- Agricultural tech firm, CubicFarm Systems (TSXV:CUB), has announced the sale of 100 machines in its largest deal to date

- The system will be installed over two phases at the customer’s location in Surrey, British Columbia

- Representing C$16.5 million in revenue, the company expects to see cash flow from mid-2020 to mid-2022

- As part of the deal, CubicFarm will establish a joint venture with the customer to operate the 100-machine facility

- Shares in the company are currently up 6.9 per cent to $0.31, with a market cap of $29.28 million

Agricultural tech firm, CubicFarm Systems (TSXV:CUB), has announced the sale of 100 machines in its largest deal to date.

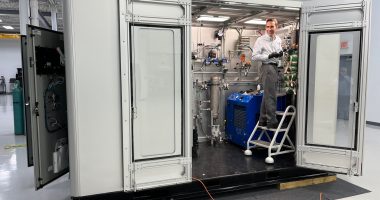

The Langley-based company offers several machine systems that enable farmers to grow high-quality, predictable crops.

Its latest sale will go to a commercial grower and agricultural wholesaler based in Surrey, British Columbia. The customer had previously paid a deposit for 12 machines, but has since revised its order for a larger quantity.

CubicFarm has already received a $1.2 million deposit, and is expecting a total of $16.5 million in revenue for the machines.

While the exact type of machine was not specified in the announcement, installation will take place in two phases. The first phase will see the installation of 26 machines later this year, while the rest are planned to be operational by mid-2022.

CubicFarm CEO, Dave Dinesen, said he is encouraged by the company’s growth in sales and the trend towards increasingly larger facilities.

“It reflects the demand emerging around the world for commercial-scale growing technology.

“Once installed, the system in Surrey will be one of the world’s largest automated vertical-farming systems,” he said.

CubicFarm has enjoyed a string of recent of recent commercial-scale sales.

In October 2019, the company sold 21 machines to a customer in Montana, USA. Prior to that, 23 machines were sold in July to a customer in Calgary, Alberta.

CubicFarm now has a backlog of 144 machines awaiting installation, representing $24.7 million in revenue.

Due to the company’s close proximity to Surrey, CubicFarm will offer a complete solution for its products. By leveraging experience gained from its R&D facility in Pitt Meadows, CubicFarm will manage both site preparation and installation.

“We are excited to be working with our customer, an established multi-industry group with investments and operations in the agriculture, technology and health space.

“Our customer understands the importance of using technology to significantly improve yields in an environmentally sustainable manner, and we look forward to helping them scale up production of fresh local vegetables for their market in southwest British Columbia and beyond,” continued Dinesen.

In conjunction with the sale, CubicFarm will also establish a joint venture with the customer to own and operate the 100-machine site.

As consideration for a 20 per cent ownership, CubicFarm will provide roughly $342,000 in the for of a zero-interest loan.

Shares in the company are currently up 6.9 per cent to $0.31, with a market cap of $29.28 million at 9:52 am EST.