- Antler Gold (ANTL) has closed a private placement financing for gross proceeds of $1,150,000

- The company issued 11.5 million units priced at $0.10 per unit

- Net proceeds will be used primarily to advance exploration work on its Namibian gold projects and the Kesya Rare Earth Project in Zambia

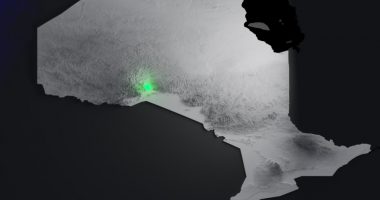

- Antler Gold is a Canadian exploration company, focused on gold projects in Namibia, Zambia and Africa

- Antler Gold Inc. (ANTL) opened trading at C$0.13

Antler Gold (ANTL) has closed its upsized private placement financing for gross proceeds of $1,150,000.

The company issued 11.5 million units priced at $0.10 per unit. Each unit consists of one common share and one share purchase warrant. Each warrant is exercisable to purchase one common share for a period of 24 months.

The company issued 399,000 compensation units to Numus Capital, the agent for the offering.

All securities issued are subject to a four-month hold period.

Net proceeds will be used to advance exploration work on its Namibian gold projects and the Kesya rare earth project in Zambia.

Antler Gold is a Canadian exploration company focused on gold projects in Namibia, Zambia and Africa.

Antler Gold Inc. (ANTL) opened trading at C$0.13.