In the realm of precious metals, gold stands as an enduring symbol of wealth and stability, coveted by investors seeking a safe haven and potential for robust returns.

Among the myriad opportunities in the gold sector, one company has been making waves with its promising opportunities – GMV Minerals Inc. (TSXV:GMV). (OTCQB: GMVMF) Positioned at the forefront of junior gold development, GMV Minerals has captured the attention of investors with its flagship Mexican Hat project, situated in the southeastern part of Arizona. Let’s delve into the intricacies of this project and explore why it is an enticing proposition for investors.

Background on the Mexican Hat Project

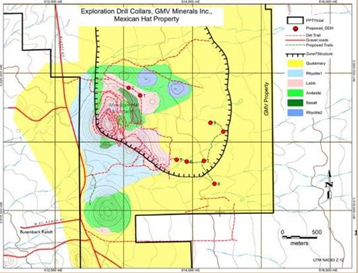

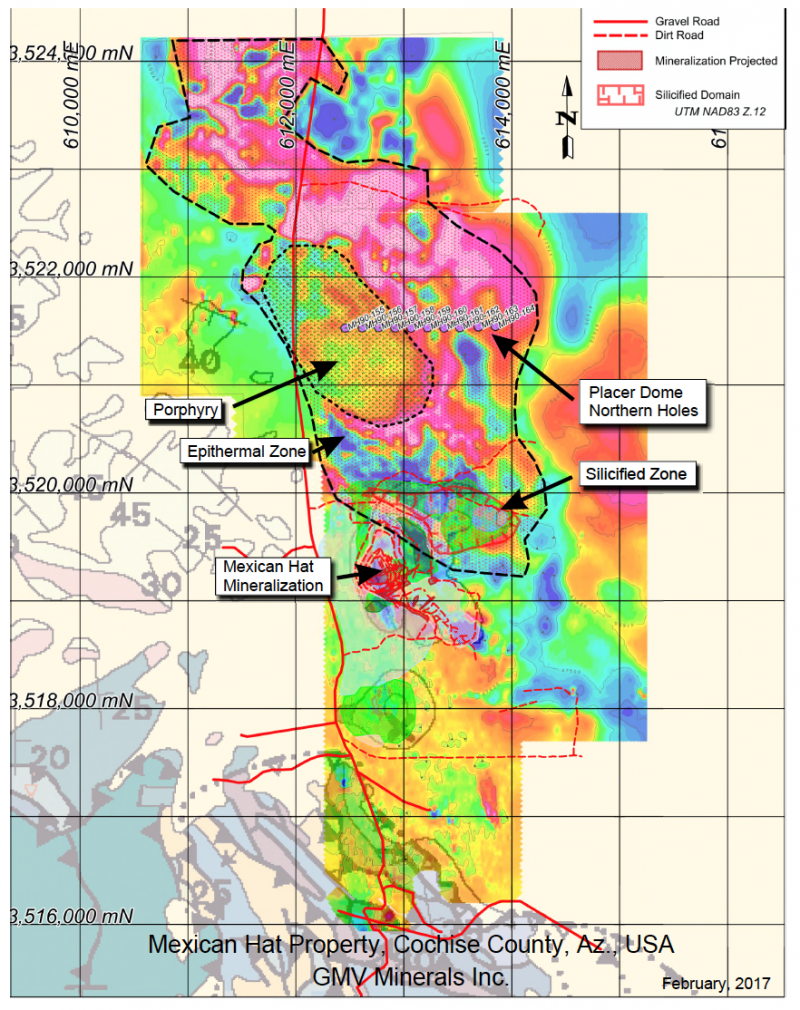

The Mexican Hat project is GMV Minerals’ PEA level gold asset, and it holds a 100 per cent interest. In a region renowned for its rich mineral endowment in Cochise County, the mining heart of Arizona, this project encompasses approximately 20 square km. of prime exploration terrain with significant gold potential. What sets Mexican Hat apart is its strategic location within a prolific mining district, offering access to established infrastructure and a favourable regulatory environment.

About 112 km southeast of Tucson, the Mexican Hat property is one of the most promising gold development opportunities in the western United States. The epithermal gold deposit was extensively explored by Placer Dome in the early 1990s prior to it being bought by Barrick Gold.

This low sulphidation, hydrothermal epithermal gold deposit rests in tertiary volcanic rocks. Similar deposits within the same basin and range province in Nevada, such as Round Mountain under Kinross Gold Corp. (TSX:K) and the Midas Deposit operated by Hecla Mining Co. (NYSE:HL), which host many million ounces of gold.

Highlights of the preliminary economic assessment (PEA)

In November 2020, GMV Minerals Inc. unveiled the results of its preliminary economic assessment (PEA) for the Mexican Hat Project, signaling a major milestone in its development journey.

The PEA reported 36.7 million tonnes grading .58 grams per tonne (gpt) gold in a 688,000 oz. inferred mineral resource. The report identified two open pits with a 1.87:1 strip ratio which was modeled to extract 32.6 million tonnes of this deposit recovering 525,000 oz. of gold over a 10-year mine life. This is a low capital cost operation, full retail cost of US$67.8 million, (quoting all new equipment) which includes US$12 million in contingency and US$13 million in sustaining capital. Heap leach testing demonstrates an exceptional recovery of 88 per cent of the gold from a two-stage crushing circuit.

