- Canadian Copper (CCI) has closed a private placement for aggregate gross proceeds of $408,000

- The company issued 4,080,000 flow-through shares at a price of C$0.10 per FT share

- The company intends to use the funding to continue to advance the Chester Copper Project

- Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio

- Canadian Copper Inc. (CCI) opened trading at C$0.085

Canadian Copper (CCI) has closed its previously announced private placement for aggregate gross proceeds of $408,000.

The company issued 4,080,000 flow-through shares at a price of C$0.10 per FT share.

Simon Quick, CEO of Canadian Copper, commented on the capital raise.

“A big thank you to our current and new shareholders. Over the last year, our team has made substantive progress at the Chester Project, equally in terms of expanding the known Chester copper resource, in addition to identifying new prospective areas with our regional trenching program. From a shareholder dilution and cost of capital perspective, this FT financing represented a share premium of ~30% to our last 30 trading days and was not accompanied by any warrants. We will deploy this FT Offering in a targeted manner that increases the Chester asset value.”

The company intends to use the funding to continue to advance the Chester Copper Project through additional near-deposit exploration work.

The company will also use the funding to de-risk the Chester deposit with metallurgical test work focused on the beneficiation understanding of the Central and East Zone.

The proceeds of the FT offering will be used to incur eligible “Canadian exploration expenses” related to the company’s projects in New Brunswick.

The company paid finder’s fees consisting of a cash commission in the amount of $12,810. All securities issued are subject to a statutory four-month hold period.

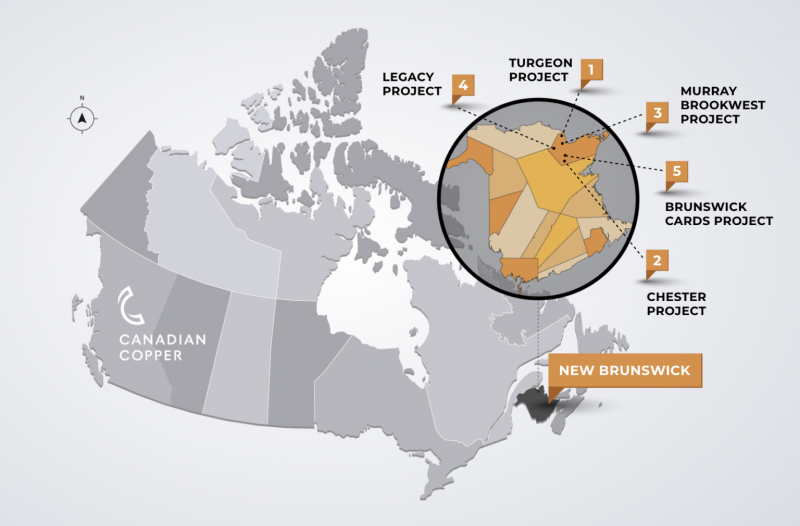

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. The company is focused on the Bathurst Mining Camp (BMC) of New Brunswick.

Canadian Copper Inc. (CCI) opened trading at C$0.085.