- Barrick Gold (TSX:ABX) remains embroiled in a dispute with the government of Mali over resource distribution at the company’s Loulo-Gounkoto gold complex

- The government has suspended gold shipments from the complex, which may lead to an operational shutdown

- Barrick is one of the top gold producers in the world generating over 4 million ounces in 2023

- Barrick Gold stock has added 0.67 per cent year-over-year and 4.23 per cent since 2019

Barrick Gold (TSX:ABX) remains embroiled in a dispute with the government of Mali over resource distribution at the company’s Loulo-Gounkoto gold complex.

As previously reported on Stockhouse, the parties had agreed on a framework to resolve their differences, but they have yet to finalize an agreement after numerous negotiation sessions. The government has gone on to block the complex’s gold shipments and arrest four employees, each of which has been charged and is pending trial.

What the Malian government is after, in short, is an increased share in Loulo-Gounkoto’s profits, despite being a 20 per cent owner and having to date “received more than 70 per cent of the economic benefits from the complex,” according to Monday’s news release.

“Even though the 2023 mining code has no application to existing operations such as Loulo-Gounkoto, the government insists on forcing Loulo-Gounkoto under the framework of that code,” the release goes on to state.

Barrick will be forced to suspend operations if shipments remain restricted at the over 29-year-old complex, cutting off approximately 5-10 per cent of Mali’s annual gross domestic product, including over US$1 billion in 2023 alone. Loulo-Gounkoto currently employs about 8,000 people, 97 per cent of which are Malian nationals.

Monday’s news follows the detention of Barrick management in September, as well as an arrest warrant against Barrick’s president and CEO Mark Bristow and numerous tax and customs claims, all issued sometime after November 25, which the gold miner considers illegitimate.

Leadership insights

“Barrick has been a committed partner to Mali for nearly three decades, delivering significant value to stakeholders and communities,” Bristow said in a statement. “Recent developments further erode investor confidence in Mali’s mining sector and will deter future investment. Nonetheless, in view of our long-standing commitment to the people of Mali, we remain open to constructive engagement with the government to resolve these issues while protecting the viability of this key economic driver for Mali.”

About Barrick Gold

Barrick is one of the top gold producers in the world generating over 4 million ounces in 2023. The company is actively diversifying its portfolio into copper, aiming to double its exposure to the critical metal by 2029.

Barrick Gold stock (TSX:ABX) last traded at C$23.90 per share. The stock has added 0.67 per cent year-over-year and 4.23 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this gold stock on the Barrick Gold Corp. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

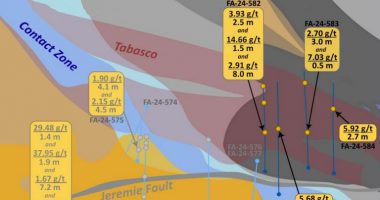

(Top photo from exploration in the Loulo region in 2023: Barrick Gold)