- Mining company, BMEX Gold (BMEX) has completed the second and final tranche of its private placement, after raising C$3.55 million

- Through the tranche, the company issued 6,666,666 flow-through units, at a price of 53.25 cents per unit

- When combined with the first tranche, BMEX has raised an aggregate $6,703,000 in total proceeds through the private placement

- With the funds raised, BMEX is well capitalised to begin aggressive exploration at its King Tut and Dunlop Bay properties

- BMEX Gold (BMEX) is down 5.63 per cent, and is currently trading for $0.67 per share

Mining company, BMEX Gold (BMEX) has completed the second and final tranche of its private placement, after raising C$3.55 million.

Through the second tranche, the company issued a total of 6,666,666 flow-through units, at a price of 53.25 cents per unit. Each flow-through unit contained one common share in BMEX Gold, and one-half of a common share purchase warrant.

One whole warrant will allow the holder to buy one more common share in the company, at an exercise price of $0.50. The warrants can be exercised within 18 months of the offering’s closing date.

When combined with the first tranche, BMEX has raised an aggregate $6,703,000 in total proceeds through the private placement. With these funds, the company has the necessary financing for exploration activities at its two projects in the Abitibi greenstone belt.

Specifically, BMEX will use the proceeds of this latest second tranche to incur eligible “Canadian exploration expenses” which qualify as “flow-through expenditures”.

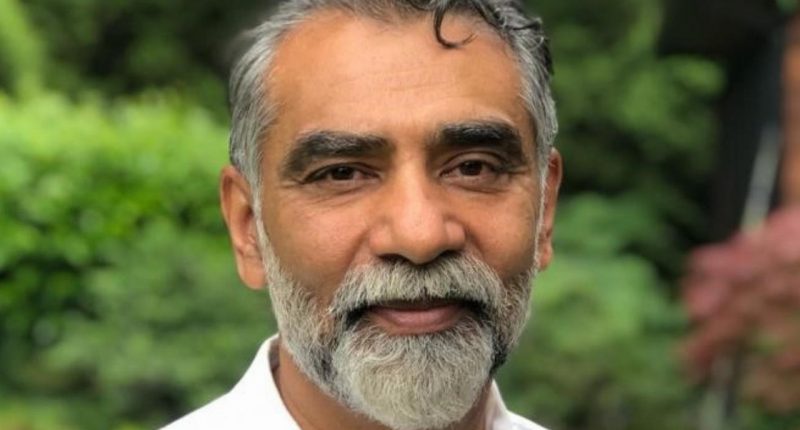

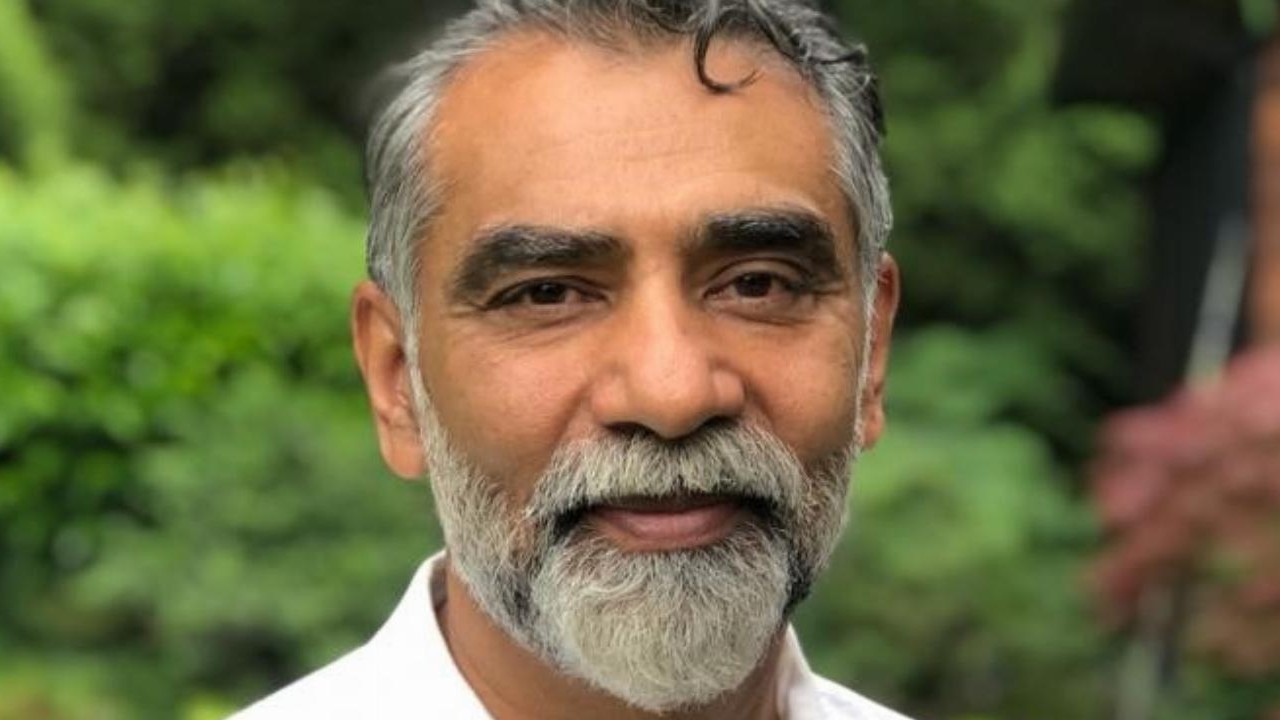

BMEX Gold’s President and CEO, Amrik Virk, commented on the positive outcome of the company’s private placement.

“With the closing of our financing we have added long-term supportive shareholders, and we are very well capitalised to move forward with an aggressive exploration program on the King Tut and the Dunlop Bay properties.

“In addition, we are getting active in our marketing program to create awareness of the company. I look forward to updating our shareholders on our progress,” he said.

BMEX Gold (BMEX) is down 5.63 per cent, and trading for $0.67 per share, as of 11:55am EDT.