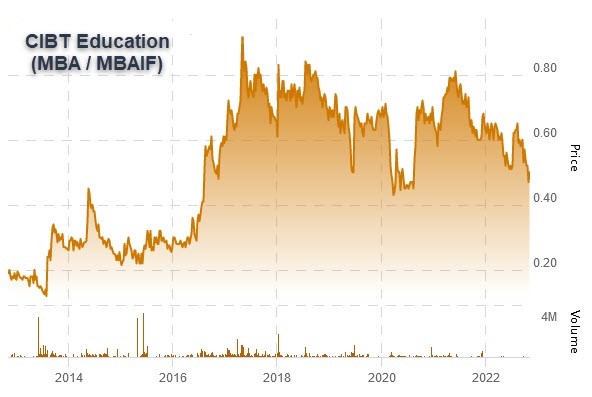

For investors used to one-way markets, 2022 has been a tough year. It’s also been an invaluable learning experience.

The days of being a ‘lazy’ investor and just riding index stocks higher are over (at least for the foreseeable future). Instead, investors once again need to be astute stock-pickers in order to manage current tough market conditions.

A small-cap stock for stock-pickers

CIBT Education Group Inc. (TSX:MBA/OTC:MBAIF) is a stock for stock-pickers. Take a look.

At first glance, investors might think that the strong, steady growth pattern for this 10-year chart belongs to some Fortune 500 companies. But, no, this is the 10-year chart of a CAD$33 million small cap.

The stable, consistent growth that one would expect of a large-cap stock. But CIBT has the growth potential of a small cap.

In a year in which the charts of even many blue-chip stocks look terrible, CIBT Education has held up remarkably well.

The recent market meltdown has hit small caps especially hard. Most are down 70 – 80% YTD (if not more). CIBT’s 52-week trading range? Roughly 30%. Strong and stable.

Why? Why does the chart of this small cap, over both shorter and longer durations, look so good?

There is nothing magical about CIBT Education’s formula for market success: loads of experience, an extremely well-positioned business model, and consistently strong execution.

Student housing: the best fundamentals in real estate today

CIBT Education (as its name implies) is in education. However, CIBT is also a vertically-integrated student housing and property management company.

Education has been a consistent growth industry. Real estate has been a consistent growth industry.

With CIBT Education, 2 + 2 = 5. That’s the ‘math’ of vertical integration.

This Company is no stranger to The Market Herald audience. We previously featured CIBT in a full-length feature from September 2021.

Vancouver’s Red Hot Real Estate Market Increases Demands for CIBT’s Student Housing Business

A lot has changed in the 14 months since, in both stock markets and real estate markets. Both previously looked like can’t-miss propositions for investors.

Since then, equity markets have suffered a meltdown. And most real estate markets are under extreme pressure in this environment of rapidly rising interest (and mortgage) rates. But not student housing.

The Market Herald recently sat down for a chat with CIBT’s CEO, Toby Chu. We expected to hear a ‘tale of caution’: difficulties weathering Covid lockdowns and other restrictions, storm clouds on the real estate horizon. We got the opposite.

Covid had only a mild impact on both CIBT’s top-and-bottom-line results. And while other real estate markets are already sagging under the strain of higher interest rates, Chu was gushing about the continuing strong fundamentals of the student housing market.

The CEO explained how and why student housing is such a bellwether housing market.

“Most students’ education plans do not change permanently, and the plan could be delayed due to the pandemic and their education re-starts after the pandemic is over. Schools across the education sector are seeing strong enrollment growth in the 2022 – 2023 academic year. When students come to study in Vancouver, our rental properties become full because we provide our housing services to over 90 schools in Metro Vancouver.”

A counter-cyclical bellwether for investors

While student housing is a real estate niche, it has several important characteristics that make it entirely unique versus other real estate sub-sectors.

- Lower sensitivity to interest rates

- Lower sensitivity to recessionary conditions

- Minimal competition due to significant capital requirements

- Strong demand and a large addressable market

With all other segments of the real estate market, market strength is ultimately driven by real estate purchases – purchases financed with significant levels of debt. As interest rates shoot higher, this automatically puts the brakes on those markets.

Student housing, however, is a rental market. Changes in interest rates have no direct impact on demand. Most parents pay for their children’s education, including their housing needs.

Similarly, student housing is a relatively recession-proof market. Education, in general, is one of the last family expenditures to get reduced in recessionary conditions.

More importantly, roughly 75% of the student housing market (in Canada) is comprised of international students. These are generally all children of affluent families and are, therefore, even less likely to make cuts in their education budget.

Imagine operating in a large market where your biggest competitor is quite happy to see you increase your market share. That’s student housing.

The largest competitor of CIBT Education in the student housing market is government. Canada’s federal government, via the Canadian Mortgage and Housing Corporation (CMHC) is active in providing student housing.

However, this isn’t a for-profit enterprise seeking to grow. This is publicly-funded support for student housing.

The government’s objective is to minimize this spending and have as small a footprint as possible in the student housing market. The more success that CIBT Education has in providing privately funded-and-operated student housing, the fewer tax dollars the federal government needs to invest here.

