXU), and a 35-year veteran in mineral exploration and production

- CFO Sanjay Swarup, who has 15 years of accounting and consulting experience in the resource sector, including serving as CFO of Mandalay Resources (TSX:MND) from 2009 to 2018

- Geologist Magnus Leijd, whose career includes posts at Tasman Metals, Lundin Mining (TSX:LUN) and North Atlantic Natural Resources

Captained by capable hands, Leading Edge’s focus on quality assets and in-demand minerals has been unfairly punished by investors’ flight to safe havens, like cash and bonds, amid weariness from persistent inflation and a recession that may already be here. Their rush to the sidelines has saddled the critical materials stock with a 34.09 per cent loss since 2018, completely disregarding Woxna, Norra Karr and Bihor Sud’s demonstrated prospectivity, the vastness of their undeveloped land, and management’s deep familiarity with successful mining operations, creating an attractive entry point well worth your full due diligence process.

Given the recent steadiness of Canadian inflation – which stands at 3.1 per cent year-over year, down from over 8 per cent last summer – and the high likelihood of future positive news flow from all three of Leading Edge’s projects, investors’ window of opportunity into the stock may prove to be short lived.

This is sponsored content issued on behalf of Leading Edge Materials, please see full disclaimer here.