- Bitfarms (TSX:BITF), a global and vertically integrated Bitcoin miner, will develop a new up-to-120-MW facility in Sharon, Pennsylvania, bringing its total network to 13 across Canada, the United States, Paraguay and Argentina

- Consideration includes the issuance of 1,532,745 common shares, which are up by 25 per cent since rival Riot Platforms’ unsolicited takeover offer last month

- Bitfarms is a global Bitcoin mining company focused on sustainable and value-accretive growth

- Bitfarms stock has added 134.62 per cent year-over-year, but only 67.89 per cent over the past five years

Bitfarms (TSX:BITF), a global and vertically integrated Bitcoin miner, will develop a new up-to-120-MW facility in Sharon, Pennsylvania, bringing its total network to 13 across Canada, Paraguay, Argentina and the United States.

The facility, under a five-year lease with option to purchase, will benefit from competitive electricity prices within the Pennsylvania-New Jersey-Maryland Interconnection (PJM), the largest wholesale electricity market in the United States, allowing Bitfarms to better optimize and hedge energy costs, including through participation in demand response and other curtailment programs.

Operations will support 8 EH/s of mining capacity of an expected company-wide 35 EH/s in 2025, and will raise the company’s 2025 power capacity to 648 MW, a 170-per-cent increase from its current capacity and 47 per cent ahead of targeted year-end 2024 capacity.

Total consideration for the facility will require Bitfarms to issue 1,532,745 common shares, with construction to begin immediately, 12 MW expected to be online by Q4 2024, and the remaining 108 MW in the second half of 2025.

Bitfarms’ ongoing strategic review

Since receiving and rejecting a US$950 million unsolicited takeover offer late last month from Riot Platforms (NDAQ:RIOT), a competing Bitcoin miner based in Texas, Bitfarms claims to have received numerous other expressions of interest, which it is considering under a recently proposed poison pill to prevent Riot and other shareholders from acquiring controlling stakes.

During the period, both companies have pulled no punches, with Riot alleging that Bitfarms’ board operates under a broken corporate governance model, and Bitfarms on Thursday retorting by citing Riot’s comparatively higher governance risk rating from Institutional Shareholder Services and its 0.4 out of 10 in board accountability from Glass Lewis & Co.

Despite the hot tempers and finger pointing, Bitfarms’ engagement has remained firmly footed in shareholder value, giving us reason to hold out hope that investors may come out ahead after the strategic review determines a path forward, supposing that Bitcoin continues its exponential and highly speculative rise in price.

Leadership insights

“Executing on our strategy to cost-effectively expand our operating footprint in the U.S., we have entered into an agreement for flexible power trading within the PJM,” Nicolas Bonta, Bitfarms’ chairman and interim chief executive officer, said in a statement. “Leveraging our operational excellence and farm design expertise, we’re poised to optimize this site, facilitating efficient growth. This U.S. expansion not only strengthens our position in the industry but also enhances our geographical diversification. As additional opportunities in our pipeline come to fruition, we will update both our contracted power capacity and our 2025 EH/s target. We remain committed to pursuing similar strategic ventures aimed at delivering significant value to our shareholders.”

“This marks Bitfarms’ debut in a largely de-regulated and curtailment-friendly U.S. power market,” said Ben Gagnon, Bitfarms’ chief mining officer. “Bitfarms will actively monitor and manage our Bitcoin mining operations and participate in PJM’s demand response programs to earn additional revenue and provide reliable services to the grid. Providing a flexible base load for PJM to call upon in hours of need is a Bitcoin mining operations responsibility to the electric grid and community. We look forward to working with our power partners and the local community to facilitate uninterrupted service during periods of grid stress.”

“We are confident that Sharon and other similar prospective PJM sites will provide long-term access to low-cost U.S. energy and flexible power-trading options. Additionally, these locations boast milder temperatures and climates than Texas,” added Philippe Fortier, Bitfarms’ senior vice president of corporate development. “Importantly, PJM’s rapid replacement of coal-powered plants is among the largest contributors to the reduction of greenhouse gasses in the U.S., rendering the opportunity both environmentally and economically sustainable. Given these significant advantages, we are actively engaged in assessing opportunities to expand our presence within the PJM region.”

About Bitfarms

Bitfarms, established in 2017, is a global Bitcoin mining company that operates 12 facilities across Canada, the United States, Paraguay and Argentina. The company held 830 Bitcoins in treasury and averaged production of 10.4 Bitcoins per day in Q1 2024, and is on track to expand its mining capacity to 21 EH/s later this year.

Bitfarms stock (TSX:BITF) is up by 9.91 per cent, trading at C$3.66 per share as of 10:31 am ET. The stock has added 134.62 per cent year-over-year, but only 67.89 per cent over the past five years.

Join the discussion: Find out what everybody’s saying about these Bitcoin mining stocks on the Bitfarms Ltd. and Riot Platforms Inc. Bullboards, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

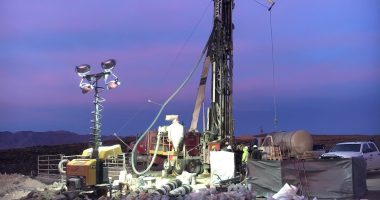

(Top photo: Bitfarms)