Businesses that create value are at the root of successful investing and the fulfilment of financial goals, but sometimes this value doesn’t manifest as net income on the balance sheet.

Certain exploration companies, like those tied to commodities such as oil or critical metals, can win market favour by establishing a project’s resource potential and chances for economical extraction years before they generate a dollar in revenue.

This more metaphorical method of identifying value, tied to assets instead of cash generation, can be a stretch for investors to get behind, and for this reason often results in share price volatility divorced from intrinsic value.

To help you put this thesis in play, here’s an oil stock and two junior miners of precious and critical metals where we see unrecognized value.

TAG Oil

TAG Oil, market capitalization C$62.94 million, is an international oil and gas exploration company active in North Africa and the Middle East.

The company’s unconventional heavy oil Abu Roash formation (ARF) in Egypt’s Badr oil field (BED-1) is estimated to contain more than 500 million barrels of oil in place with a high probability for commercial development. At current prices, this potential resource represents more than US$41 billion in the ground.

Despite producing more than 10,000 barrels to date from its initial horizontal well and having another in the works, and the company holding no debt and C$12.7 million in cash as of Q1 2024, TAG Oil stock (TSXV:TAO) has given back 48.48 per cent year-over-year, last trading at C$0.34 per share, severely discounting its billions in upside potential.

Toby Pierce, TAG Oil’s chief executive officer, spoke with Stockhouse’s Lyndsay Malchuk about the oil stock’s initial horizontal well. Watch the interview here.

Noble Mineral Exploration

Noble Mineral Exploration, market cap C$11.84 million, is a junior mining stock offering exposure to a diversified portfolio of projects and other mining stocks, including:

- More than 60,000 hectares of drill-ready mineral rights in Northern Ontario, Quebec and Newfoundland prospective for nickel, cobalt, gold, copper, graphite, platinum group metals and rare earth elements.

- 2,913,000 shares of Canada Nickel Company (TSXV:CNC).

- 19.5 million shares and 750,000 2-year warrants of Spruce Ridge Resources.

- 1.4 million shares and 800,000 warrants of Go Metals (CSE:GOCO).

Noble management has distinguished itself through disciplined capital allocation, accumulating 11 diversified projects and attracting numerous joint venture partners, affording investors quite a lot to hang their conviction on. Though you’d hardly be able to tell, judging by how shares of Noble Mineral Exploration (TSXV:NOB) have given back 16.67 per cent since 2019 and last traded at C$0.05 per share.

Its latest collaboration, with Canada Nickel Company, will see the partners consolidate highly prospective nickel claims east of Timmins, Ontario, and spin them out into a new public company, providing a strong catalyst for shareholder value.

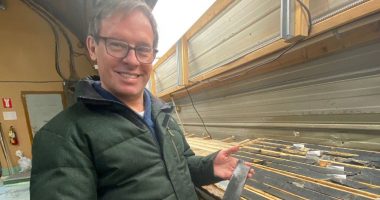

Vance White, Noble Mineral Exploration’s chief executive officer, spoke with Stockhouse’s Lyndsay Malchuk about the spin-out. Watch the interview here.

Riley Gold

Riley Gold, market cap C$8 million, is an exploration and development company in Nevada run by a management team with a track record spanning each phase of the mining life cycle.

The junior mining stock’s 24.7-square-kilometre Pipeline West/Clipper gold project in the Battle Mountain Eureka trend is under a US$20 million earn-in agreement with senior gold miner Kinross Gold (TSX:K). The project’s key features include:

- Neigbouring past production and current reserves and resources totalling more than 50 million ounces of gold.

- Historical drilling highlights of 1.7 g/t gold over 12.2 m, including 2.59 g/t gold over 4.6 m.

- Multiple gold targets along a 3-km trend supported by past drilling, geophysics and gold-in-soil anomalies.

Riley’s more than 31-square-kilometre Tokop gold project, located within the Walker Lane Trend, is host to multiple styles of gold mineralization, as highlighted by 2021 drilling as high as 98 g/t gold over 2.92 m and 235 g/t silver over 1.4 m, in addition to numerous geophysical targets to be explored.

With a senior gold miner now drilling its main project and gold trading near its all-time-high, it feels like a steal that shares of Riley Gold (TSXV:RLYG) have added only 5.56 per cent year-over-year.

Todd Hilditch, Riley Gold’s chief executive officer, spoke with Stockhouse’s Coreena Robertson about Kinross’ earn-in drilling program on the Pipeline West/Clipper gold project. Watch the interview here.

Join the discussion: Find out what everybody’s saying about these oil and junior mining stocks on the TAG Oil Ltd., Noble Mineral Exploration Inc. and Riley Gold Corp. Bullboards, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of TAG Oil Ltd., Noble Mineral Exploration Inc. and Riley Gold Corp., please see full disclaimer here.

(Top photo of Noble Mineral Exploration’s Nagagami Complex in Ontario: Noble Mineral Exploration)