- Datametrex (DM) is reporting revenue of C$18.3M in Q2 2022, up from $10.7M in Q1

- The period was marked by a significant increase in IT services revenue to over $2M, up 141 per cent YoY

- Marshall Gunter, CEO of Datametrex, sat down with Sabrina Cuthbert to discuss the company’s results

- The company continues to test its Smart EV Charger while focusing on growing Medi-Call subscribers

- It has also submitted an application to graduate to the TSX

- Datametrex AI is a technology company offering AI-based solutions for cybersecurity, telehealth and electric vehicles

- Datametrex (DM) opened trading at $0.095 per share

Datametrex (DM) is reporting revenue of C$18.3M in Q2 2022, up from $10.7M in Q1.

The period was marked by a significant increase in IT services revenue to over $2M, up 141 per cent YoY. This has led to ongoing discussions with several partners to expand the company’s AI and technology verticals globally outside of government work.

Marshall Gunter, CEO of Datametrex, sat down with Sabrina Cuthbert to discuss the company’s results.

“Our 2022 second-quarter results reflect a strong increase in our IT services as we expand our core AI and IT services to companies globally. We look forward to further expanding these services through MediCall and DMEVS. We are proud to be one of the small-cap stocks to maintain a strong cash balance and are thrilled to see our share buyback program gain traction.”

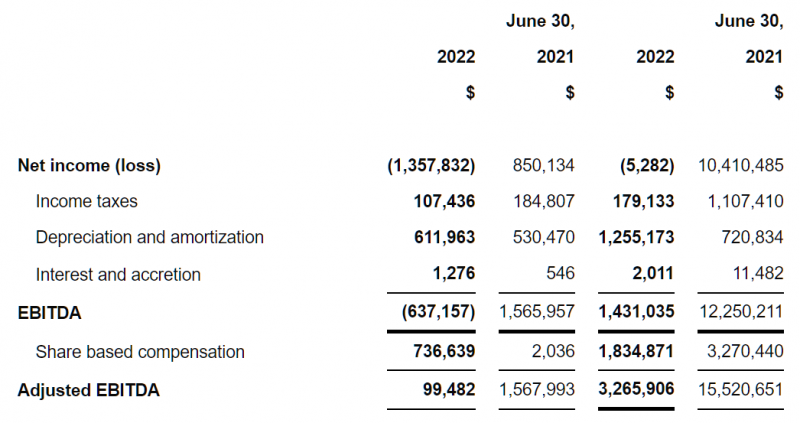

According to management, Datametrex’s adjusted EBITDA of $3,265,906 represents the most accurate reflection of operations over the past six months.

Cash on hand remains strong at approximately $14M with cash flow from operations of $766,000 for the quarter.

The company also deployed $934,116 to exercise a normal course issuer bid.

Outlook

Testing trials are underway for Datametrex’s Smart EV Charger. An initial seven commercial properties in North Vancouver will install its EVS chargers and EV charging stations.

After launching the Medi-Call app on iOS and Android, the company is focused on building subscribers and expanding with diversified services to fit patient needs.

The company has also submitted all required documents to uplist to the TSX.

Datametrex AI is a technology company offering AI-based solutions for cybersecurity, telehealth and electric vehicles.

Datametrex AI Ltd. (DM) opened trading at $0.095 per share.