Major barriers to entry, a huge addressable market

Despite the lack of for-profit competition in the off-campus student housing market, this is still a real estate market. This means that there are major barriers to entry for new competitors.

With prospective competitors of CIBT needing first to buy or develop their own student housing properties, substantial capital needs and rising interest rates increase these barriers to entry. And this is a big market.

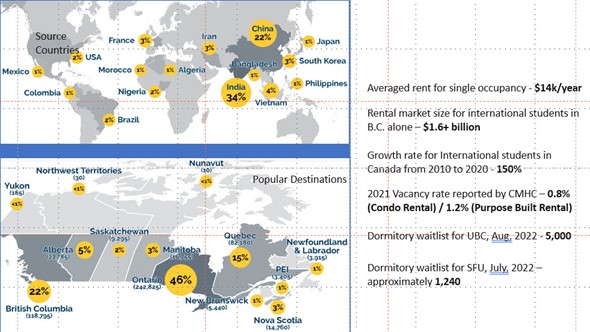

CIBT Education is based in Canada and provides education services and student housing for the Canadian market. More specifically, CIBT is heavily focused on the Vancouver (British Columbia) student housing market.

In Vancouver alone, this is a $1.6 billion housing market.

Let’s put this into context.

CIBT Education is the largest off-campus housing provider in this $1.6 billion market via its subsidiary, Global Education City (GEC). The fundamentals for the B.C. student housing market are extremely robust.

Not surprisingly, CIBT is executing well in this robust market. In the Company’s most recently reported results (Q3 2022), CIBT reported YTD revenues of CAD$52.67 million, an 18% year-over-year increase during the pandemic periods. Adjusted EBITDA (YTD) rose to CAD$14.96 million, a 39% y-o-y increase.

Looking for more growth?

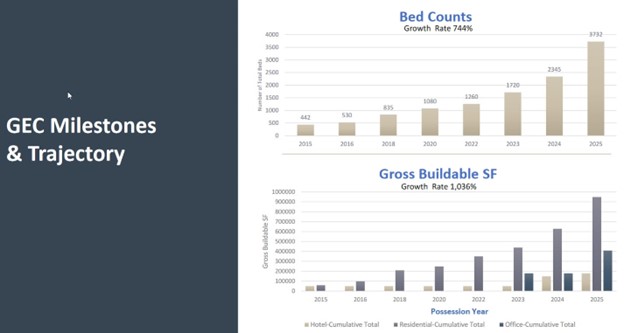

The graphic above shows a rising growth curve for CIBT in terms of its total bed count and the total square footage of property under its GEC brand. The Company’s best years are projected to be immediately ahead. Is this plausible?

Let’s crunch the numbers. CIBT is forecasting its total bed count to rise from 1260 in 2022 to 3732 by 2025, ~200% growth over the next 3 years.

As noted above, the University of British Columbia alone has a 5,000-student waiting list for student housing. Bed count numbers certainly look achievable.

But CIBT can’t simply conjure new rental units into existence. It needs additional properties (and student housing units) to fill this unmet demand. Here is where sharp investors will start to salivate.

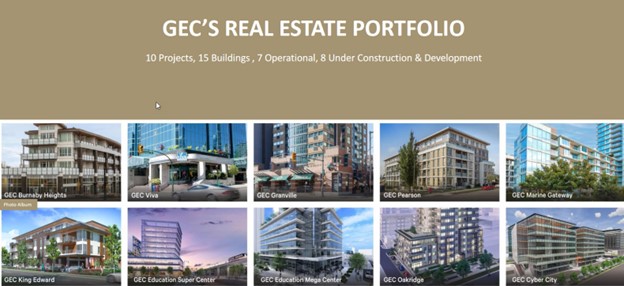

A large-and-growing property management portfolio

CIBT’s $520 million property portfolio comprises 7 student housing properties currently in operation and 8 under development, adding another $900 million to its planned portfolio. More than half of CIBT’s total pipeline of student housing has yet to come online.

As these under-development projects are completed, they will account for the expected/projected growth in gross buildable square footage.

CEO Chu told The Market Herald that one of these development projects is due to be completed by year-end (GEC King Edward). Each new student housing facility that is added means a large incremental jump in revenues.

Translation: 2023 is looking like a much better year for revenue and earnings growth than 2022. How much potential revenue growth is ripening on the vine for CIBT? Let’s do some more crunching.

The average rent for a single-occupancy student housing unit: C$14,000 per year.

The waiting list for UBC: 5,000 students.

5,000 X CAD$14,000 = CAD$70 million.

CIBT Education can more than double its total revenues just by addressing the student housing waiting list of one educational institution, as an example.

B.C.’s other major university, Simon Fraser University, reports an official waiting list of ‘only’ 1,240 students (CAD$17.3 million per year in potential additional revenues). However, SFU is only serving 7.5% of SFU’s total student population, according to a recent Vancouver Sun newspaper report.

Besides the two largest universities in Vancouver, there are over 200 other public and private colleges and universities in Metro Vancouver. Most of these institutions do not provide housing.

