With the price of gold ascending by more than 100 per cent since 2022, hitting an all-time-high of US$3,433.47 per ounce in June, the metal has once again reasserted its role as a quintessential portfolio hedge.

This article is disseminated in partnership with LAURION Mineral Exploration Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Here’s a list of the macroeconomic events that gold has lifted a portfolio through over recent years:

- Generationally high post-COVID inflation, reaching 8.1 per cent in Canada in June 2022 and holding the TSX at a standstill, rebounding in December 2023, with consumer prices remaining elevated across the world.

- Numerous ongoing wars, including Russia-Ukraine since February 2022 and the Gaza war since October 2023, both of contributing to commodity and energy price volatility and market dips in global markets. This is in addition to uncertainty surrounding the Israel-Iran war started on June 13, 2024 and currently under a tenuous ceasefire.

- United States (U.S.) president Donald Trump’s aggressive trade policy, which has raised import tariffs on global partners peaked around 25 per cent on steel and between 10-25% on chines Goods, destabilizing long-standing relationships and near-term earnings outlooks in a bid to fortify the U.S.’s role on the world stage.

Gold’s portfolio support during the currently unstable economic environment, which it has delivered on countless times before – including during the Global Financial Crisis (2008) and the Dot-Com Bubble (2000) – is complemented by a growing consensus about the metal’s status as a cash-equivalent asset.

- According to the World Gold Council, while the metal isn’t recognized as a high-quality liquid asset (HQLA) under Basrl II Framework banking regulations – adopted in the U.S., European Union and United Kingdom. Under the gold standard, a currency’s value was fixed to a set amount of gold, with governments guaranteeing conversion at that rate—for example, the U.S. dollar was pegged at $35 per ounce until 1971. Gold wasn’t market-priced but officially valued. While the gold standard ended, regulations like Basel III now recognize gold as HQLA under the upcoming Basil iteration originally slated for July 2025.

This milestone would doubtlessly catalyze central bank buying, which is on track to surpass 1,000 tons for the fourth straight year, and accelerate the shift away from the U.S. dollar as a reserve currency driven by Trump’s unpredictability and his widespread public criticism of U.S. Fed chair Jerome Powell, further crystalizing gold’s role in the financial system as both an investment and a monetary asset.

Concurrently, major gold producers across the world are facing declining reserves because of the slow pace of new discoveries and gold’s stagnant performance from 2012 to 2022, eroding their margin of safety gained in the lead-up to the Global Financial Crisis. This dynamic is forcing producers to evaluate and acquire exploration-stage projects with data-driven resource potential, shining a light on junior gold miners that has not shone this bright in more than a decade.

Investors looking to maximize operational leverage to record gold prices are then in a position to tap into junior mining stocks’ turning tide and demonstrated ability to deliver exponential returns by allocating into standout operators in the space, whose high-conviction assets, robust exploration data and disciplined leadership teams align with gold’s growing importance in the global economy.

A junior gold miner with a history of value creation

A junior gold miner built to excel under our thesis is LAURION Mineral Exploration (TSXV:LME), market capitalization C$112.35 million, a mid-stage company with a more than 10-year track record of generating shareholder value by advancing its dual mineralized gold and polymetallic Ishkõday Project in Ontario through exploration and development. LAURION’s more than 1,250 per cent return since June 2015, miles ahead of the TSX Index’s 81.8 per cent effort, is supported by:

- Ishkõday’s two past-producing, surface-accessible mines, including:

- The Sturgeon River Mine, yielding 73,322 ounces of gold and 15,929 ounces of silver between 1936 to 1942 at an average grade of 17 grams per ton (g/t) of gold. The Brenbar Mine, which produced 135 tons averaging 20 g/t gold between 1941 and 1949.

- This is in addition to a pair of legacy stockpiles hosting more than 10,000 ounces of gold combined, with numerous metallurgical testwork programs and ore sorting tests completed by the Saskatchewan Research Council in 2023.

- A leadership team with strong shareholder alignment – including a more than 73.6 per cent stake owned by insiders, friends and family with the president and chief executive officer Cynthia Le Sueur-Aquin as the largest shareholder -as well as decades of directly applicable experience in mineral exploration and development, including metallurgy, geological modelling and capital markets.

- 100-per-cent-owned claims and mining leases with surface rights under a 21-year term.

- Proximity to water, grid power and a major regional highway, plus easy access to skilled labour from the nearby town of Beardmore 28 kilometres (km) northeast, as well as Thunder Bay 220 km northeast.

