- Calima (CE1) is nearing completion of its five-well drilling campaign at its Brooks property in Calgary

- Gemini #10 and #11 are on production, with #10 producing at type curve rates, while the remainder are planned to come online before the end of the year

- The Leo #4 well is generating positive operating revenue, with further evaluation ongoing across the Holborn property in Edmonton

- President and CEO Jordan Kevol spoke with Sabrina Cuthbert about the prospects for ongoing and future production

- Calima is an oil and gas producer and explorer with assets in Alberta and B.C.

- Calima Energy (CE1) closed down by 3.85 per cent, trading at A$0.125 per share

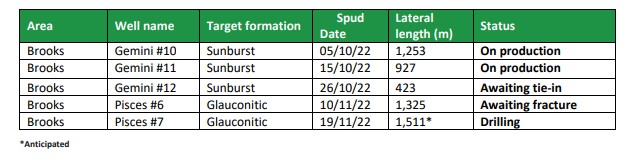

Calima (CE1) is nearing completion of its five-well drilling campaign at its Brooks property in Calgary.

It has drilled three Sunburst wells (Gemini) and one Glauconitic well (Pisces), with one Glauconitic (Pisces) well currently being drilled.

Gemini #10 is in production and producing at type curve rates, while Gemini #11 is in production as of November 24.

Gemini #12 was scheduled to be in production by the following weekend.

The company expects to see oil production from #11 and #12 approximately one week after each comes into production.

It plans to initiate fracture stimulation completion for Pisces #6 and #7 in the second week of December, with initial flow back and testing in late December.

Q4 2022 drilling campaign summary

Leo #4 was a step-out oil well drilled in the Sparky Formation at Holborn (North Thorsby) in Edmonton in January 2022. It reached a depth of 4,088 m and was fracture stimulated in June 2022.

Following a four-month testing period, the well produced 13,150 boe through the end of October. On a risk-adjusted basis, initial production is approximately 80 per cent of the budget. However, with water cut rates in the range of 80-85 per cent in the Sparky A reservoir, the drilling of follow-up wells within this channel is not forecast to be highly economic.

The well generates positive operating revenue and will add new reserves with the fluids being treated at the company’s Thorsby 16-5 battery.

Total fluid inflow is significant, with initial rates in the range of 1,000 bbl/d, indicating a very permeable reservoir where further technical work will look to pinpoint higher oil saturation targets.

Calima continues to evaluate its Holborn land base, including a second follow-up location off the same pad as Leo #4, which would target the Sparky C sand.

President and CEO Jordan Kevol spoke with Sabrina Cuthbert about the prospects for ongoing and future production.

Calima is an oil and gas producer and explorer with assets in Alberta and B.C.

Calima Energy (CE1) closed down by 3.85 per cent, trading at A$0.125 per share.