- Radisson Mining Resources (TSXV:RDS) has arranged a C$1.5 million investment from a fund led by former Goldcorp CEO, David Garofalo

- The company will issue five million Class A common shares and 2.76 million charity flow-through shares, all of which have been purchased by the Marshall Precious Metals Fund

- The proceeds will be used to fund exploration activities at Radisson’s O’Brien gold project in Quebec

- In conjunction with the offering, Laurentian Bank Securities will be issued a finder’s fee of up to six per cent of the gross proceeds

- Radisson Mining Resources (RDS) is currently up 6.38 per cent and is trading at 25 cents per share

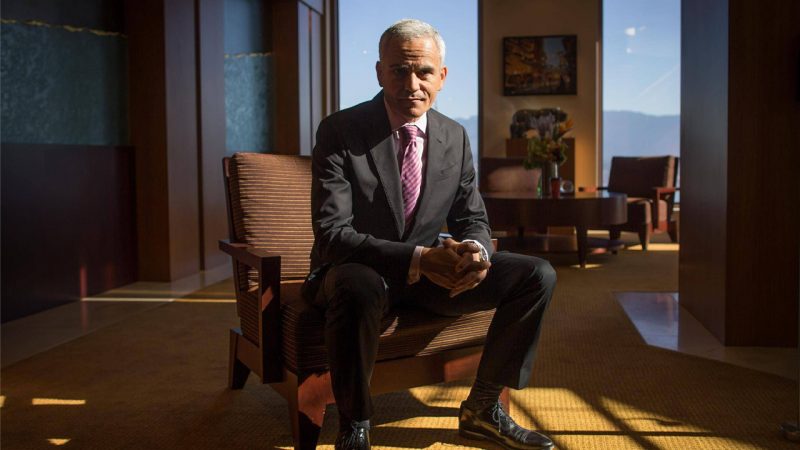

Radisson Mining (TSXV:RDS) has arranged a C$1.5 million investment from MPM Capital Management, a fund led by former Goldcorp CEO, David Garofalo.

Under the terms of the non-brokered private placement, the company will issue a minimum of five million Class A common shares at a price of 20 cents each, as well as at least 2.76 million charity flow-through shares at a price of 36.2 cents. All of these securities have been purchased by the Marshall Precious Metals Fund.

“Marshall Precious Metals is delighted to make one of its first investments in an area that I know well from my many years in northern Quebec with Inmet Mining and Agnico-Eagle.

“Radisson has assembled a very accomplished management team and Board of Directors and has undertaken an aggressive exploration program on an impressive land position in one of the most prolific gold districts in the world,” David said.

David is a significant figure in the Canadian resources industry, with 30 years of experience in creating and growing multi-billion dollar mining operations across several continents.

Prior to his position at Goldcorp, David served as President and CEO of Hudbay Minerals from 2010 until 2015, and as CFO of Agnico Eagle from 1998 until 2010.

In 2009, he was named Canada’s CFO of the Year by Financial Executives International Canada, and was recognised as The Northern Miner’s Mining Person of the Year in 2012.

Mario Bouchard, President and CEO of Radisson Mining Resources, said he is delighted to welcome the Marshall Precious Metals Fund as a shareholder.

“Over the years, Mr. Garofalo has been instrumental in creating value through the exploration, development, and operation of several high-grade, world-class gold deposits.

“As such, we are very pleased to be one of the first investments of his new investment fund. We are grateful for his confidence in the potential of the O’Brien project and look forward to his continued support in the coming years,” he said.

The company intends to use the funds raised under the placement to advance work at its wholly owned O’Brien gold project in the prolific Larder-Lake-Cadillac Break in Abitibi, Québec.

Radisson Mining Resources (RDS) is currently up 6.38 per cent and is trading at 25 cents per share at 1:35pm EDT.