This is sponsored content issued on behalf of Coppernico Metals Inc., please see full disclaimer here.

The price of copper is sitting near a decade high, having gained over 50 per cent since pandemic-era lows, including over 15 per cent year-over-year, thanks to the metal’s essential uses across the industrial landscape, making junior stocks lagging this price surge attractive targets for a potential investment. Copper’s main uses include:

- Resistance to corrosion, leading to applications across plumbing, industrial equipment and construction, each of them fundamental to our day-to-day lives.

- Unmatched durability and conductivity in electric vehicle (EV) motors, batteries, electrical wiring and solar cells, with an EV requiring up to 183 pounds of copper, according to the Copper Development Association, and EV sales growing at an exponential rate over the past few years, according to data from the International Energy Agency, granting the copper supply chain a robust value proposition.

Data and analytics company GlobalData quantifies copper’s tailwind at a 4.2 per cent compound annual growth rate for global production through this decade, reaching 29.3 million tons by 2030. BHP, the world’s largest mining company by market capitalization, takes us two decades further, seeing demand surpassing 50 million tons per year by 2050, driven by momentum in digitization, electrification and emissions reduction.

With a long-term time horizon to capitalize on, investors have an opportunity to align their portfolios with projects positioned to compound shareholder value through exploration and development.

A junior copper stock mispricing its project’s district-scale potential

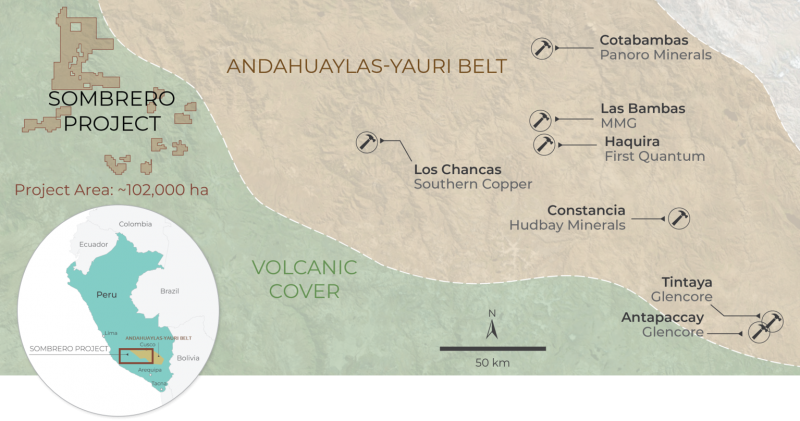

Coppernico Metals (TSX:COPR), market capitalization C$30.14 million, is a junior miner worth analyzing for the potential to harvest value from copper’s long-term runway thanks to the dislocation between 1) its stock’s over 43 per cent loss since listing in August 2024, and 2) its 102,000-hectare Sombrero copper-gold project in Peru – the second-largest copper producing country in 2023 according to Natural Resources Canada – where geology analogous to major deposits and numerous high-grade discoveries suggest the potential for a world-class deposit.

The Sombrero Project

Sombrero boasts geological similarities to nearby company-making projects, including MMG’s Las Bambas mine, which contains 4.9 million tons of copper reserves and 7.9 million tons of resources, and Glencore’s Tintaya deposit, a copper and gold mine that operated for 28 years, beginning in 1985, and produced about 37,000 tons of copper in concentrate in 2012 before closing down.

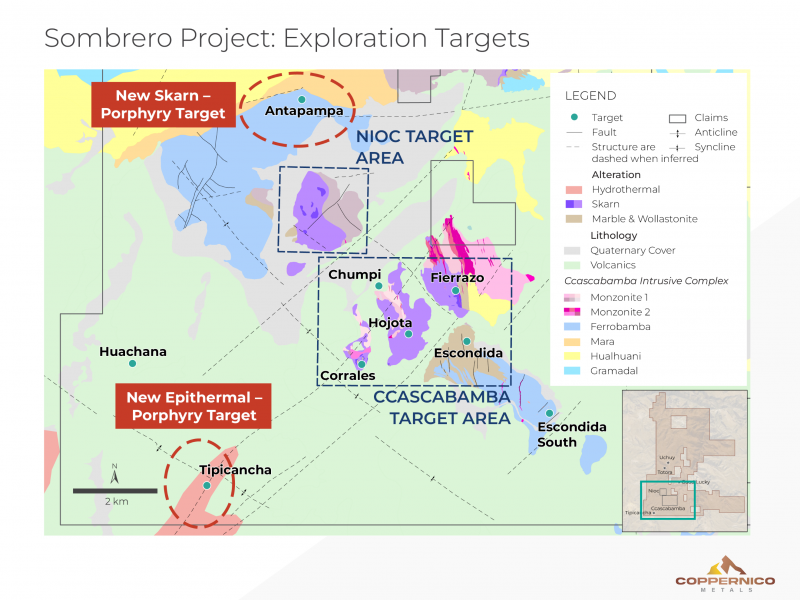

Sombrero’s similarities to these tier-1 projects are based on sampling and drilling, which have delineated a handful of high-potential targets within and around the broader Ccascabamba target area.