“With US$2,200/oz. gold, if we made money at US$1,600, you can imagine at US$2,200 the numbers are significantly better,” CEO Ian Klassen said in an interview with the Market Online Canada.

The PEA outlined a robust economic case, showcasing the project’s potential to emerge as a profitable gold mine. Key highlights of the PEA include:

- Impressive resource estimates: The PEA confirmed the presence of a substantial gold resource at Mexican Hat.

- Favourable economics: The economic analysis revealed compelling financial metrics, including a projected discounted pre-tax net present value (NPV) of US$395 million and an internal rate of return (IRR) better than 77 per cent.

- Scalability and growth potential: The PEA underscored the scalability of the Mexican Hat Project, with opportunities for expansion and optimization to enhance operational efficiency and maximize shareholder value.

- Sustainable development approach: GMV Minerals emphasized its commitment to responsible mining practices, incorporating environmental and social considerations into the project’s development framework.

Management’s take – a clear path to production

Gold prices are up more than 13 per cent over the past six months and recently hit a record high above US$2,200. Gold has seen a lot of upward movement after the Federal Reserve brushed off multiple hotter-than-expected inflation reports and reaffirmed its outlook for three interest rate cuts this year.

Klassen explained that, for a project that will likely take less than US$50 million to put into production, to have a discounted NPV in excess of C$500 million, institutional money may well gravitate towards Mexican Hat. He further noted some downward pressure on the U.S. dollar would also help the gold price, pointing to recent commentary from the likes of JP Morgan prognosticating its value to reach US$2,300 and higher this year.

“I think that if we see in the early days of April that we stayed above US$2,100, I think it is a good signal for a lot of institutions that they might want to start allocating a portion of their money back into the space, which would help a company like ours because, there is probably not a clearer path to production for a company this size in the southwestern United States,” Klassen said.

Meet the team

GMV Minerals’ leadership team brings a wealth of experience and expertise to the table.

Lead consultant Dr. David Webb, B.A.Sc., M.Sc., Ph.D., P.Geo., P.Eng. is the project manager in the field. He has had a 40-year career continuous in mineral exploration and development. He put a gold mine into production in Mongolia and has put mines in production in the Northwest Territories where he is currently developing a project. He is also a mining engineer and has been working with GMV since day one on developing Mexican Hat.

More technical members are on the company’s advisory board, as well as part of its management team in directors Carl Hale, B.Sc., R.P.G, Q.P. and Robert Coltura, who has been working in the markets, financing wise, for several years.

Joel Schneyer is another advisory board member and has been hailed by Klassen as a “very sound and stable hand” for the company to make key introductions.

“We have day-to-day expertise, but we also have forward-looking help that we have been able to bring in that have been able to open up their Rolodexes and make some very good introductions for us going forward, and we just see that continuing,” Klassen added.

Investment corner

As a sign of the current junior market sentiment a market capitalization of just C$14.25 million, GMV Minerals Inc. presents investors with a unique opportunity to capitalize on the potential of the Mexican Hat project and the broader gold market. With a solid foundation of geological merit and a favourable PEA demonstrating robust economics, the company is poised for significant value creation in the years ahead.

Investing in GMV Minerals Inc. offers exposure to:

- A high-quality asset: The Mexican Hat project boasts substantial gold resources in a mining-friendly jurisdiction, positioning GMV Minerals for long-term success.

- Exploration upside: The company’s exploration efforts continue to unlock additional value potential, with ongoing drilling campaigns aimed at expanding the resource base and delineating new mineralization zones.

- A strategic advantage: GMV Minerals Inc. benefits from an experienced management team with a proven track record in exploration and project development, providing confidence in the company’s ability to execute its growth strategy effectively.

Since this time last year, GMV stock has moved 83.33 per cent higher and has shown steady growth of 26.92 per cent since 2019.

In conclusion, GMV Minerals Inc. stands as a compelling investment opportunity in the junior gold development sector, driven by the promising prospects of the Mexican Hat project and a commitment to value creation for shareholders. As the company advances towards production, investors are encouraged to delve deeper into GMV Minerals Inc.’s story and consider the potential rewards of participating in this golden venture.

For investors still on the fence, Klassen offered these final thoughts;

“At US$2,200 gold, the economics on this package just burst out,” he said. “Sometimes you go knock on a number of doors to remind people of what you have been sitting on so that you don’t get a market valuation of C$12 (million) or C$13 million when you are in possession of something that is a half a billion dollars through development. We are really just one drill conversion program targeting past Placer Dome holes to mature our resource … then we are at the pre-feasibility stage. That makes for a pretty mature project and one that we are really excited about seeing come through to fruition.”

To keep up with the latest developments from the company, visit gmvminerals.com.

Join the discussion: Find out what everybody’s saying about this stock on the GMV Minerals Inc. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Insert GMV Minerals Inc., please see full disclaimer here.