- Blackrock Silver Corp. (BRC) has signed an option agreement with Tearlach Resources Limited (TEA)

- The agreement grants Tearlach the option to acquire up to a 70-per-cent interest in the lithium minerals in certain unpatented mining claims in Nevada

- Tearlach can make the acquisition by incurring cumulative exploration expenditures of US$15,000,000 and completing a feasibility study within five years

- Blackrock is a junior precious metals exploration company

- Blackrock Silver Corp. opened trading at $0.48

Blackrock Silver Corp. (BRC) has signed an option agreement with Tearlach Resources Limited (TEA).

The two companies went into the agreement through their respective subsidiaries: Blackrock Gold Corp. and Pan Am Lithium (Nevada) Corp.

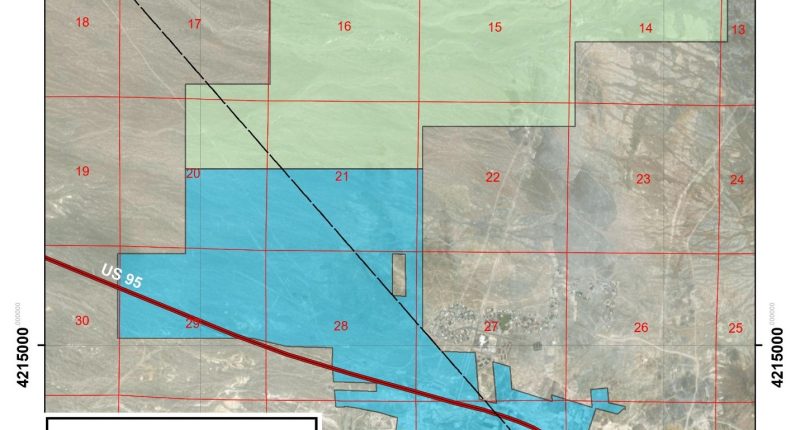

The agreement grants Tearlach the option to acquire, in two stages, up to a 70-per-cent interest in the lithium minerals in certain unpatented mining claims forming a portion of the company’s Tonopah North Project in Esmeralda County and Nye County, Nevada.

Tearlach will be entitled to undertake the acquisition by incurring cumulative exploration expenditures of US$15,000,000 and completing a feasibility study within five years.

“This deal creates significant value for Blackrock shareholders by pairing our emerging lithium discovery with a world-class lithium technical team while retaining shareholder upside in potential new silver and gold discoveries on our underexplored Tonopah North project,” stated Andrew Pollard, President and Chief Executive Officer of Blackrock.

“This transaction allows Blackrock shareholders to gain an interest in an active lithium project while allowing the company to focus its resources on our high-grade precious metal discoveries,” he added.

“With initial mapping completed and a world-class-Nevada based team with significant geological and processing experience in lithium-bearing clays, we have a roadmap to accelerate and aggressively drill,” said Morgan Lekstrom, Chief Executive Officer of Tearlach.

“We plan to drill a much larger core program and advance to the resource estimate while concurrently running engineering and process models,” he added.

Upon Tearlach completing the initial earn-in and exercising the first option, Tearlach and Blackrock Gold shall sign a definitive mining joint venture agreement in respect of the management and ownership of the optioned zone of the Tonopah North Project.

After completion of the additional earn-in, Tearlach may elect to exercise the second option, upon which its participation interest in the joint venture shall increase by an additional 19 per cent to a total of 70 per cent.

The parties to the joint venture shall contribute to future expenditures in accordance with their respective participating interests as prescribed in the joint venture agreement.

Blackrock is a junior precious metals exploration company focused on its Nevada portfolio of properties consisting of low-sulphidation epithermal gold and silver projects.

Blackrock Silver Corp. opened trading at $0.48.