- BTB Real Estate Investment Trust has published its inaugural environmental, wocial and governance (ESG) report

- The ESG report highlights environmental stewardship milestones, such as the execution of climate risk assessment, progress towards collecting energy usage data in properties and implementation of energy-efficient technologies across its portfolio

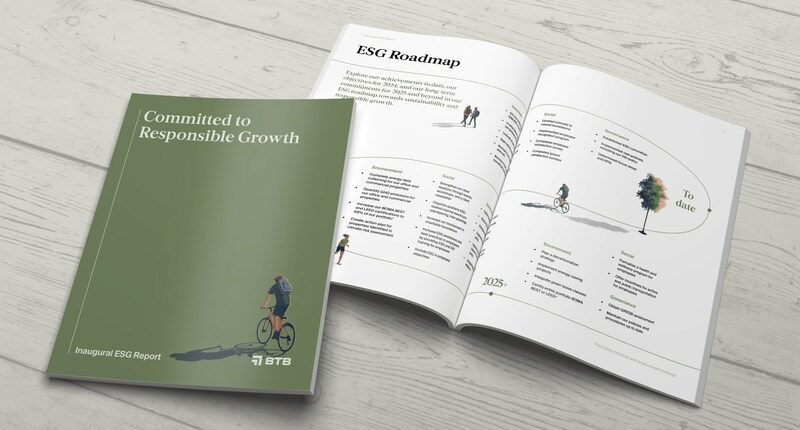

- The REIT also unveiled its sustainability roadmap that outlines key initiatives and targets for the coming years

- BTB Real Estate Investment Trust closed trading at C$99.84 per share

BTB Real Estate Investment Trust (TSX:BTB.UN) has published its inaugural environmental, social and governance (ESG) report.

Offering an overview of 2023’s sustainability activities, the ESG report highlights environmental stewardship milestones, such as the execution of climate risk assessment, progress towards collecting energy usage data in properties, implementation of energy-efficient technologies across its portfolio, as well as the introduction of sustainable building materials and practices.

The REIT also unveiled its sustainability roadmap that outlines key initiatives and targets for the coming years. The report includes an outline of future initiatives, with a focus on innovation, collaboration and measurable impact.

Key elements of the sustainability roadmap include creating an action plan for properties identified in climate risk assessment, as well as completing energy data collecting for off-downtown core office and necessity-based retail properties and implementing energy-saving projects.

The team intends to quantify greenhouse gas emissions for off-downtown core office and the necessity-based retail portfolio, while also increasing its BOMA BEST (Canada’s largest environmental assessment and certification program for existing buildings) and LEED (Leadership in Energy and Environmental Design, a worldwide green building rating system) certifications to 68 per cent for off-downtown core office and necessity-based retail portfolio by the end of this year.

“Throughout this transformative journey, we questioned our methods, scrutinized our processes, and tirelessly sought ways to enhance our approach,” Michel Léonard, BTB’s president and chief executive officer said in a news release. “Our managers and employees not only embrace the significance of ESG but also play a pivotal role in propelling us toward this milestone. As we release this comprehensive report and unveil our forward-looking sustainability roadmap, we stand in a strong position to elevate our practices, contribute meaningfully to a more sustainable future for all and create lasting value for all stakeholders.”

The company stated it intends to release an ESG report annually, providing a comprehensive overview of its activities and showcasing the achievements that define the company’s commitment to reliable business practices.

BTB Real Estate Investment Trust’s primary objective is to maximize total return to unitholders, to generate stable monthly cash distributions that are reliable and fiscally beneficial to unitholders, to grow its assets through internal growth and accretive acquisitions, and optimize the value of its assets through dynamic management of its properties to maximize their long-term value.

BTB Real Estate Investment Trust closed trading up 0.07 per cent at C$99.84 per share.

Join the discussion: Find out what everybody’s saying about this stock on the BTB Real Estate Investment Trust Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.