- Dollar Tree Inc. (NASDAQ:DLTR) announced that CEO and Chairman Rick Dreiling has stepped down for personal reasons

- Dreiling said in a news release that his health has been presenting some new challenges over the past two months

- The company, which also owns Family Dollar, has seen its shares plummet over 50 per cent this year

- Dollar Tree stock (NASDAQ:DLTR) last traded at US$66.81

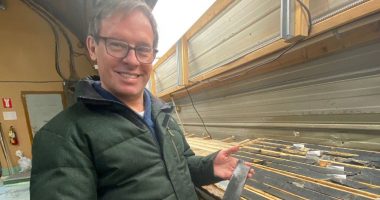

Dollar Tree Inc. (NASDAQ:DLTR) announced that CEO and Chairman Rick Dreiling has stepped down for personal reasons.

“With my health presenting some new challenges over the past two months, the time is right for me to step away and focus on myself and my family,” Dreiling said in a news release. “I have been honored to serve the customers and associates of Dollar Tree and Family Dollar since 2022. Having worked side-by-side with Mike, I am confident in his strong leadership, deep passion for our business and ability to create value.”

Dreiling, who joined the struggling discount retailer as executive chairman in March 2022, leaves amid significant challenges facing the retailer.

The company, which also owns Family Dollar, has seen its shares plummet over 50 per cent this year. In September, Dollar Tree revised its outlook for the remainder of the year, citing “immense pressures” on its low- and middle-income customer base. Once a rapidly expanding sector, dollar stores are now grappling with strategic missteps and fierce competition from larger retailers like Walmart (NYSE:WMT).

In the wake of Dreiling’s departure, Dollar Tree has appointed COO Michael Creedon as interim CEO and Edward J. Kelly as chairman. The company is actively searching for a permanent CEO to guide it through these turbulent times.

Dollar Tree also reaffirmed its commitment to exploring “strategic alternatives” for Family Dollar, which has also faced ongoing struggles. The chain, acquired in 2015 for $8.5 billion, was expected to bolster Dollar Tree’s competitive edge. However, by early 2024, more than 900 Family Dollar locations had closed, raising questions about the viability of the acquisition.

Dollar Tree Inc. is an operator of discount variety stores. Its business segments include Dollar Tree and Family Dollar. Dollar Tree segment is the operator of discount variety stores offering merchandise predominantly at the fixed price.

Dollar Tree stock (NASDAQ:DLTR) last traded at US$66.81 and has lost 52.97 per cent since the year began.

Join the discussion: Find out what everybody’s saying about this stock on the Dollar Tree Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image via @DollarTree on Twitter/X)