- American Lithium (LI) has signed a royalty buyback agreement with Nevada Alaska Mining

- The arm’s-length agreement will see American Lithium buy back the remaining 1-per-cent gross overriding royalty on its wholly-owned TLC Lithium Project in Nevada

- Consideration totals 950,000 LI common shares

- American Lithium is actively developing large-scale uranium and lithium projects within mining-friendly jurisdictions throughout the Americas

- American Lithium (LI) closed up by 15.93 per cent, trading at $4.73 per share

American Lithium (LI) has signed a royalty buyback agreement with Nevada Alaska Mining.

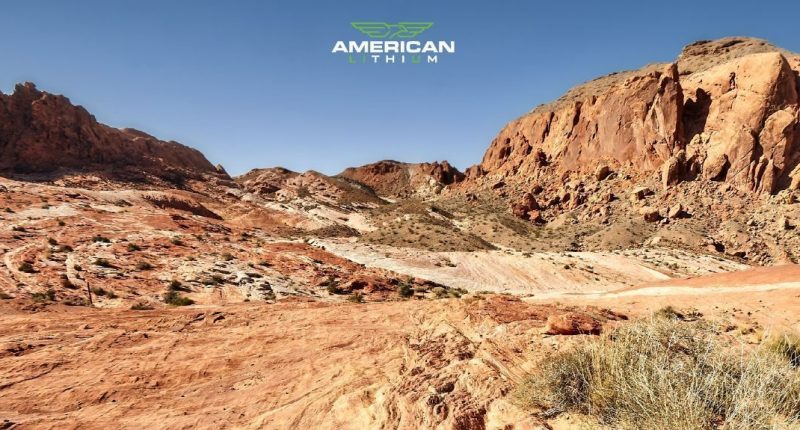

The arm’s-length agreement will see American Lithium buy back the remaining 1-per-cent gross overriding royalty on its wholly-owned TLC Lithium Project in the Esmerelda lithium district northwest of Tonopah, Nevada.

American will issue 950,000 common shares subject to a hold period of four months and one day.

The transaction remains subject to the approval of the TSXV.

“We are very pleased to have reached this agreement with the royalty holder to buy back this valuable royalty, which also ensures that the company will control 100 per cent of all concessions comprising TLC,” stated Simon Clarke, American Lithium’s CEO.

“As TLC moves through development and into production, this transaction should be highly accretive and will maximize project value. Removing this remaining royalty also enables us to present TLC as wholly unencumbered in our maiden PEA, which is expected to be released in the next few days,” he added.

American Lithium is actively developing large-scale uranium and lithium projects within mining-friendly jurisdictions throughout the Americas, including Nevada and Peru.

American Lithium (LI) closed up by 15.93 per cent, trading at $4.73 per share.