- Canadian Copper (CCI) has initiated a non-brokered, flow-through share offering for gross proceeds of up to $300,000

- The company will issue up to 3,000,000 flow-through shares at $0.10 per FT share

- The proceeds of the FT offering will be used to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures”

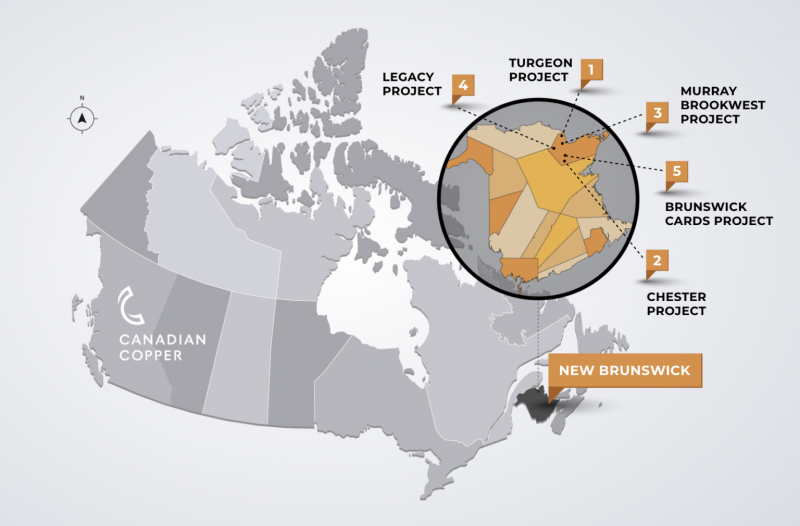

- Canadian Copper Inc. is a mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects

- Canadian Copper Inc. opened trading at $0.08

Canadian Copper (CCI) has initiated a non-brokered, flow-through share offering for gross proceeds of up to $300,000.

The company will issue up to 3,000,000 flow-through shares at a price of $0.10 per FT share.

The proposed April 7th, 2022 Federal Budget introduced a 30-per-cent Critical Mineral Exploration Tax Credit (CMETC) for specified minerals, including copper and zinc, to which this offering of Canadian Copper FT shares should qualify.

The company intends to use the funding to continue to advance the Chester Copper Project through additional near-deposit exploration work.

The company will also use the funding to de-risk the Chester deposit with metallurgical test work focused on the beneficiation understanding of the Central and East Zone.

The proceeds of the FT offering will be used to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) related to the company’s projects in New Brunswick, Canada.

The company plans to incur qualifying expenditures on or before December 31, 2023 (or such other period as may be permissible under applicable tax legislation), and to renounce all the qualifying expenditures in favour of the subscribers of the FT shares effective December 31, 2022.

The offering is expected to close on December 16, 2022.

A statutory four-month hold period will apply to all securities issued in connection with the offering.

Canadian Copper Inc. is a mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects.

Canadian Copper Inc. opened trading at $0.08.