This past week, Canada’s main stock index, the TSX, hovered just shy of a new all-time high, buoyed by rising metal prices. However, the optimism was tempered as markets stuttered in response to renewed fears surrounding geopolitical tensions, particularly regarding Russia. Investors are closely monitoring these developments, which could impact market stability.

Defence stocks shine

In the face of these uncertainties, stocks linked to the defence sector experienced a notable uptick. Companies involved in defence have seen increased demand, reflecting a broader trend of heightened military spending and strategic investments in security.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Bombardier’s strong Q3 performance

A highlight of the week was Bombardier (TSX:BBD, Forum), which reported impressive growth in its Q3 2024 results. The jet maker delivered US$2.1 billion in revenue, marking a 12 per cent year-over-year increase. This growth was largely driven by a robust aftermarket performance and a favorable delivery mix. Key highlights include:

- Services revenue surged by 28 per cent YoY to a record US$528 million, supported by an expanded support network. Bombardier is on track to exceed its goal of US$2 billion in aftermarket revenues by 2025.

- The company completed 30 deliveries in Q3, concluding the quarter with a backlog of US$14.7 billion and a unit book-to-bill ratio of 1.

- Net income reached US$117 million, a significant increase from US$19 million in Q2, with adjusted net income at US$81 million, up by US$1 million YoY.

- Adjusted earnings per share (EPS) were US$0.74, slightly up from US$0.73 YoY, while diluted EPS stood at US$1.09.

- The company reported an adjusted EBITDA of US$307 million, reflecting an 8 per cent YoY increase and an adjusted EBITDA margin of 14.8 per cent.

Bombardier’s liquidity position remains strong, with US$1.2 billion available at the quarter’s end, including US$900 million in cash and cash equivalents. Following the quarter, the company increased its revolving credit facility from US$300 million to US$450 million, reinforcing its financial flexibility.

Bombardier stock (TSX:BBD) last traded up 1.70 per cent at C$95.66.

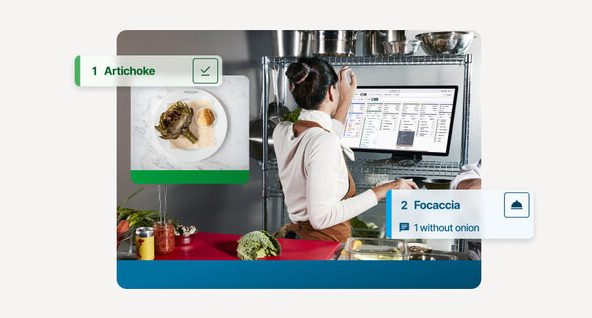

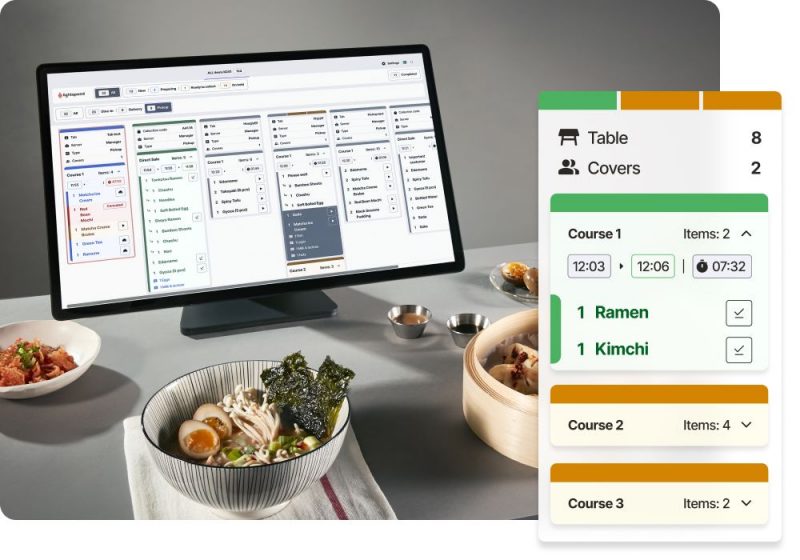

Tech success: Lightspeed Commerce

The technology sector has also been thriving, with Lightspeed Commerce (TSX:LSPD, Forum) making headlines by launching its next-generation Kitchen Display System (KDS) (pictured above). This innovative solution is designed to enhance efficiency in high-volume kitchens, addressing critical operational challenges faced by restaurant staff. Key features of Lightspeed KDS include:

- Real-time updates to minimize miscommunication between front-of-house and back-of-house teams, which 62 per cent of restaurant staff reported as a frequent issue

- Instant reflection of last-minute order changes, allowing kitchens to maintain accuracy and adapt quickly

- Customizable workflows to help balance dine-in and delivery orders, addressing the bottlenecks that often occur during peak times

- A commitment to sustainability by reducing paper and food waste through automation and a paperless system

With 81 per cent of Americans dining out at least once a month, food waste is getting more and more excessive and the demand for such technological solutions is on the rise, positioning Lightspeed as a key player in the evolving foodservice industry.

Lightspeed stock (TSX:LSPD) last traded down 0.20 per cent at C$24.61.

Canopy Growth expands cannabis offerings

In another significant development, Canopy Growth (TSX:WEED, Forum) announced the launch of the award-winning Claybourne cannabis brand in Canada through an exclusive licensing agreement. Claybourne, a top cannabis brand in California, is known for its high-quality products, including infused pre-rolls and indoor flower. Canadian consumers will initially have access to Claybourne’s Frosted Flyers infused pre-rolls, featuring popular strains like Blue Dream and Pineapple Express.

The Canadian pre-roll segment has seen remarkable growth, expanding by 94 per cent since 2022, with infused pre-rolls now representing 9.6 per cent of the recreational market.

Canopy Growth stock (TSX:WEED) last traded down 1.68 per cent at C$5.27.

Tempus fugit

As the TSX navigates through a week of mixed signals, investors are encouraged to stay informed about stock activity and market trends. Keeping a close eye on developments in sectors like defence, aviation, technology, and cannabis will be crucial for making informed investment decisions. Stay tuned for more updates to ensure your portfolio remains aligned with the latest market dynamics.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up HereFor previous editions of Buzz on the Bullboards, click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image via Lightspeed Commerce Inc.)