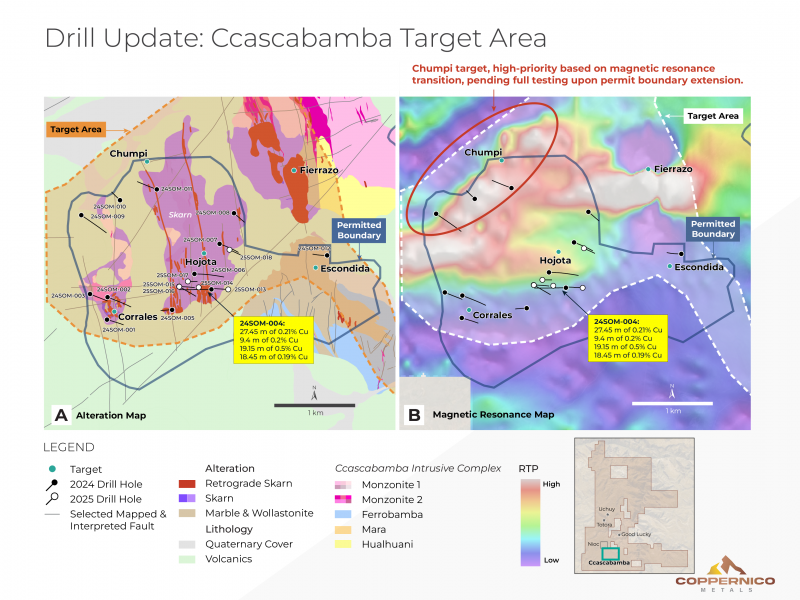

The first five drillholes under the phase-1 exploration program at Sombrero delivered a highlight of 19.15 m grading 0.50 per cent copper and 27.45 m grading 0.21 per cent copper (drillhole 4) from the Hojota target. The Corrales target, for its part, showed elevated copper, zinc and manganese values, which may be indicative of further copper mineralization to the north, west and east. Grades are broadly consistent with those seen in large-scale systems such as Las Bambas, further supporting the projects’ analogous geology.

Drillholes 6 through 8 at Hojota identified further copper mineralization, while drillholes 9 through 11 at North Corrales and the Chumpi target encountered evidence of a hydrothermal system, including numerous veins with strong copper mineralization.

On March 3, 2025, Coppernico announced that it had completed 18 drillholes totaling approximately 7,100 m as part of its phase-1 drilling program. In 2024 alone, the company completed 12 drillholes spanning 5,203 m, gaining valuable knowledge of Ccascabamba’s geochemistry and alteration, supporting the consideration of a follow-up phase-2 program focused on refining and testing high-priority targets.

Drilling to date, which has been completed under budget and on time, continues to support a large, multi-phase mineralized system. Additionally, concurrent mapping and sampling unveiled two high-potential targets, Tipicancha and Antapampa, outside of the Ccascabamba target area. As of December 2024, the company had $11 million in cash.

The Tipicancha target

The Tipicancha target, southwest of the Ccascabamba target area, houses an epithermal system with porphyry potential where mapping and rock sampling indicate an alteration zone measuring at least 1 km by 2 km, including a 400 m by 1,500 m anomaly with elevated copper, gold, silver and molybdenum values.

The target remains open to the north and at depth. Coppernico is continuing its mapping and sampling efforts to better understand its full extent and potential.

The Antapampa target

The Antapampa target is an iron-skarn occurrence spanning a 1 km by 1 km area, where outcrops and sub-crops of massive hematite-magnetite mineralization are associated with garnet skarn.

The target, located only 1.5 km north of the Nioc target area, contains mineralization and alteration near the contact between the Ferrobamba limestone and the Mara formation, a geological setting considered prospective elsewhere within the Sombrero Project.

Mapping and sampling efforts over the coming months aim to delineate the Antapampa target’s footprint and better understand its potential relationship with the Nioc target.

Coppernico Metals’ wealth of catalysts positioned for a potential re-rating

With results to date continuing to support the thesis that Sombrero may host significant mineralization, the company could benefit from a broad range of catalysts that could help to further demonstrate the project’s value to the market.

These could include testing possible correlations between magnetic anomalies, intrusion boundaries and potential mineralized zones, investigating the project’s most prospective historical drilling covering the Fierrazo target (slides 13-15), as well as advancing other key targets such as Tipicancha, Chumpi and Escondida South.

Investors can expect assays from four drillholes from the Hojota area over the near term, as Coppernico completes the three remaining drillholes under phase 1 targeting areas with minimal to no previous drilling.

The company will officially conclude its phase-1 exploration after its 20th drillhole on Sombrero, temporarily pausing field activities to allow for efficient capital allocation, ongoing data analysis and progress with the permitting process.

Once Coppernico has reviewed incoming assays, it will update investors with a detailed assessment. The company expects the first two phases of exploration at Sombrero to combine for 30 drillholes spanning 11,500 metres.

Revisiting reevaluation: A case of market reassessment

Guided by a proven leadership team with discovery, fundraising and acquisitions experience, as well as notable strategic investors – including Teck Resources with a 9.9 per cent stake and Newmont with a 6.28 per cent stake – it seems that Coppernico Metals’ district-scale potential remains largely unrecognized by the market.

This case is further supported by the stock’s over 40 per cent decline since listing in 2024, a move that appears disconnected from the copper price’s resilient climb higher – not to forget gold’s recent ascent to an all-time-high – and the company’s flexibility to pursue strategic opportunities given its strong cash position.

With over 100,000 acres of prospective land in a region known for its world-class deposits and a growing number of encouraging technical indicators, Coppernico Metals offers meaningful exposure to exploration-driven upside.

Join the discussion: Find out what everybody’s saying about this junior copper and gold stock on the Coppernico Metals Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

Disclosures from Coppernico Metals Inc.

- Coppernico is solely responsible for the technical information herein about its Ccascabamba project, such disclosure having been reviewed by its qualified person Tim Kingsley, C.P.Geo.

- Stockhouse has written this article with information compiled from third-party sources and does not make its own opinions. The information presented in this article comes from Coppernico Metals (when writing technically about the Ccascabamba project), and third-party sources outside of both Coppernico Metals and Stockhouse’s control.

(Top photo of drilling at Coppernico Metals’ Sombrero copper and gold project in Peru: Coppernico Metals)