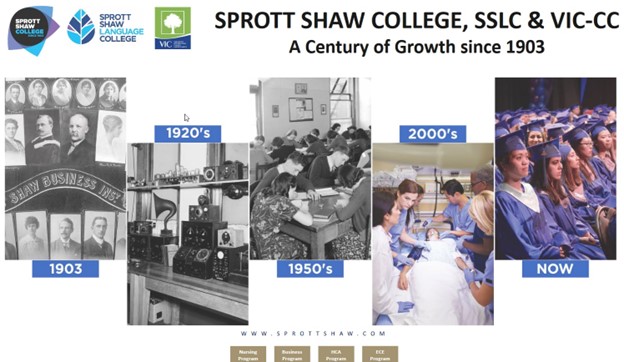

CIBT Education Group didn’t just stumble into this lucrative and recession-proof housing market. CIBT’s roots are in education.

The Company has 28+ years of experience in providing education services in Canada. This includes Sprott Shaw College.

The company has its own pipeline of students requiring student housing. Via GEC, CIBT then offers a full spectrum of services to meet students’ housing needs.

Excellent demographics for Canadian (and B.C.) student housing

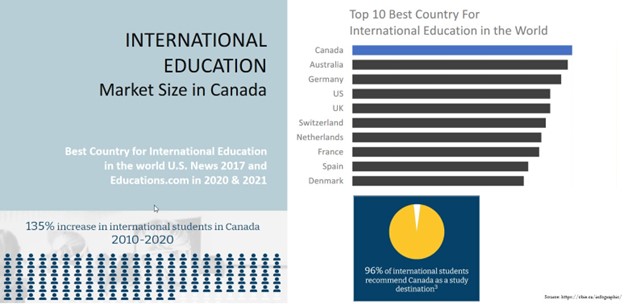

U.S.-based investors might wonder why CIBT is operating in the Canadian student housing market. Here, a number of important factors drive the strength of this student housing market.

As previously noted, the B.C. student housing market alone is a very robust market: $1.6 billion per year. Demand for student housing is heaviest among international students (75% of CIBT’s student housing population), and the number of international students in Canada rose by 150% from 2010 – 2020 alone.

The Canadian housing market, in general, has seen its vacancy rate shrink to an ultra-tight 0.8%. Students looking for accommodations outside of on-campus “student housing” units have very few options.

Canada has become the preferred destination for international students.

While CIBT generates its own pipeline of students for student housing, the overall “pipeline” of foreign students seeking student housing in Canada (and Vancouver) is poised to continue to grow.

CIBT offers a superb value proposition

The Company is operating primarily in a CAD$1.6 billion market, with substantial barriers to entry and mostly only passive competition. Its market cap is only CAD$32 million.

CIBT Education Group has CAD$520 million of assets on its balance sheet and completed financings of CAD$0.50 billion during the past few years. But its market cap is only CAD$32 million.

CIBT offers investors CAD$60.9 million in annual revenues currently, with CAD$5.177 million in net income and EBITDA of CAD$21.4 million. Yet the market cap is only CAD$32 million.

The Company is a steal at its current valuation. But while most companies/industries are starting to wilt under the burden of rising interest rates and increasingly recessionary conditions, CIBT is expecting its best growth years to be immediately ahead.

CIBT Education is a stable buy-and-hold investment that true “investors” can add to their portfolios.

CIBT Education is a high-growth, recession-proof small cap with a track record of strong performance and its best years still ahead.

The best of both worlds for investors.

When CEO Toby Chu was talking about his recent interactions with investors (in investor road shows and industry events), he remarked to The Market Herald how he was seeing an increasing interest from institutional investors.

Coming up in another full-length feature for The Market Herald, what the Smart Money sees when they look at CIBT – and why they like it.

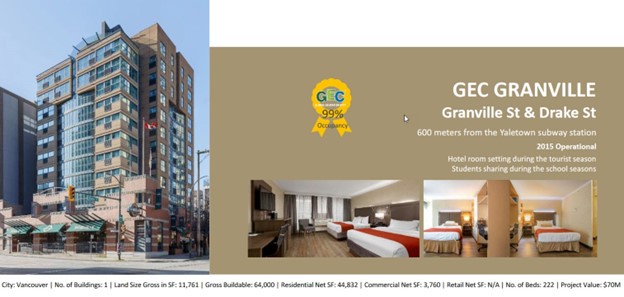

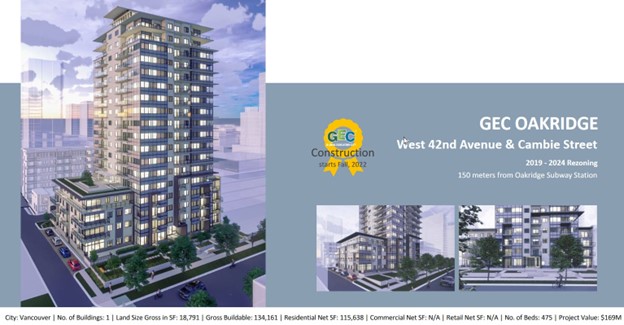

Appendix: CIBT Education’s portfolio of student housing properties

FULL DISCLOSURE: This is a paid article by The Market Herald.