North American stocks have had a strong week.

Markets on both sides of the border responded well to the U.S. Federal Reserve’s vote to hold interest rates between 5.25 per cent and 5.50 per cent for a fifth straight meeting. The central bank has kept rates at this 23-year high since July.

Not only did the major indices on Bay Street and Wall Street see fresh highs on Wednesday, the likes of Chipotle (NYSE:CMG) and Progressive (NYSE:PGR) also scored all-time highs, while companies operating in the tech orbit such as NVIDIA (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA) also had a lot of success this week.

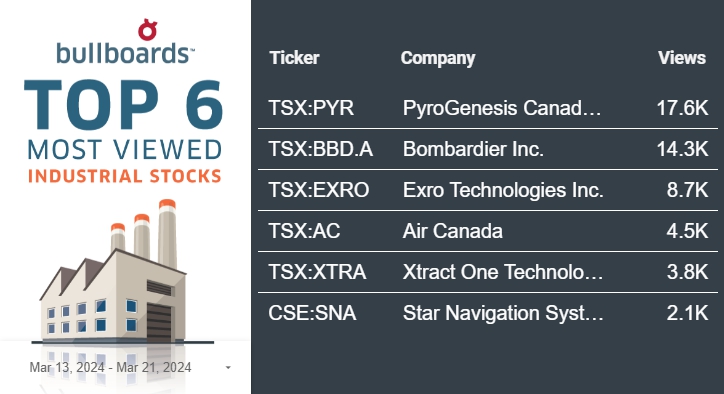

While the big names do their thing, users on Stockhouse’s Bullboards have been tracking a similar trajectory among some smaller-cap businesses that they hope will share comparable results. Two of the most popular stocks have recently made intriguing moves to enhance their financial performance.

Calgary-based oil and gas company Baytex Energy Corp. (TSX:BTE, Forum) is planning to generate a serious influx of cash to better bolster its financial position.

The Canadian oil and gas stock announced its intent to offer US$575 million aggregate principal amount of senior unsecured notes due in a private placement offering.

The Calgary-based company intends to use the net proceeds from the offering to redeem US$409.8 million aggregate principal amount of its outstanding 8.75 per cent notes due April 1, 2027, to repay a portion of the debt outstanding on its credit facilities and for general corporate purposes.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Senior notes are a type of bond issued by a company to raise funds with a higher priority in terms of repayment compared with other forms of debt. It is considered less of a risk to invest in senior notes than a stock, but senior notes typically offer lower interest rates.

Companies issue senior notes to borrow money at a lower cost compared with other forms of debt. When investors purchase these notes, they are essentially lending money to the company for a predetermined period, during which they receive periodic interest payments. Upon maturity, the company repays the principal amount borrowed.

In a similar vein, investors of aviation stock Bombardier Inc. (TSX:BBD, Forum) have been notified the company made a partial redemption of its senior notes.

The Canadian business jet manufacturer issued a notice of partial redemption for US$100 million principal amount of its outstanding 7.875 per cent senior notes due 2027, which will be paid using cash from its balance sheet.

Senior notes are a type of bond that have priority over other debts in case a company declares bankruptcy. While they have a lower degree of risk compared with stocks, senior notes often also pay lower rates of interest.

Senior notes are a common way for companies to borrow money with lower interest than other kinds of debt. When notes are redeemed for company shares, they reduce the businesses’ debt obligations.

The redemption date is April 15, 2024, and the redemption price for the redemption notes is 100 per cent of the principal amount redeemed, plus accrued and unpaid interest.

Payment of the redemption price and surrender of the notes for redemption will be made through the facilities of the Depository Trust Company on April 15.

Tilray Brands’ (TSX:TLRY, Forum) subsidiary, has been approved to supply Portugal’s first medical cannabis extract.

The product, known as Tilray Oral Solution (THC 5, CBD 20), will be available in late spring for use in “several critical areas of patient care,” according to a news release.

The news comes three years after Tilray Medical secured Portugal’s first authorization to offer medical cannabis products in 2021, bolstering the subsidiary’s diversified portfolio of EU-GMP-certified products, which are available in more than 20 countries across five continents.

“This is a monumental step forward for patient care in Portugal. With the approval of our first medical cannabis extract, we are proud to be at the forefront of medical cannabis research and accessibility and continue to demonstrate our commitment to providing innovative, safe and effective therapeutic options to patients,” Denise Faltischek, Tilray’s chief strategy officer and head of international, said in a statement. “We continue to pioneer the future of medical cannabis, furthering our mission to empower and inspire individuals to live their best lives.”

Next week, we will dive into the data from the last quarter and figure out a clearer answer for where the markets are at (and where they are headed). Make sure to stay up to date, and of course, stay focused to keep on top of where the tides are taking small-cap stocks and the markets.

For previous editions of Buzz on the Bullboards: click here.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up HereThe material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.