- Condor Gold (TSX:COG) has received environmental permits for the America open pit at the La India project

- The America pit is a high grade gold resource, grading at 8.1 grams per tonne of gold

- Condor intends to mine America and the other small, high-grade gold resource early to pay down plant and equipment expenditure

- America is expected to produce roughly 30,000 ounces of gold

- Condor Gold (COG) is up 23 per cent at C$0.68 per share and has a market cap of $64 million

Condor Gold (TSX:COG) has received its environmental permit for the America open pit, part of Condor’s La India project in Nicaragua.

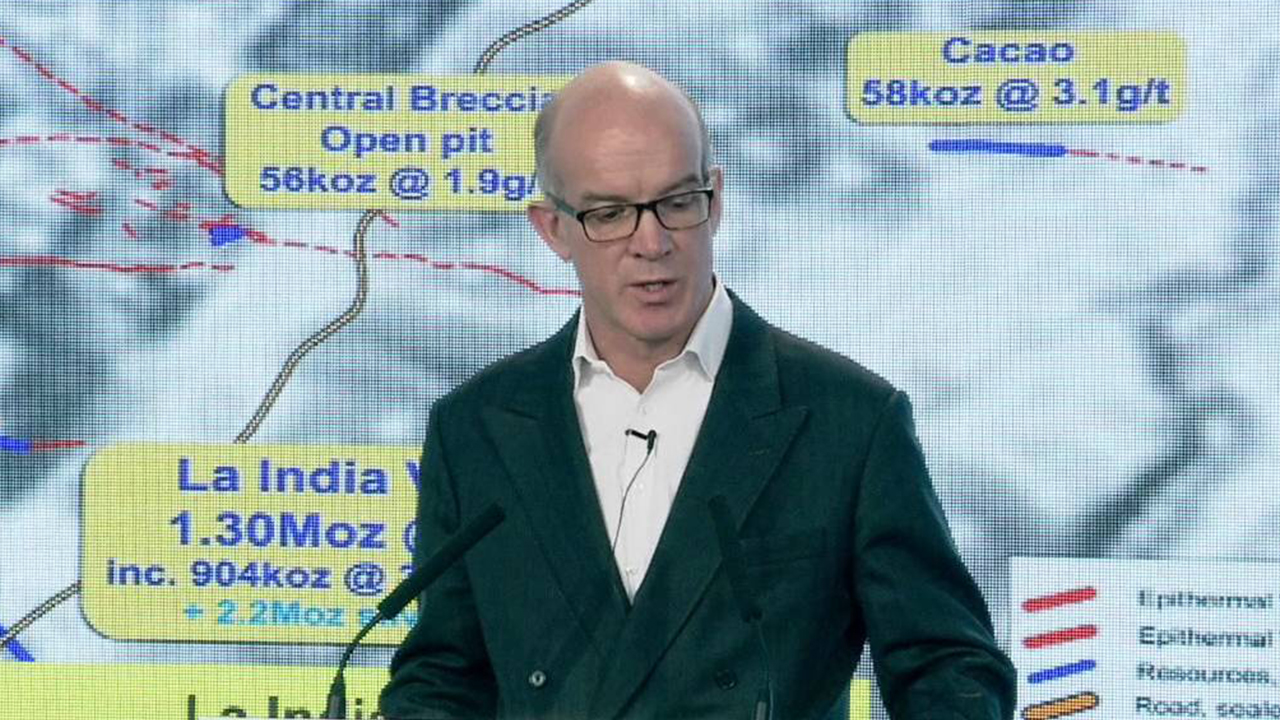

The America pit is the third open pit that Condor has received mining approval for at the La India site. The Mestiza open pit and La India open pit are the other two.

The three open pit mines now have a combined total gold resource of 1.12 million gold ounces.

La India, the largest resource, hosts 8,377,000 tonnes of gold at an average grade of 3.1 grams per tonne, for an estimated total of 837,000 ounces of gold.

America and Mestiza are secondary mining targets, used to improve the mine life during production and provide flexibility for the company moving forward.

America is expected to host 114,000 tonnes at a grade of 8.1 grams per tonne of gold, containing roughly 30,000 ounces.

Mestiza hosts 92,000 tonnes at a grade of 12.1 grams per tonne of gold, for a total of 36,000 ounces.

Condor’s CEO and Chairman, Mark Child, said that Condor has been granted the key environmental permit to develop and exploit gold from a third high-grade open pit.

“When added to the high grade La India open pit and Mestiza open pit, Condor has 1.12 million ounces of gold open pit mineral resources, including mineral reserves permitted for extraction.

“The permitted high grade America open put and recently permitted Mestiza open pit adds flexibility to the mine schedule, potentially improving project economics and extending the life of mine,” he added.

The America and Mestiza deposits are in line for early production, according to Condor. This will help the company reduce the payback period on the plant and equipment fees and improve the internal rate of return.

This is down to America and Mestiza having much higher gold grades than La India, which is a much larger resource but a lower grade.

Condor Gold (COG) is up 23 per cent at C$0.68 per share, as of 3:34pm EDT.