- Microsoft (NASDAQ:MSFT) reported its financial results for Q2 of its fiscal year 2025, revealing revenues of US$69.6 billion, which represents a 12 per cent year-on-year increase

- For the quarter ending December 31, 2024, the company’s net income reached US$24.1 billion, marking a 10 per cent rise compared to the same period last year

- Microsoft’s Cloud services were a significant driver of growth, generating US$40.9 billion, a 21 per cent increase year-on-year.

- Microsoft stock (NASDAQ:MSFT) last traded at US$414.99

In the “era of AI”, things won’t be the same for Microsoft (NASDAQ:MSFT).

The tech giant reported its financial results for Q2 of its fiscal year 2025, revealing revenues of US$69.6 billion, which represents a 12 per cent year-on-year increase. For the quarter ending December 31, 2024, the company’s net income reached US$24.1 billion, marking a 10 per cent rise compared to the same period last year.

Highlights

- Revenue: US$69.6 billion (up 12 per cent year-on-year and up from Q1’s US$65.6 billion)

- More personal computing (including Xbox) revenue: US$14.7 billion

- Operating income: US$31.7 billion (up 10 per cent year-on-year)

- Net income: US$24.1 billion (up 10 per cent year-on-year)

Q2 performance

Microsoft’s Cloud services were a significant driver of growth, generating US$40.9 billion, a 21 per cent increase year-on-year. The company’s AI business also experienced a substantial boost, with a 175 per cent increase year-on-year, surpassing an annual revenue rate of $13 billion.

“We are focused on improving the profitability of the business in order to position it for long-term growth driven by higher-margin content and platform services, and we are delivering on this plan. Black Ops 6 was top-selling game on Xbox and PlayStation this quarter and saw more players in its launch quarter than any other paid release in the franchise history,” Nadella said on the call.

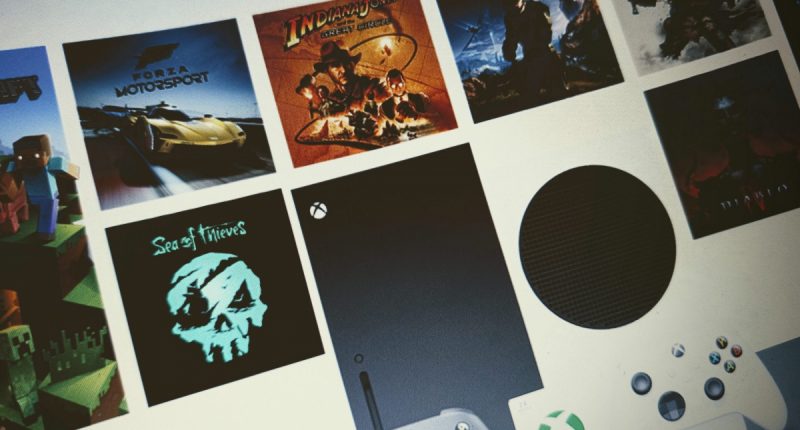

However, the gaming segment faced challenges, with overall gaming revenue decreasing by 7 per cent and hardware sales dropping by 29 per cent. Despite this, Xbox content and services revenue rose by 2 per cent, thanks to the strong performance of Activision Blizzard content, including the launch of Call of Duty Black Ops 6.

If “everything is an Xbox, does that mean nothing is an Xbox?

During the earnings call, CEO Satya Nadella highlighted several achievements and future expectations:

- Xbox Game Pass: Set a new quarterly revenue record, with the PC subscriber base growing by over 30 per cent.

- Xbox Cloud Gaming: 140 million hours streamed during the quarter.

- Indiana Jones and the Great Circle: Played by over four million people since its launch on December 9th, 2024. Honestly, more people should be playing it, it was the best game of last year, in this reporter’s less-than-humble opinion.

Nadella emphasized Microsoft’s strategy to improve the profitability of its gaming business by focusing on higher-margin content and platform services. Looking ahead, Microsoft expects Xbox content and services revenue to grow in the “low to mid-single digits” for Q3, driven by first-party content and Game Pass.

“Hardware revenue will decline year over year,” Amy Hood, executive vice president and chief financial officer, added, dousing any potential excitement for whatever the next Xbox system was going to offer against the PlayStation 6 or Nintendo Switch 2 systems.

If gaming software continues to perform well, but hardware projection to slow down, could this motivate Microsoft to push their gaming content to as many players as possible? The ongoing relationship with Sony (NYSE:SONY) and Nintendo (OTC:NTDOY) have worked out well for everyone involved. The current “everything is an Xbox” marketing campaign has certainly promoted inclusivity over exclusivity. Hey, it worked for Windows.

“In closing, we continue to innovate across our tech stack to help our customers in this AI era, and I’m energized by the many opportunities ahead,” CEO Nadella said on the call.

Microsoft Corp. develops and supports software, services, devices and solutions. The company’s segments include productivity and business processes, intelligent cloud and more personal computing.

Microsoft stock (NASDAQ:MSFT) ended Thursday 6.18 per cent lower at US$414.99, but has risen 2.78 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Microsoft Corp. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Xbox Game Pass home screen.)