- Exploration has de-risked a 6km x 2.5km corridor together with ongoing permitting, engineering and offtake efforts, as detailed on slide 8 of LAURION’s investor presentation from its 2025 shareholder meeting.

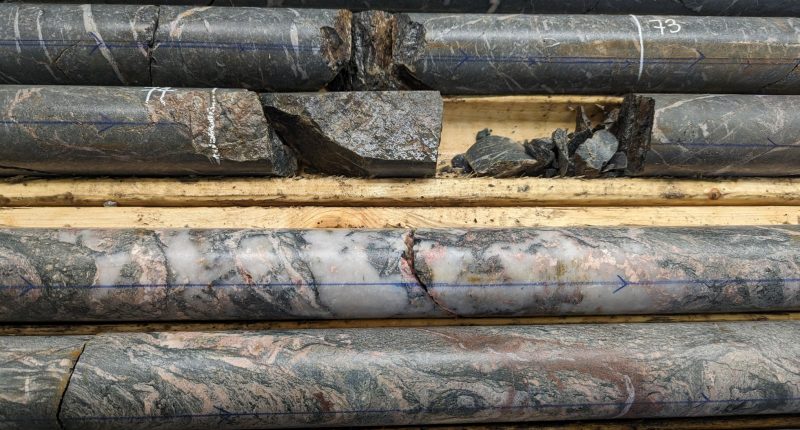

The junior miner has ushered the wholly owned, 57-square-km project from initial high-grade prospecting in 2008 into an attractive acquisition target backed by cutting-edge geophysics, structural and 3D modeling, and modern data analytics to expand and refine targets. 22 mineralized structures were revealed that have kept LAURION’s drill bits spinning for more than 90,000 metres (m) to date.

Ishkõday’s key vector for value creation, identified during 2022 drilling, is a 6 x 2.5 km mineralized corridor sporting seven distinct gold-silver-zinc-copper trends between the A Zone and the Brenbar Mine, with the Sturgeon River mine in between, offering ample evidence for large volumes of metal-bearing hydrothermal fluids comprising both early epithermal and later orogenic mineral systems.

The junior gold miner further inspected this corridor during 2023 drilling, executing on a 7,943-m program targeting the Sturgeon River Mine area and surrounding zones, delivering highlight results of 3.5 m at 29.45 g/t gold, including 0.55 m grading 186 g/t gold in a northeast extension, and 7.95 m at 3.61 g/t gold, including 0.5 m at 36.60 g/t gold in a southeast extension.

This was followed by a spring 2024 drilling campaign testing the most encouraging targets in the Sturgeon River Mine area, yielding standout intercepts of 10.25 m at 0.49 g/t gold, including 4.10 m at 0.98 g/t gold, and 1.30 m at 20.19 g/t gold, including 0.50 m at 52.30 g/t gold. These results build upon Ishkõday’s NI 43-101 technical report (Mineral Property of Merit Report) released in February 2024, which estimates the project’s exploration potential to range from 22.5 to 45 million tons averaging 0.11 g/t to 8.67 g/t gold.

A fall 2024 drilling program followed a few months later, testing high-priority zones on the 85M, M21, M24 and M25 veins northwest of the Sturgeon River Mine area, achieving up to 5.25 m at 7.29 g/t gold, including 0.50 m at 68.50 g/t gold.

Ishkõday’s value-accretive drilling history is on track to add momentum thanks to recently completed magnetotelluric and 2D deep induced polarization surveys over the Brenbar and Sturgeon River Mine areas. These surveys, offering high-resolution resistivity and chargeability imaging down to 2 km deep, will hone a planned 2025 exploration program by illuminating zones below known intercepts, veins and otherwise prospective geology.

LAURION’s 2025 exploration program

LAURION’s fully funded 2025 exploration program officially kicked off in May, and will consist of 7,000 m strategically distributed to expand mineralization, test continuity and identify new, potentially high-grade structures at the Brenbar and Sturgeon River mines, as well as the M24, M25 and 85M veins.

When it comes to the Brenbar Mine, the junior miner will concentrate its efforts on:

- Structural intersections of shear zones and fractures.

- High-priority veins aligned with geophysical anomalies.

- Alteration and brecciation zones linked to high-grade mineralization.

