- The US Department of the Interior recently added 10 minerals, including silver, to the US Geological Survey List of Critical Minerals

- An operator positioned to benefit from this new spotlight is Apollo Silver (TSXV:APGO), which is advancing the second-largest undeveloped primary silver project in the US

- The silver stock has added 177.24 per cent year-over-year, trouncing silver’s 53.90 per cent effort over the period

The US Department of the Interior recently added 10 minerals, including silver, to the US Geological Survey List of Critical Minerals.

The precious metal’s inclusion places it at the centre of US economic and national security, supported by varied uses-cases spanning everything from solar panels to automobiles to medical equipment, signaling that domestic resources ready to bolster the supply chain may be prioritized for subsidies, streamlined permitting and potential stockpiling initiatives.

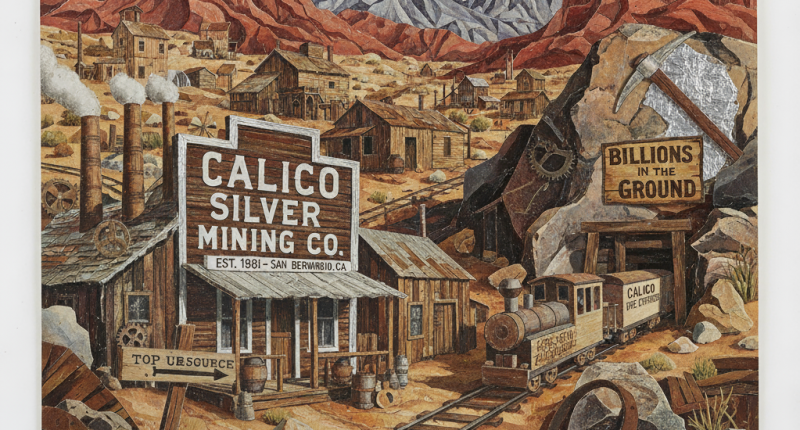

An operator positioned to benefit from this new spotlight is Apollo Silver (TSXV:APGO) , market capitalization C$191.46 million, which is advancing the Calico project in San Bernardino, California, the second-largest undeveloped primary silver project in the US.

Calico houses a large, bulk-minable silver deposit, complemented by economical barite and zinc concentrations, with all three officially recognized as critical minerals in the US. The project’s resource estimate details 125 million ounces of silver measured and indicated and 58 million ounces of silver inferred, representing almost US$9 billion in minerals in the ground.

“Apollo Silver welcomes the US government’s efforts to strengthen domestic silver mining by placing silver on the USGS List of Critical Minerals,” Ross McElroy, president and chief executive officer of Apollo Silver, said in Thursday’s news release. “This development will not only bring increased investor attention to the sector but will also help boost Apollo’s profile of its Calico silver project. The inclusion of silver on the Critical Minerals List strengthens the project’s case for consideration under the Fast-41 program, a US government initiative aimed at streamlining permitting processes for critical and resource projects. With the US importing 64 per cent of its silver consumption in 2024, this designation emphasizes silver’s strategic value and irreplaceable role across both industrial and defense industries.”

Apollo also owns the Cinco de Mayo project in Chihuahua, Mexico, featuring a historical inferred resource estimated at 52.7 million ounces of silver, in addition to 785 million pounds of lead, 1,777 million pounds of zinc and 96,000 ounces of gold, adding more than US$5 billion to its total undeveloped resources.

The company’s leadership team, underpinned by geological experience across the mining lifecycle, as well as an in-house expert in San Bernardino project development, recently closed a C$26.78 million financing to continue advancing its project portfolio, including validating Calico’s numerous opportunities for expansion.

Join the discussion: Find out what investors are saying about this silver stock on the Apollo Silver Corp. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.