Investing in junior mining stocks is essential for proper portfolio diversification, but identifying undervalued stocks is a key part of maximizing returns.

A reliable way for finding value in the junior mining sector is targeting companies with depressed share prices that don’t reflect the companies’ strong records in project development. This mismatch between market perception and intrinsic value offers a window of opportunity for investors to take advantage of.

A junior mining stock sporting the hallmarks of undervaluation is New Pacific Metals (TSX:NUAG;NYSE-A:NEWP) with a market capitalization of C$478 million. This Canadian developer focused on advancing two precious metals projects in Bolivia, a top-5 global silver producing country, has seen its stock rise by only 63 per cent since 2017, despite:

- A project portfolio representing billions of dollars of intrinsic value,

- Management with experience in mining finance, government relations, exploration and project development,

- Substantial investments from Silvercorp Metals (TSX/NYSE-A:SVM) (27.4 per cent), the largest primary silver producer in China, and Pan American Silver (TSX:PAAS) (11.6 per cent), one of the world’s largest silver producers,

- Target commodities, including silver, zinc, lead and gold, each of which offers attractive prospects for long-term growth due to their diversified roles across industries, including renewable energy.

New Pacific Metals has consistently focused on creating shareholder through a carefully executed strategy of project identification, acquisition, geological studies, and drilling. Since 2017, this approach has built a strong track record that remains unappreciated in the market, making today the perfect time to consider the company’s growth potential and long-term value for investors.

The Carangas project

New Pacific Metals’ 41-square-kilometre Carangas project in Bolivia is located 190 km southwest of Oruro within the South American Epithermal Belt, a host to large precious metal deposits and operations across the continent that remains underexplored.

The company recently issued a Preliminary Economic Assessment (PEA) in October this year, detailing an efficient, low-cost open-pit mining scenario. Here are the highlights:

- Post-tax net present value (NPV) (5%) of US$501 million and internal rate of return (IRR) of 26% at base case metal prices of US$24/oz of silver, US$1.25/lb of zinc, and US$0.95/lb of lead.

- At $30/oz silver, the NPV and IRR rise to $748 million and 34%, respectively.

- Production of 106 million ounces of silver, 620 million pounds of zinc and 382 million pounds of lead over a 16-year mine life, generating US$867 million in post-tax cash flow at $24/oz silver.

- Low initial capital costs of US$324 million, average all-in sustaining costs of US$7.60 per ounce of silver and total operating costs of US$18.60 per ton milled, enabling a post-tax payback of only 3.2 years.

Many junior mining stocks face challenges related to capital management and significant upfront capital expenditures. These hurdles can often impede project development and strain company resources. However, New Pacific Metals has adopted a strategic approach to mitigate these risks at Carangas.

Instead of developing the entire resource at once, New Pacific focuses on the deposit’s highest-value material. By targeting a rich, near-surface section of 64 million tonnes grading at 63 g/t silver, 0.8% zinc, and 0.4% lead, the company minimizes initial capital requirements while leaving the rest of the deposit for future development. This phased strategy offers several advantages:

- Lower initial costs: By targeting the high-grade, near-surface mineralization, New Pacific reduces upfront investment needs.

- Faster production: Concentrating on a smaller, higher-grade portion of the deposit can potentially accelerate the project timeline, allowing for earlier cash flow generation.

- Reduced risk: A smaller operation allows for operational learning and process optimization before expansion.

- Future growth flexibility: The remaining resource provides optionality for future expansion as market conditions and company finances allow.

Additionally, Carangas benefits from proximity to infrastructure and a low strip ratio, further enhancing project economics. By leveraging these advantages without requiring significant upfront investment, New Pacific is well-positioned to achieve strong returns while effectively managing risk. This approach underscores the company’s commitment to responsible capital management and sustainable growth in the junior mining sector.

Management will now turn its attention to advancing Carangas’ permitting process, followed by further technical evaluation and a potential financing and development decision. Key permitting milestones include:

- A comprehensive mine development agreement with the local community.

- Conversion of its exploration license into a mining license through Bolivia’s Oruro Mining Task Force, with New Pacific Metals set to become the first miner to make the transition under Bolivia’s 2014 mining code.

The Silver Sand project

The market’s misperception of New Pacific Metals is further illustrated by its flagship Silver Sand project, acquired in 2017 and located in Bolivia’s Potosi Department, whose 2024 Pre-feasibility Study details an open-pit mining operation highlighted by:

- A post-tax net present value (NPV) (5 per cent) of US$740 million at US$24 per ounce of silver.

- At $30/oz silver, the NPV and IRR rise to $1,124 million and 48%, respectively.

- Over US$1.1 billion in cash flow, at $24/oz silver, over 13 years through the sale of 157 million ounces of silver.

- Initial capital costs of only US$358 million and average all-in sustaining costs of only US$10.69 per ounce of silver.

Exposure to Silver Sand’s potential cash flows of US$1.1 billion along with US$0.9 billion of potential cash flows recently outlined at Carangas in the PEA (both assuming a $24/oz silver price) show clear upside relative to New Pacific’s C$478 million market cap. This valuation disparity is clearly attractive under current market conditions and is posed to narrow as the ongoing permitting process runs its course at both projects.

New Pacific Metals is a bargain for your long-term capital

The present macroeconomic environment, plagued by high consumer prices, is incentivizing investors to save cash and ignore undervalued junior mining stocks like New Pacific Metals, gifting readers with long-term capital the opportunity to build a position during a period of proverbial blood in the streets.

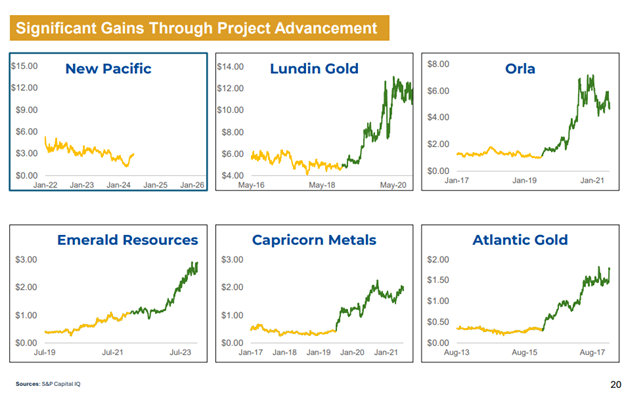

With operations propelled by Silver Sand and Carangas, in addition to numerous peers that have experienced recent gains from project advancements (graph below), readers can pick up shares today at a market cap 6 times smaller in size to the projects combined NPV of US$1.872 billion at $30/oz, far undercutting management’s development track record since 2017.

Further de-risked by a strong balance sheet (US$22 M cash on had at June 30, 2024), as well as substantial investments from Silvercorp Metals (TSX/NYSE-A:SVM) (27.4 per cent), the largest primary silver producer in China, and Pan American Silver (TSX:PAAS) (11.6 per cent), one of the world’s largest silver producers, New Pacific Metals offers investors many green flags to expect a long-term share price re-rating as the mining life-cycle takes its course

Join the discussion: Find out what everybody’s saying about this undervalued junior silver, zinc, lead and gold mining stock on the New Pacific Metals Corp. Bullboard and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of New Pacific Metals Corp., please see full disclaimer here.

(Top photo of drilling at New Pacific Metals’ Carangas project in Bolivia: New Pacific Metals)