- Following up on high-grade historical intercepts, highlighted by 69.1 g/t gold over 0.3 m and 20.9 g/t gold over 1 m in BB10-19, as well as 10.2 g/t gold over 0.4 m in BB10-22.

- Following up on 2010 drilling by Kodiak/Prodigy Gold that discovered broad gold zones with stacked veining and widespread alteration, highlighted by 10.85 m averaging 0.28 g/t gold and 5.10 m averaging 0.5786 g/t gold.

In terms of the Sturgeon River Mine, 2025 exploration will further investigate the following vectors for shareholder value creation:

- High-grade intercepts from 2023 and 2024 drilling.

- In-fill drilling to more accurately delineate mineral continuity and deeper mineralized structures beneath historic underground workings using 3D modelling and geophysical data.

- Strike extensions to the north and south of the mine, as well as new zones to the northwest, including follow-up on the M24 and M25 vein systems.

This program represents phase one of an envisioned multi-year exploration plan designed to expand high-grade gold intercepts, follow up on high-potential drill targets and prospect the Sturgeon River Mine’s richly mineralized western quadrant, all in an effort to advance Ishkõday towards an initial resource estimate.

“We believe this program will unlock meaningful extensions at both Brenbar and Sturgeon River, with the potential for new discoveries at depth and along strike,” Le Sueur-Aquin said in a statement. “The integration of geophysics, historic data and structural mapping allows us to advance Ishkõday as a true district-scale derisked dual mineralized gold-polymetallic system.”

Further De-risking by a gold market tailwind, a wealth of high-grade exploration results and management’s disciplined track record, Ishkõday is on a path to greater scale and value creation, offering investors a data-driven opportunity to build a position today and compound it over the long term.

A model junior gold miner trading at an irrational discount

While we have established LAURION’s high-quality assets and operations over the course of this article, substantiating the stock’s more than 12-bagger return over the past decade, shares have, nevertheless, given back more than 60 per cent from their all-time-high of C$1.10 in February 2022, meriting a closer look as to why.

When we dig into the junior gold miner’s news releases around the initial 50 per cent drop in stock price beginning in September 2022, we quickly realize that investor pessimism was unwarranted, as evidenced by a successful capital raise, robust intercepts reported on October 18 and 25, followed by the acquisition of 100 per cent of the Brenbar Mine in December.

LAURION stock has since been range-bound between C$0.34 and C$0.70, despite the junior miner gradually increasing its knowledge of Ishkõday’s geology, leveraging:

- The 2023 exploration program, initiated in March with relogging and resampling of historical drillholes, followed by a geophysical survey announced in May and a drilling program in October, the latter yielding the 0.55 m intercept grading 186 g/t gold cited earlier in this article.

- Intercepts from 2023 drilling that hit the wire in 2024 on January 5 and 12, significantly expanding the Sturgeon River mineralized system to 1,600 m long and more than 600 m deep.

- The aforementioned spring 2024 drilling program, which broke ground in March, delivered initial assays in May uncovering three new gold zones grading up to 4.23 g/t gold, and followed these up with a second batch towards the end of the month confirming Sturgeon River mineral continuity. These results set the tone for value-accretive fall 2024 exploration, which leads us to the present moment, only a matter of weeks away from the 2025 program.

Currently trading at C$0.41, towards the lower end of the range, LAURION stock fails to adequately reflect the underlying company’s consistent harvesting of exploration upside over the past three years, continually advancing Ishkõday towards an initial resource estimate and a potentially significant investment outcome, with paths towards both milestones only likely to become clearer as 2025 exploration gets underway,

Backed by a current C$8.8 million in cash (C$4 million earmarked for 2025 exploration), and a favorable macroeconomic environment for gold, LAURION is well ahead of the market when it comes to making this investment outcome a reality, having partnered with financial advisor U.S. Capital Global since 2023 to engage with strategic parties, leveraging its extensive network of family offices, institutional funds and industry specialists.

Supported by gold’s ability to thrive during periods of market uncertainty, such as the present moment, LAURION is confident that U.S. Capital Global will lead it to “opportunities that have the potential to unlock meaningful shareholder value,” according to an April 2025 news release, with numerous discussions ongoing with interested acquirers and institutional investors.

In this way, excessive investor pessimism and green flags for high conviction across the board make LAURION Mineral Exploration a no-brainer when it comes to aligning your portfolio with the highest probabilities of success.

Join the discussion: Find out what everybody’s saying about this Canadian junior gold miner on the LAURION Mineral Exploration Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.