It may be the start of a new month, but Canada’s main stock index has been anything but quiet. The S&P/TSX Composite Index hovered near the 30,100-mark midweek, up about 1 per cent from its previous close, after a volatile start that saw the benchmark plunge to levels not seen since late September before staging a strong rebound. Energy shares led Wednesday’s rally, buoyed by firmer oil prices, while investors digested a data-heavy week and Prime Minister Mark Carney’s newly unveiled budget aimed at reducing Canada’s reliance on U.S. trade through major stimulus measures.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Against this backdrop, three companies have captured investor attention. Each represents a different sector—energy, biotech, and aerospace—offering unique stories for market watchers.

Baytex Energy (TSX:BTE, Forum) delivered a solid Q3, pointing to its operational resilience given softer commodity prices. The company reported production of 150,950 boe/d, with liquids making up 86 per cent of the mix. Free cash flow came in at C$143 million, while adjusted funds flow totalled C$422 million ($0.55 per share). Net income was C$32 million ($0.04 per share), and net debt declined to C$2.2 billion, supported by disciplined capital allocation and a robust credit facility of US$1.1 billion maturing in 2029.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every third Thursday!

Buzz on the Bullboards | Sign Up Here

Operationally, Baytex achieved record output in the Pembina Duvernay, averaging over 10,000 boe/d—up 53 per cent from Q2—while its Eagle Ford program delivered efficiency gains with a 12 per cent reduction in drilling and completion costs. Looking ahead, Baytex expects C$300 million in free cash flow for 2025, prioritizing debt repayment and balance sheet strength.

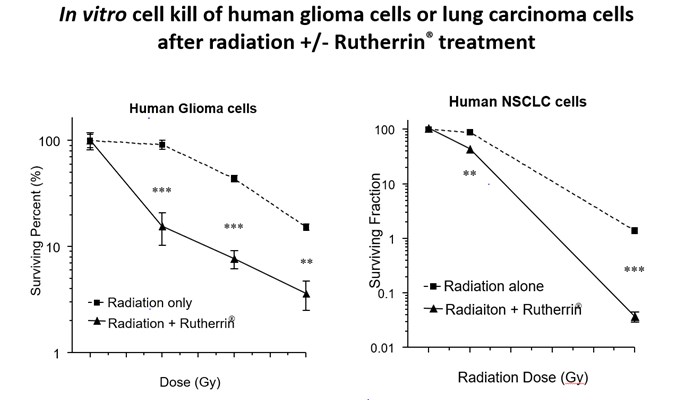

Theralase (TSXV:TLT, Forum) is making waves in oncology research with its X-ray-activated Rutherrin therapy. Recent preclinical findings show Rutherrin significantly enhances radiation therapy, achieving over 10-fold tumour uptake compared to healthy tissue and delivering up to 100 times greater cancer cell kill versus radiation alone. The compound demonstrated complete tumour regression in colorectal cancer models and prolonged survival in glioblastoma and lung cancer studies.

These results position Rutherrin as a potential breakthrough in overcoming treatment resistance and stimulating systemic immunity. The company plans GLP toxicology studies in 2026, paving the way for clinical trials targeting aggressive cancers such as GBM, NSCLC, pancreatic, lymphoma, and colorectal.

Bombardier’s (TSX:BBD, Forum) Global 8000 business jet has officially received Transport Canada Type Certification, marking a milestone for the world’s fastest business aircraft. With a top speed of Mach 0.95 and an industry-leading range of 8,000 nautical miles, the Global 8000 sets new benchmarks for performance and passenger comfort. Its cabin altitude of 13,317 metres at 12,500 metres—the lowest among business jets—combined with advanced air filtration and circadian lighting systems, promises reduced fatigue and enhanced wellness for long-haul travellers.

FAA and EASA certifications are expected soon, aligning with Bombardier’s plan to bring the aircraft into service this year. This achievement reinforces Bombardier’s position at the forefront of ultra-long-range business aviation.

Final thoughts

From Baytex’s disciplined energy strategy to Theralase’s cutting-edge cancer therapy and Bombardier’s aviation innovation, these companies exemplify the diversity and dynamism of Canadian markets. For investors, these headlines are more than just news—they’re signals to dig deeper. Conduct thorough due diligence, assess risk profiles, and explore how these developments fit into your portfolio strategy. In a market that rewards foresight, informed decisions are your best asset.

Get “Buzz on the Bullboards” delivered to your inbox every other Thursday!

Buzz on the Bullboards | Sign Up HereFor previous editions of Buzz on the Bullboards, click here.

Join the discussion: Find out what everybody’s saying about these stock on Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.