- Critical Elements Lithium Corporation (CRE) has filed a NI 43-101 report on its Rose Lithium-Tantalum project

- This represents the qualifying report for a feasibility study on the James Bay, Québec-based property

- Expected life of mine of 17 years

- Average operating costs of US$74.48 per tonne milled, US$540 per tonne of concentrate (all concentrate production combined)

- Estimated initial capital cost US$357 million before working capital

- Critical Elements Lithium Corporation (CRE) is down 2.78 per cent and is trading at $ 1.40 per share as of 1:54 p.m. ET

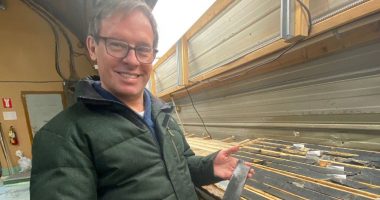

Critical Elements Lithium Corporation (CRE) has filed a National Instrument 43-101 technical report on its Rose Lithium-Tantalum project.

This represents the qualifying report for a feasibility study on the James Bay, Québec-based property.

NI 43-101 highlights:

- Average production, Year 2 to Year 16 of 173,317 tonnes of chemical grade 5.5 per cent spodumene concentrate

- Average production, Year 2 to Year 16 of 51,369 tonnes of technical grade 6 per cent spodumene concentrate

- Average production, Year 2 to Year 16 of 441 tonnes of tantalum concentrate

- Expected life of mine of 17 years

- Average operating costs of US$74.48 per tonne milled, US$540 per tonne of concentrate (all concentrate production combined)

- Estimated initial capital cost US$357 million before working capital

Critical Elements is working on becoming a large and responsible supplier of lithium to the electric vehicle and energy storage system industries.

Critical Elements Lithium Corporation (CRE) is down 2.78 per cent and is trading at $ 1.40 per share as of 1:54 p.m. ET.