- CE Brands (CEBI) has announced a $3 million private placement of senior secured convertible notes

- The notes, to be issued on or about April 25, 2022, will bear interest at a rate of 15.0 per cent per annum

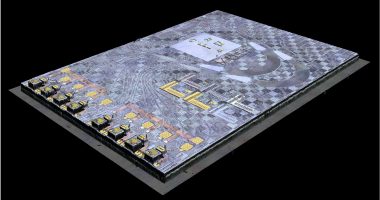

- CE Brands designs, develops and distributes smart consumer electronic products with leading manufacturers and iconic brands

- CE Brands (CEBI) opened trading at C$0.69 per share

CE Brands (CEBI) has announced a $3 million private placement of senior secured convertible notes.

Craig Smith, CEO of CE Brands commented on the capital raise.

“We are very pleased to be able to announce this financing on the heels of improving sales trends and the revenue-generating potential of our expanding portfolio of branded products.”

“We believe that this financing will provide sufficient near-term working capital to allow us to build on the momentum of our most recent new product launches and to continue to progress towards our objective to launch an additional 3 new products by the middle of 2022,” he added.

“Vesta, through this latest financing, continues to be an active supporter of CE Brands and the long-term vision of CE Brands’ management,” said Adam Hoffman, President of Vesta. “The progress shown through the latest successful product launches provides evidence of CE Brands’ ability to utilize its proprietary technology to identify and develop compelling consumer electronics products” continued Mr. Hoffman.

The notes, to be issued on or about April 25, 2022, will bear interest at a rate of 15.0 per cent per annum, payable on the first and second anniversary of the issue date.

Prior to maturity, the notes are convertible into common shares of CE Brands at a conversion price per share of $1.50.

The noteholders will receive an aggregate of 1,500,000 common share purchase warrants. Each warrant will have an exercise price of $1.00 per share and will be exercisable on or before the second anniversary of the issue date.

CE Brands will pay eligible finders a cash fee equal to 4.0 per cent of the aggregate gross proceeds raised from an investor under the offering.

The offering is subject to the approval of the TSXV and the listing of the underlying common shares. The shares are currently listed on the TSX under the symbol CEBI.

CE Brands designs, develops and distributes smart consumer electronic products with leading manufacturers and iconic brands.

CE Brands (CEBI) opened trading at C$0.69 per share.